Judges Scientific And Two More UK Growth Companies With High Insider Stakes

The UK market has shown resilience, with the FTSE 100 and FTSE 250 indices both responding positively to encouraging GDP growth figures. In such a buoyant environment, growth companies with high insider ownership can offer compelling opportunities for investors looking for firms with strong internal confidence and commitment.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 30.1% |

Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

TEAM (AIM:TEAM) | 25.8% | 58.8% |

Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

Afentra (AIM:AET) | 38.3% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

We'll examine a selection from our screener results.

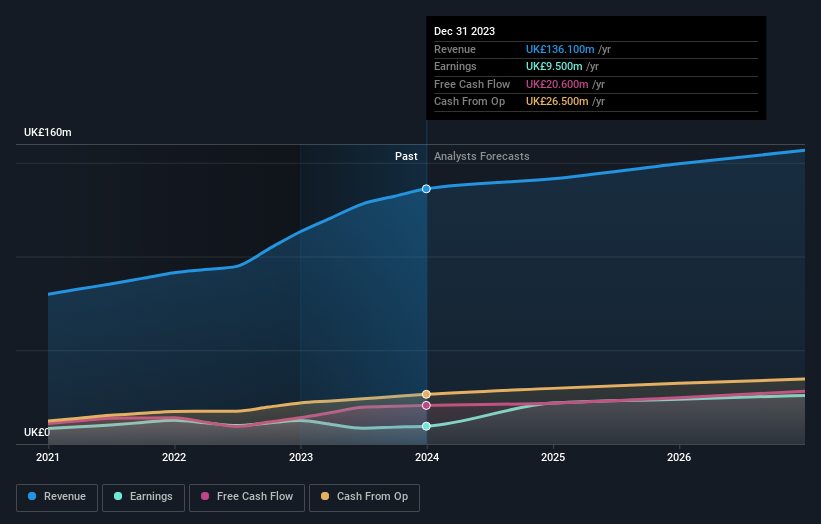

Judges Scientific

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc is a company that designs, manufactures, and sells scientific instruments, with a market capitalization of approximately £670.77 million.

Operations: The company generates its revenue primarily through two segments: Vacuum, which contributes £63.60 million, and Materials Sciences, contributing £72.50 million.

Insider Ownership: 11.5%

Earnings Growth Forecast: 25.3% p.a.

Judges Scientific, a UK-based company, is experiencing moderate revenue growth at 4.8% annually, slightly outpacing the market's 3.5%. However, its earnings are set to rise significantly by 25.32% per year over the next three years. Despite high levels of debt and lower profit margins compared to last year (7% down from 11%), insider activity has been quiet with no substantial buying in recent months. Recent corporate governance changes and a dividend increase suggest active management engagement and shareholder return focus.

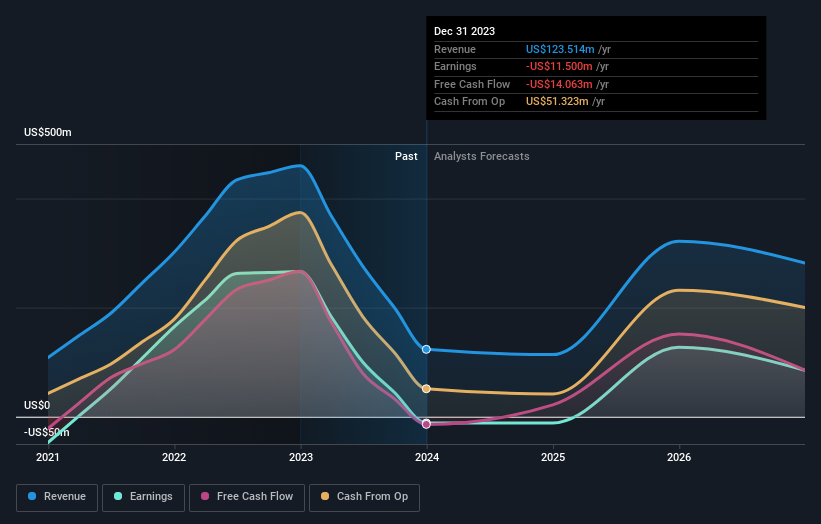

Gulf Keystone Petroleum

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is a company focused on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market capitalization of approximately £327.83 million.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, amounting to $123.51 million.

Insider Ownership: 10.8%

Earnings Growth Forecast: 47.6% p.a.

Gulf Keystone Petroleum is poised for substantial growth, with earnings expected to increase by 47.61% annually and revenue projected to outpace the UK market significantly at 25.1% per year. Despite a highly volatile share price recently, the company is trading at 55.6% below its estimated fair value, suggesting potential undervaluation. Recent strategic moves include a share buyback program announced on May 13, 2024, aiming to repurchase up to US$10 million in shares by June 2024 or until completion.

TBC Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates as a diversified financial services provider offering banking, leasing, insurance, brokerage, and card processing solutions across Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.38 billion.

Operations: The company generates revenue through banking, leasing, insurance, brokerage, and card processing services across multiple countries.

Insider Ownership: 18%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group is experiencing robust growth with earnings and revenue forecasted to outpace the UK market at 15.22% and 18.3% per year, respectively. However, it faces challenges with a high bad loans ratio of 2.1% and a low allowance for bad loans at 74%. Recently, the bank initiated a GEL 75 million share buyback program to reduce capital and support shareholder value, demonstrating confidence in its financial health despite market volatility and internal financial metrics concerns.

Delve into the full analysis future growth report here for a deeper understanding of TBC Bank Group.

Taking Advantage

Click here to access our complete index of 64 Fast Growing UK Companies With High Insider Ownership.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:JDG LSE:GKP and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance