John Paulson's Strategic Moves in Q1 2024 Highlight Madrigal Pharmaceuticals' Prominent Role

Insight into Paulson's Latest 13F Filings and Its Impact on His Investment Portfolio

John Paulson (Trades, Portfolio), the President and Portfolio Manager of Paulson & Co. Inc., is renowned for his expertise in merger arbitrage and event-driven strategies. With a distinguished career that began in mergers and acquisitions, Paulson has developed a keen eye for value in tumultuous markets. His educational background includes an MBA from Harvard Business School and a summa cum laude degree from New York University. Since founding his firm in 1994, Paulson has been recognized as a leading figure in the hedge fund industry, managing significant assets with a focus on mergers, events, and distressed strategies.

Summary of New Buys

John Paulson (Trades, Portfolio)'s portfolio saw the addition of two new stocks in the first quarter of 2024. The most significant new holding is Altice USA Inc (NYSE:ATUS), with 1,160,265 shares valued at approximately $3.03 million, making up 0.21% of the portfolio. The second addition is Carrols Restaurant Group Inc (NASDAQ:TAST), comprising 58,006 shares, which represents about 0.04% of the portfolio with a total value of $551,640.

Key Position Increases

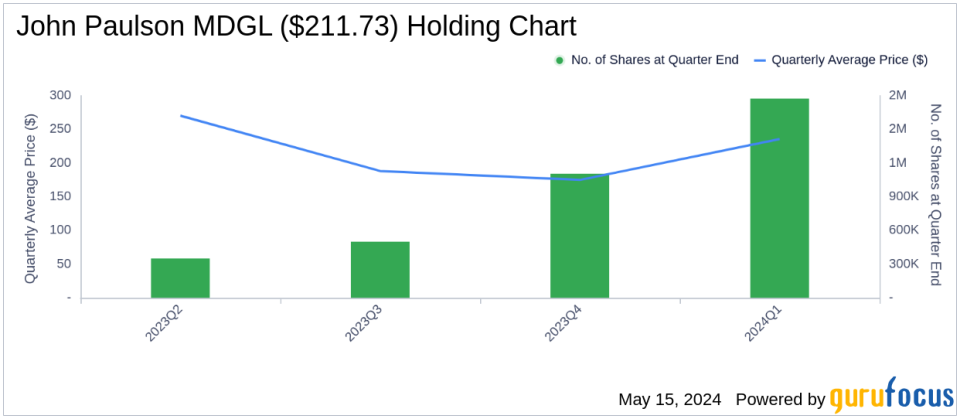

Paulson has notably increased his investment in several stocks. A standout is Madrigal Pharmaceuticals Inc (NASDAQ:MDGL), where he boosted his stake by 669,259 shares, bringing his total to 1,775,000 shares. This adjustment marks a significant 60.53% increase in share count and impacts the portfolio by 12.34%, with a total value of $473.996 million. Another significant increase was in Novagold Resources Inc (NG), with an additional 3,696,578 shares, bringing the total to 27,238,061 shares, valued at $81.714 million.

Summary of Sold Out Positions

During the first quarter of 2024, John Paulson (Trades, Portfolio) decided to exit his position in SSR Mining Inc (NASDAQ:SSRM), selling all 2,000,000 shares, which previously had a -1.94% impact on the portfolio.

Key Position Reductions

Paulson also reduced his holdings in certain stocks. The most notable reduction was in Anglogold Ashanti PLC (NYSE:AU), where he cut his position by 900,587 shares. This reduction led to a -23.49% decrease in shares and had a -1.52% impact on the portfolio. During the quarter, the stock traded at an average price of $18.84 and has seen a return of 46.37% over the past three months and 33.37% year-to-date.

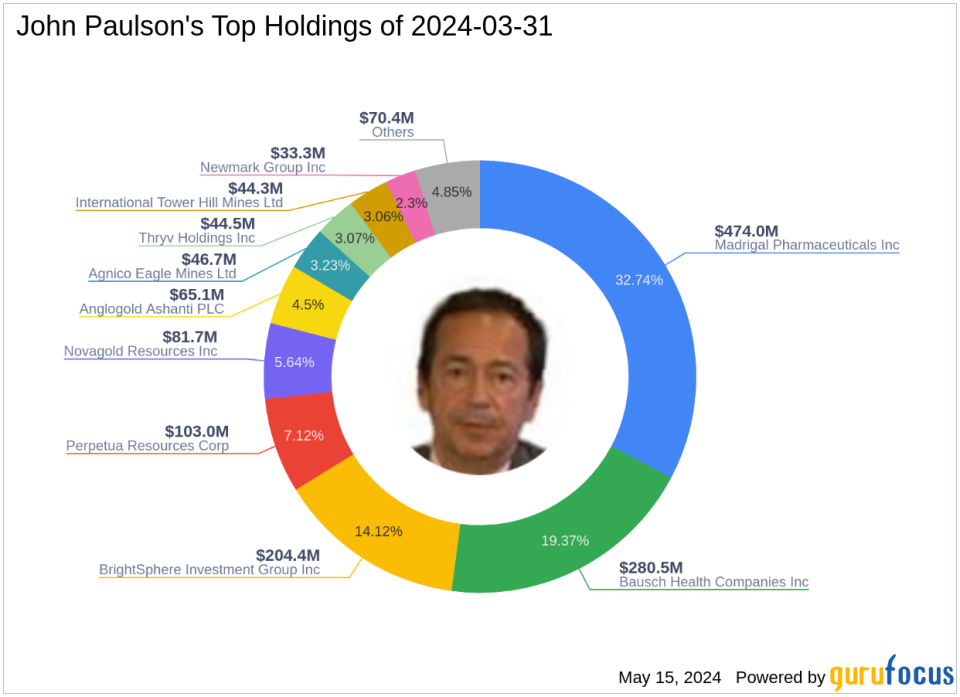

Portfolio Overview

As of the first quarter of 2024, John Paulson (Trades, Portfolio)'s investment portfolio included 18 stocks. The top holdings were 32.74% in Madrigal Pharmaceuticals Inc (NASDAQ:MDGL), 19.37% in Bausch Health Companies Inc (NYSE:BHC), and 14.12% in BrightSphere Investment Group Inc (NYSE:BSIG). Other significant holdings include Perpetua Resources Corp (NASDAQ:PPTA) and Novagold Resources Inc (NG), making up 7.12% and 5.64% of the portfolio, respectively.

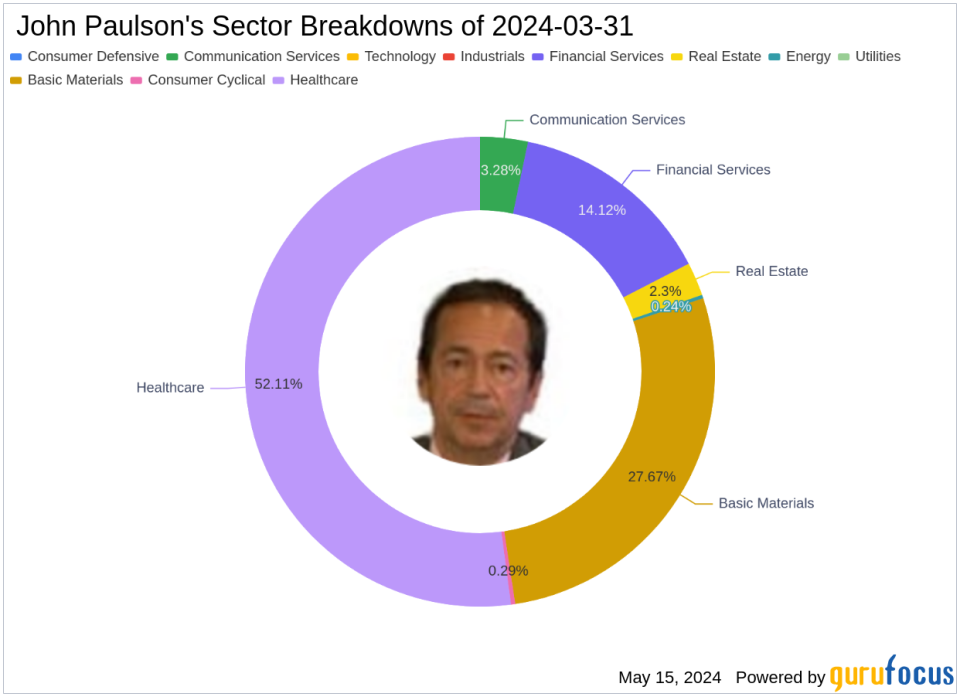

The portfolio is primarily concentrated in industries such as Healthcare, Basic Materials, Financial Services, Communication Services, Real Estate, Consumer Cyclical, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance