July 2024 Guide To Growth Companies With High Insider Ownership

As global markets navigate through a period of heightened anticipation for upcoming earnings reports and central bank decisions, investors are closely monitoring shifts in market dynamics. In such an environment, growth companies with high insider ownership can be particularly intriguing due to the alignment of interests between company executives and shareholders, potentially fostering greater confidence in the company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Norbit

Simply Wall St Growth Rating: ★★★★★☆

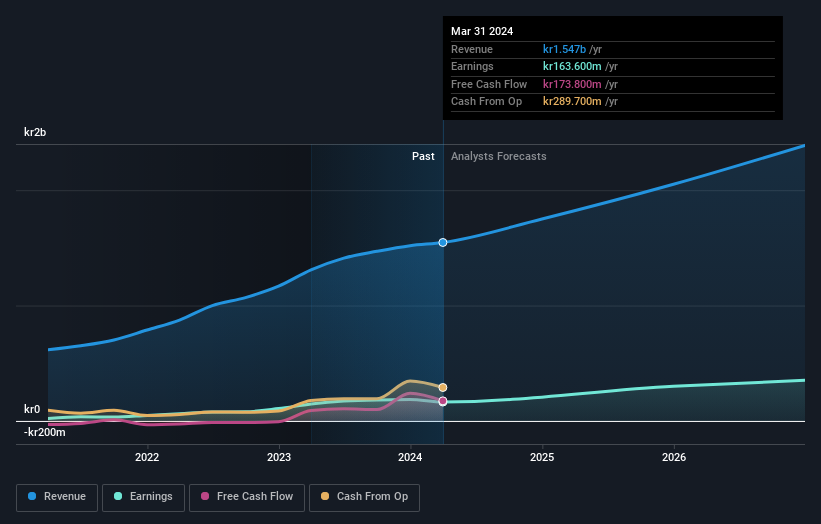

Overview: Norbit ASA specializes in providing technology products and solutions, with a market capitalization of NOK 4.81 billion.

Operations: The company's revenue is divided into three main segments: Oceans (NOK 584.70 million), Connectivity (NOK 554.60 million), and Product Innovation and Realization (PIR) at NOK 444.60 million.

Insider Ownership: 32.5%

Norbit ASA, a growth-focused company with high insider ownership, is experiencing significant earnings and revenue growth. Its earnings are expected to grow by 25.57% annually, outpacing the Norwegian market significantly. Despite recent fluctuations in net income and EPS as reported in Q1 2024, Norbit maintains a positive outlook for 2024 with anticipated revenue between NOK 1.7 billion and NOK 1.8 billion. However, there has been notable insider selling over the past three months which could raise concerns about long-term confidence among insiders.

Jiangsu Xinquan Automotive TrimLtd

Simply Wall St Growth Rating: ★★★★★★

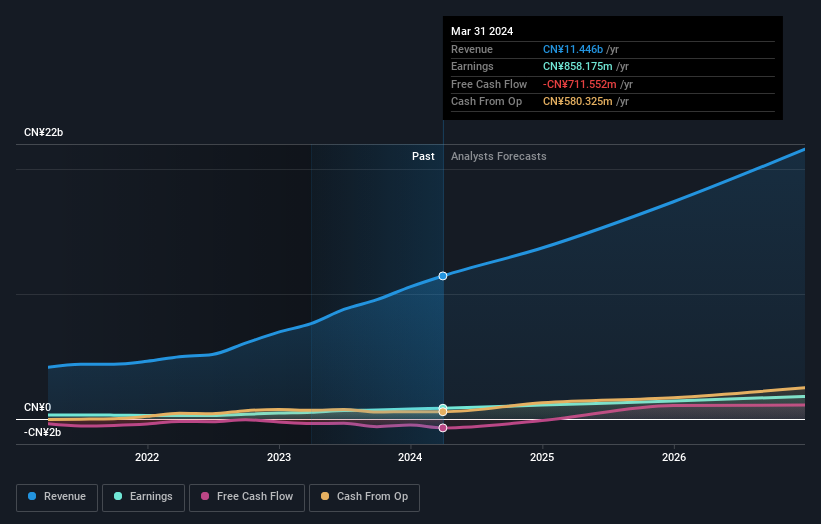

Overview: Jiangsu Xinquan Automotive Trim Co., Ltd. is a company based in China that specializes in the design, development, manufacturing, sale, and supply of auto parts, with a market capitalization of approximately CN¥19.41 billion.

Operations: The company generates CN¥11.45 billion in revenue from its auto parts and accessories segment.

Insider Ownership: 39.4%

Jiangsu Xinquan Automotive Trim Co., Ltd. has shown robust growth with a 59.3% increase in earnings over the past year and forecasts indicating significant revenue growth at 22.9% annually, outstripping the Chinese market's 13.7%. Despite a low dividend coverage by cash flow, the company's strategic share buybacks and strong insider ownership underscore confidence in its trajectory. Analysts predict a potential price rise of 51.7%, supported by an expected high return on equity of 20.9% in three years.

Fujian Aonong Biological Technology Group Incorporation

Simply Wall St Growth Rating: ★★★★★☆

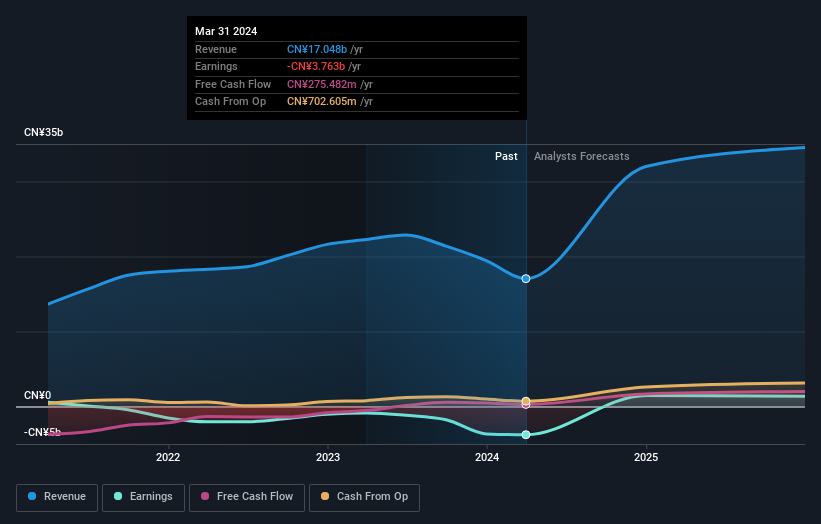

Overview: Fujian Aonong Biological Technology Group Incorporation operates in various sectors including feed production, pig raising, food processing, supply chain services, agricultural internet platforms, and bio-pharmaceuticals across China and globally, with a market capitalization of approximately CN¥3.42 billion.

Operations: The company generates revenue through feed production, pig raising, food processing, supply chain services, agricultural internet platforms, and bio-pharmaceuticals.

Insider Ownership: 13%

Fujian Aonong Biological Technology Group Incorporation Limited, despite recent removals from major indices, is anticipated to pivot towards profitability with expected earnings growth of 125.74% annually over the next three years. The company's revenue growth forecast at 34.4% annually significantly outpaces the market expectation of 20%. However, its share price has been highly volatile recently, and it reported substantial losses in its latest financial results with a net loss increasing notably from the previous year.

Next Steps

Gain an insight into the universe of 1453 Fast Growing Companies With High Insider Ownership by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OB:NORBTSHSE:603179 and SHSE:603363.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance