July 2024 Insight On United Kingdom's Undervalued Small Caps With Insider Actions

As the United Kingdom braces for its upcoming elections, market sentiment remains cautiously optimistic, reflected in a slight uptick in FTSE 100 futures. This backdrop of political and economic uncertainty can often highlight opportunities within the small-cap sector, where undervalued stocks may benefit from less direct exposure to global economic shifts and more from domestic developments. In such a climate, identifying small caps with strong fundamentals and insider buying actions could be particularly compelling. These elements often suggest confidence in the company's prospects by those who know it best.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Stelrad Group | 9.2x | 0.5x | 45.21% | ★★★★★★ |

Ultimate Products | 10.1x | 0.8x | 14.62% | ★★★★★☆ |

Norcros | 7.5x | 0.5x | 45.00% | ★★★★★☆ |

THG | NA | 0.4x | 43.86% | ★★★★★☆ |

Bytes Technology Group | 28.7x | 6.5x | 15.81% | ★★★★☆☆ |

CVS Group | 20.4x | 1.1x | 43.29% | ★★★★☆☆ |

J D Wetherspoon | 21.3x | 0.4x | -58.29% | ★★★★☆☆ |

Robert Walters | 21.4x | 0.3x | 36.27% | ★★★☆☆☆ |

Trifast | NA | 0.4x | -47.48% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.7x | 40.67% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

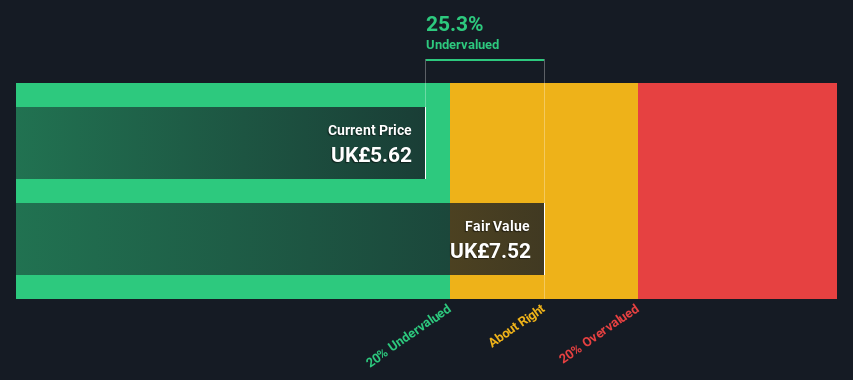

Polar Capital Holdings

Simply Wall St Value Rating: ★★★★★☆

Overview: Polar Capital Holdings is a specialist, investment-led, active fund management company with a market capitalization of approximately £197.59 million.

Operations: The Investment Management Business generated £197.59 million in revenue, with a gross profit margin of 88.53% and a net income margin of 20.65%. Operating expenses for the period were £118.86 million, impacting the overall profitability metrics detailed above.

PE: 13.3x

Polar Capital Holdings, reflecting a compelling narrative in the realm of undervalued entities, recently affirmed its dividend while showcasing a robust financial uptick with year-over-year revenue and net income growth. With earnings per share increasing from £0.368 to £0.423, their financial health appears solid. Insider confidence is evident as insiders have recently purchased shares, underscoring their belief in the company's prospects amidst a backdrop of no customer deposit reliance and external borrowing as its sole funding source. This strategic positioning might suggest resilience and potential for sustained growth.

Victoria

Simply Wall St Value Rating: ★★★★☆☆

Overview: Victoria is a diversified flooring company with operations spanning soft flooring and ceramic tiles across the UK, Europe, North America, and Australia.

Operations: The company generates its revenue from diverse geographical segments, with UK & Europe Soft Flooring contributing £643.8 million and North America adding £163.3 million. Gross profit margins have shown a fluctuating trend, with a notable figure of 35.69% in mid-2019 but declining to 31.75% by the end of 2023.

PE: -1.9x

Victoria PLC, a lesser-known entity in the UK market, recently showcased insider confidence with significant share purchases, signaling strong belief in the company's prospects. Despite a highly volatile share price over the past three months, earnings are projected to surge by 86% annually. With all funding sourced from external borrowing—posing higher risks—Victoria still managed to maintain shareholder interest ahead of its fiscal year results announcement on June 19, 2024. This blend of financial dynamics and insider actions paints a promising picture for potential growth.

Navigate through the intricacies of Victoria with our comprehensive valuation report here.

Gain insights into Victoria's historical performance by reviewing our past performance report.

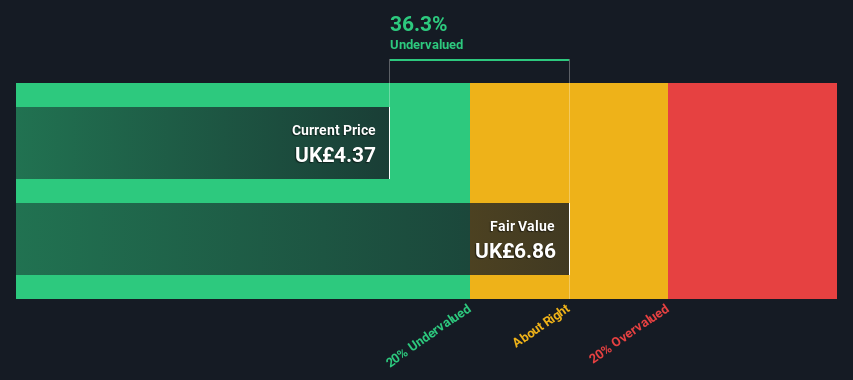

Robert Walters

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Robert Walters is a professional recruitment firm with operations in specialist sectors and a market capitalization of approximately £407 million.

Operations: Robert Walters and Resource Solutions generate revenues primarily through recruitment services, with £836 million and £228.1 million respectively. The company's gross profit margin has shown fluctuations over the years, recently recorded at 36.35% in the latest financial period.

PE: 21.4x

Amid a challenging landscape, Robert Walters stands out with its robust earnings forecast, predicting a 28.57% growth annually. Despite a dip in profit margins from 3.6% to 1.3% over the past year, insider confidence remains high as evidenced by recent share purchases by company insiders, signaling their belief in the firm's potential. Additionally, at its recent AGM on April 30, 2024, a final dividend of 17 pence per share was affirmed, underscoring its commitment to shareholder returns despite current financial pressures. This blend of insider activity and proactive financial strategies paints Robert Walters as an intriguing prospect within the undervalued segments of the UK market.

Dive into the specifics of Robert Walters here with our thorough valuation report.

Evaluate Robert Walters' historical performance by accessing our past performance report.

Key Takeaways

Take a closer look at our Undervalued Small Caps With Insider Buying list of 35 companies by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:POLR AIM:VCP and LSE:RWA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance