Jolywood Suzhou Sunwatt Leads Three High Insider Ownership Growth Companies On Chinese Exchange

As global markets navigate through varying economic signals, with China recently unveiling significant measures to stabilize its property sector, investors continue to scrutinize opportunities within this evolving landscape. In this context, companies like Jolywood Suzhou Sunwatt that boast high insider ownership might offer a unique appeal, suggesting a strong alignment between company management and shareholder interests in these complex times.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.5% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Here's a peek at a few of the choices from the screener.

Jolywood (Suzhou) Sunwatt

Simply Wall St Growth Rating: ★★★★★☆

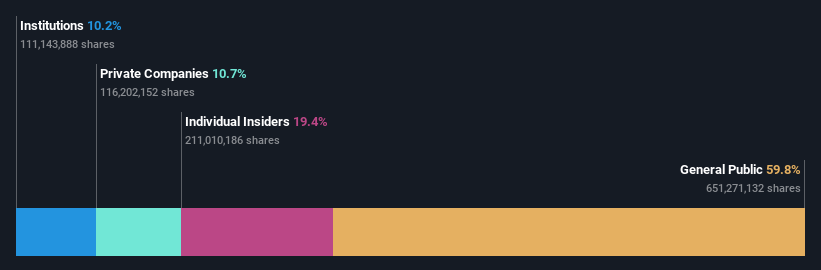

Overview: Jolywood (Suzhou) Sunwatt Co., Ltd. is a global manufacturer and seller of integrated photovoltaic products, with a market capitalization of approximately CN¥8.84 billion.

Operations: The company generates CN¥10.84 billion in revenue from its photovoltaic industry segment.

Insider Ownership: 19.4%

Jolywood (Suzhou) Sunwatt is positioned in a challenging yet potentially rewarding market segment. Despite a significant forecasted annual earnings growth of 43.5% and revenue growth of 21.1%, the company's recent performance indicates financial stress, with a substantial net loss reported in Q1 2024 (CNY 172.48 million) compared to a profit in the previous year. This downturn coincides with lower profit margins and high debt levels, raising concerns about its short-term financial health despite promising growth projections and strategic dividend decisions during its recent Annual General Meeting.

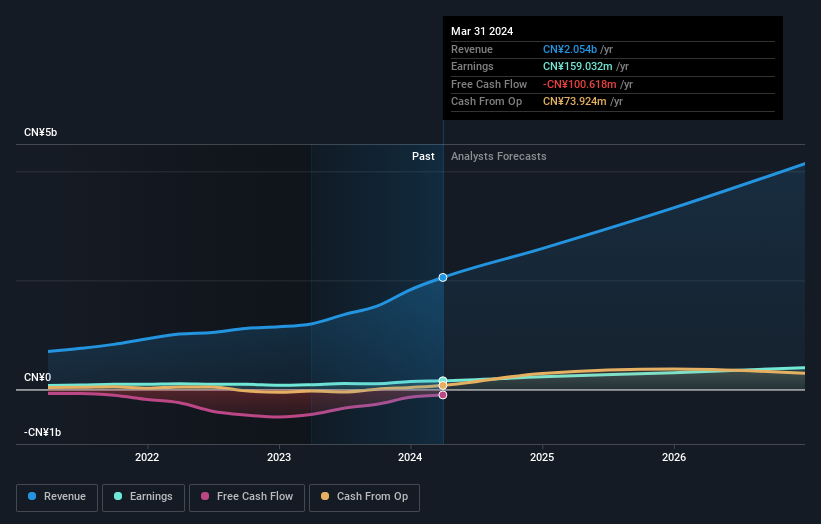

Wuxi Longsheng TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd specializes in manufacturing auto parts in China, with a market capitalization of approximately CN¥5.16 billion.

Operations: The company generates its revenue primarily from the production of automotive components.

Insider Ownership: 35.2%

Wuxi Longsheng TechnologyLtd, a growth-oriented firm with high insider ownership in China, demonstrates robust financial performance and promising growth prospects. The company's revenue is expected to grow by 25% annually, outpacing the Chinese market average of 14%. Similarly, its earnings are forecasted to increase by 31.2% per year. Despite these strengths, it faces challenges such as a highly volatile share price and a low forecast return on equity (14.4%) in three years. Recent achievements include significant year-over-year earnings growth of 82.8% and shareholder approval for a dividend increase at the latest annual general meeting.

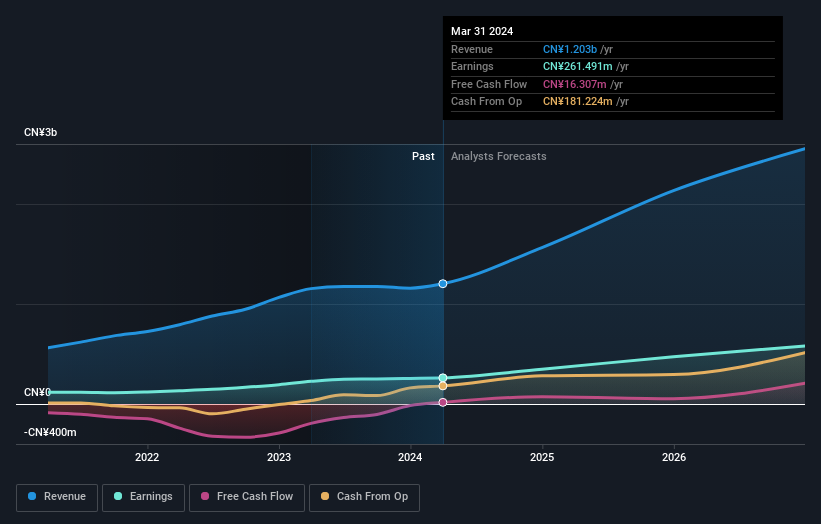

POCO Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd., operating in the electronics sector, develops and sells alloy soft magnetic materials and components, with a market capitalization of approximately CN¥11.81 billion.

Operations: The company generates revenue primarily from electronic components, totaling approximately CN¥1.20 billion.

Insider Ownership: 25%

POCO Holding, a Chinese company with high insider ownership, shows promising growth metrics. Its annual earnings are expected to increase by 28.1% and revenue by 26.8%, both surpassing the Chinese market averages of 23.3% and 14%, respectively. However, its forecasted Return on Equity is relatively low at 18.1%. Recent corporate actions include amendments to the company's articles of association and a dividend affirmation of CNY 2 per ten shares for 2023.

Key Takeaways

Investigate our full lineup of 412 Fast Growing Chinese Companies With High Insider Ownership right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:300393 SZSE:300680 and SZSE:300811.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance