July 2024 Insight Into Australia's Undervalued Small Caps With Insider Buying

Despite a relatively flat performance over the last week, the Australian market has seen a commendable annual increase of 7.5%, with earnings expected to grow by 13% per annum. In this context, undervalued small-cap stocks with insider buying activity represent intriguing opportunities for investors looking to potentially benefit from overlooked segments of the market.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.3x | 2.7x | 48.13% | ★★★★★★ |

Nick Scali | 13.6x | 2.5x | 46.13% | ★★★★★★ |

RAM Essential Services Property Fund | NA | 5.7x | 41.09% | ★★★★★☆ |

Healius | NA | 0.6x | 43.54% | ★★★★★☆ |

Codan | 28.9x | 4.2x | 26.64% | ★★★★☆☆ |

Dicker Data | 20.9x | 0.8x | 3.37% | ★★★★☆☆ |

Eagers Automotive | 9.6x | 0.3x | 33.59% | ★★★★☆☆ |

Elders | 20.3x | 0.4x | 49.91% | ★★★★☆☆ |

Tabcorp Holdings | NA | 0.7x | 19.61% | ★★★★☆☆ |

Coventry Group | 283.1x | 0.4x | -17.15% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Codan

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications equipment and metal detection, with a market capitalization of around A$1.07 billion.

Operations: In its operations, the company generates revenue primarily from Communications and Metal Detection segments, contributing A$291.50 million and A$212.20 million respectively. Gross profit margin has shown a trend of fluctuation over the observed periods, with a notable figure of 54.42% reported in the most recent data from 2023-12-31.

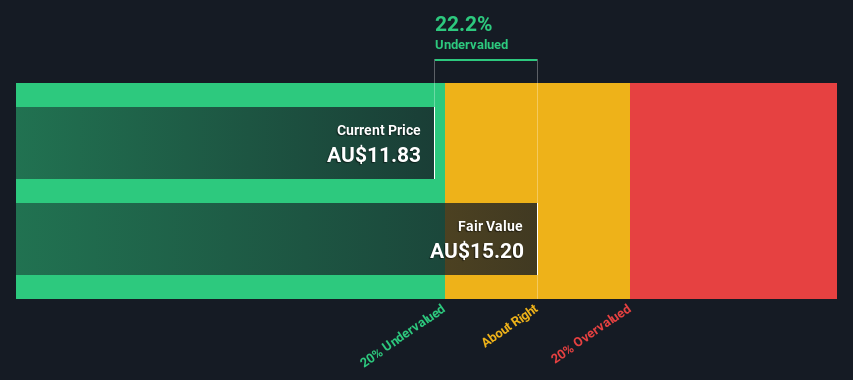

PE: 28.9x

Codan, an Australian company, has recently seen insider confidence bolstered by share purchases, signaling trust in its potential. With earnings forecast to grow 16.2% annually, this insight reflects a promising outlook despite its reliance on higher risk funding sources. Such financial dynamics suggest that Codan is priced below its intrinsic market value, aligning with traits typically sought after in lesser-known entities ripe for growth. This combination of insider buying and financial prospects makes Codan a noteworthy consideration for those exploring opportunities beyond the usual big names.

Click here and access our complete valuation analysis report to understand the dynamics of Codan.

Gain insights into Codan's past trends and performance with our Past report.

Orora

Simply Wall St Value Rating: ★★★★☆☆

Overview: Orora is a company engaged in packaging solutions and distribution, operating primarily across Australasia and North America, with a market capitalization of approximately A$3.17 billion.

Operations: Australasia and North America generate A$1.03 billion and A$3.02 billion in revenue respectively for the company, with a notable gross profit margin improvement from 16.68% to 18.95% over the observed periods. The net income margin has seen a fluctuation, starting at -4.02%, reaching as high as 5.20%, and closing at 3.48% in the most recent data provided.

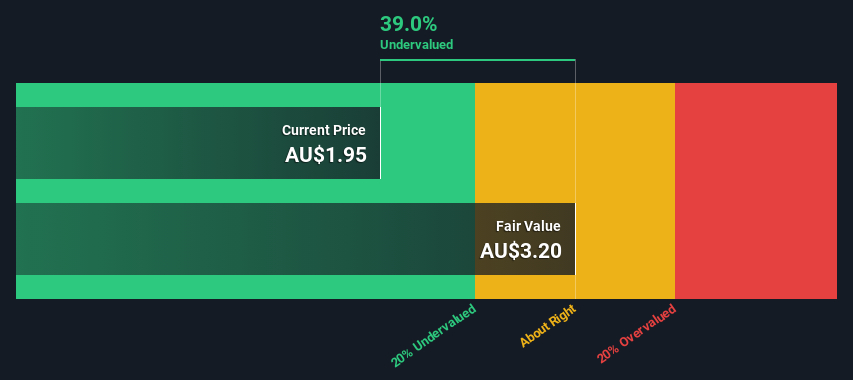

PE: 18.0x

Orora has recently demonstrated insider confidence, with key stakeholders bolstering their holdings—a positive indicator of belief in the company's potential. Despite challenges, such as high-risk funding solely through external borrowing and earnings impacted by one-off items, Orora is poised for growth with a forecasted 14.82% earnings increase annually. This aligns with its strategic decisions revealed during the April Analyst/Investor Day, suggesting a resilient outlook for this lesser-known entity in Australia's market landscape.

Tabcorp Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tabcorp Holdings is a diversified entertainment group operating in gaming services and wagering and media, with a market capitalization of approximately A$11 billion.

Operations: The company's gross profit margin consistently stood at 1.0, reflecting a complete conversion of revenue to gross profit in recent periods. Net income, however, varied significantly, with the latest figures showing a net loss which highlights volatility in profitability despite stable gross margins.

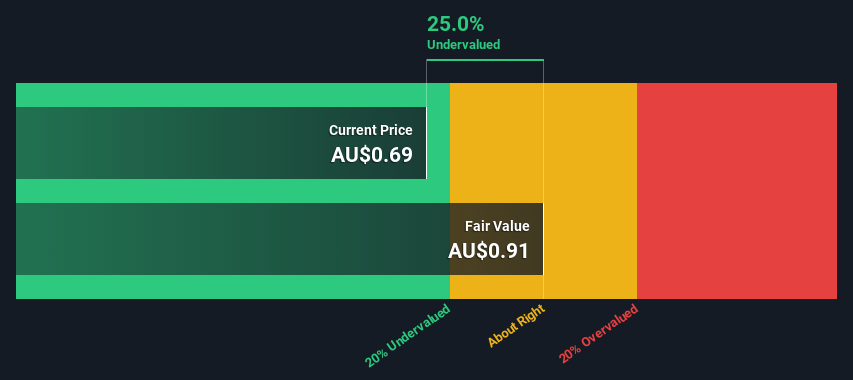

PE: -2.6x

Tabcorp Holdings, reflecting a noteworthy potential in the undervalued segment of Australian enterprises, has seen insider confidence bolstered with recent share purchases. With earnings expected to climb by roughly 80% annually, this insight aligns with strategic moves by insiders who have recently invested in their own company’s stock. Despite relying solely on external borrowing—a higher risk funding method—these internal investments suggest a strong belief in future growth and stability.

Take a closer look at Tabcorp Holdings' potential here in our valuation report.

Evaluate Tabcorp Holdings' historical performance by accessing our past performance report.

Where To Now?

Investigate our full lineup of 27 Undervalued ASX Small Caps With Insider Buying right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CDA ASX:ORA and ASX:TAH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance