July 2024 Insight Into Three Chinese Stocks Estimated To Be Trading Below Value

Amid a backdrop of fluctuating global markets, Chinese stocks have shown signs of weakening as concerns about the country's economic slowdown weigh on investor sentiment. This environment may present opportunities for investors to consider stocks that are potentially undervalued, offering a strategic entry point in a market poised for future adjustments.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥160.00 | CN¥328.66 | 51.3% |

Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥17.58 | CN¥34.05 | 48.4% |

Anhui Anli Material Technology (SZSE:300218) | CN¥13.42 | CN¥26.41 | 49.2% |

Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥23.41 | CN¥46.93 | 50.1% |

DongHua Testing Technology (SZSE:300354) | CN¥31.35 | CN¥57.95 | 45.9% |

Chengdu Easton Biopharmaceuticals (SHSE:688513) | CN¥31.42 | CN¥66.56 | 52.8% |

INKON Life Technology (SZSE:300143) | CN¥7.64 | CN¥14.64 | 47.8% |

Thunder Software TechnologyLtd (SZSE:300496) | CN¥44.00 | CN¥84.89 | 48.2% |

Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.13 | CN¥18.84 | 51.5% |

Levima Advanced Materials (SZSE:003022) | CN¥13.38 | CN¥27.29 | 51% |

Let's uncover some gems from our specialized screener

Shanghai Baolong Automotive

Overview: Shanghai Baolong Automotive Corporation specializes in manufacturing and selling automotive parts and components, with a market capitalization of approximately CN¥6.83 billion.

Operations: The firm specializes in the production and sale of automotive parts and components.

Estimated Discount To Fair Value: 42.6%

Shanghai Baolong Automotive, trading at CN¥30.75, is perceived as undervalued against a fair value estimate of CN¥55.85, reflecting a substantial discount. Despite recent earnings dip to CN¥68.01 million from last year's CN¥93.37 million, the company is poised for robust growth with revenue and earnings forecasted to outpace the Chinese market significantly at 24.2% and 30.14% per year respectively. However, its dividend sustainability is questionable as it's not well covered by cash flows, indicating potential financial strain or prioritization of reinvestment strategies.

Ningbo Jifeng Auto Parts

Overview: Ningbo Jifeng Auto Parts Co., Ltd. specializes in the production of automotive interior parts in China, with a market capitalization of approximately CN¥12.91 billion.

Operations: The company generates revenue primarily from the production of automotive interior parts.

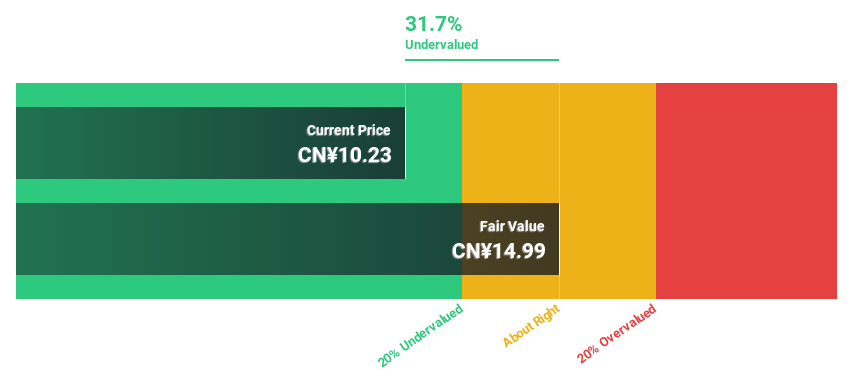

Estimated Discount To Fair Value: 31.7%

Ningbo Jifeng Auto Parts, priced at CN¥10.23, trades below its fair value estimate of CN¥14.98, suggesting a significant undervaluation based on DCF analysis. Despite a recent drop in net income from CN¥60.03 million to CN¥19.07 million and earnings per share halving, the company is forecasted to see earnings grow by 59.63% annually over the next three years. However, interest coverage remains weak, indicating potential financial stress despite strong investor backing from a recent CNY 1.18 billion private placement.

Sichuan Guoguang Agrochemical

Overview: Sichuan Guoguang Agrochemical Co., Ltd. specializes in the research, development, manufacturing, marketing, and distribution of agrochemical products and materials both domestically and internationally, with a market capitalization of CN¥7.06 billion.

Operations: The company generates revenue from the research, development, manufacturing, and distribution of agrochemical products and materials across domestic and international markets.

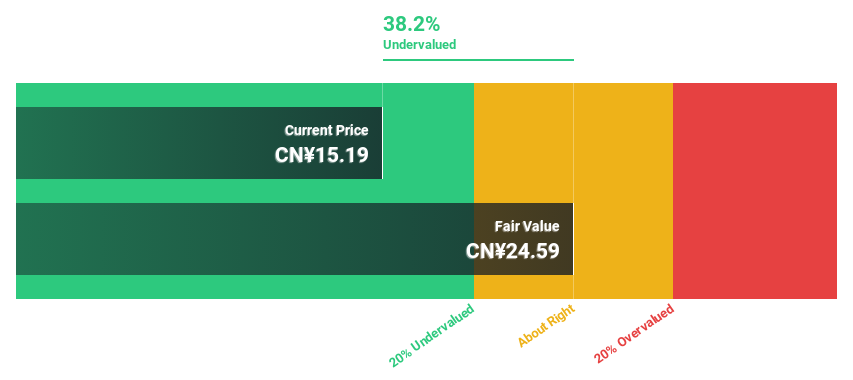

Estimated Discount To Fair Value: 38.2%

Sichuan Guoguang Agrochemical, with a current trading price of CN¥15.42, appears undervalued compared to a DCF-based fair value estimate of CN¥24.92. The company has demonstrated substantial earnings growth, up 147.7% over the past year and is projected to expand earnings by 20.2% annually. Despite this, its dividend track record remains unstable and shareholder dilution has occurred in the past year. Recent financial reports show robust sales and net income increases in Q1 2024, reinforcing its growth trajectory amidst a dynamic market environment.

Summing It All Up

Get an in-depth perspective on all 104 Undervalued Chinese Stocks Based On Cash Flows by using our screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:603197 SHSE:603997 and SZSE:002749.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance