As job hopping slows, the median pay bump for changing employers has fallen from 20% to 10%

Good morning. CFOs are concerned about retaining exceptional talent. And Gen Z workers don’t tend to stay in the same jobs for too long. But new research by the Bank of America Institute suggests that job hoppers could be taking a pause as pay bumps for changing jobs fizzle.

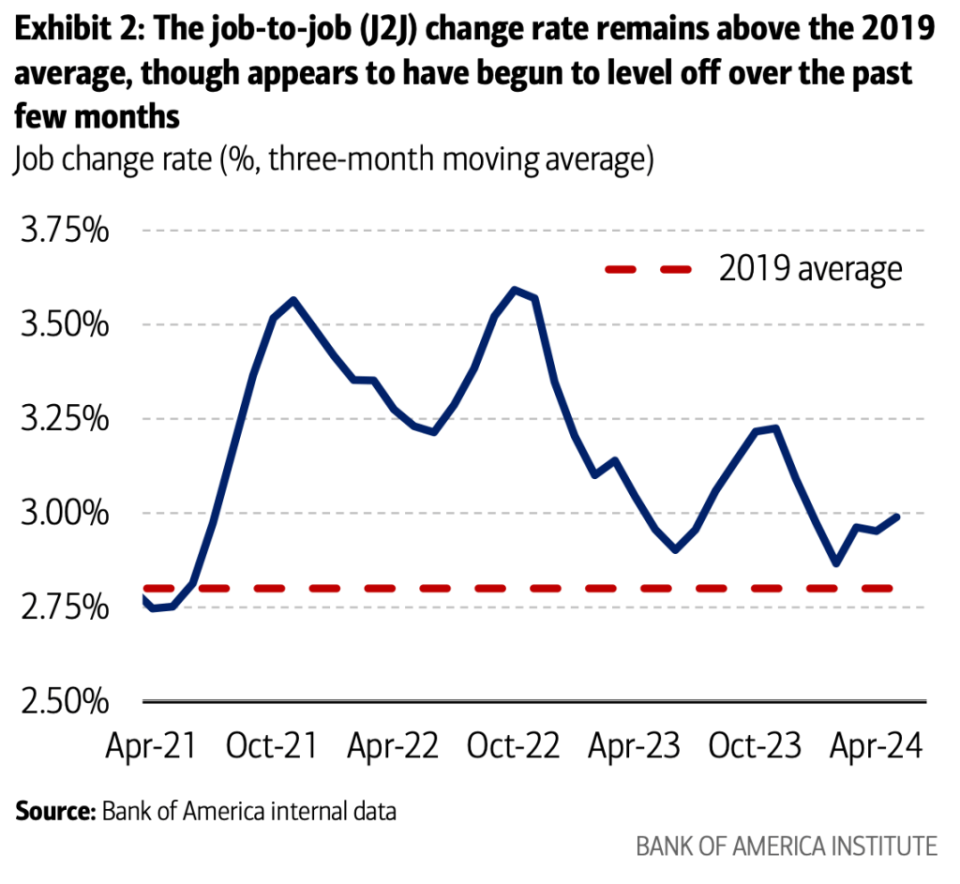

During the height of the Great Resignation in 2022, a record 4.5 million workers quit their jobs, according to Bureau of Labor Statistics data. Bank of America researchers looked at aggregated and anonymized internal deposit account data across millions of customers to track job-to-job (J2J) moves. They found out the rate at which people are making these J2J changes by identifying changes in payroll within deposit accounts.

J2J moves are still above 2019 levels, according to the report. However, the most recent change rate is estimated to be around 3% on average. Moves are starting to moderate from the unprecedented highs of the Great Resignation when the change rate reached almost 4%.

However, there has been somewhat of a rebound in the J2J rate of higher-income customers (earning $100,000 or more, with the year-over-year change surpassing that of lower-income customers (earning $50,000 or less) in the past few months, according to the findings. This reverses a trend that existed since April 2021. But the researchers suggest the current rebound is a stabilization of the earlier sharper fall in the higher-income job change rate.

For those individuals who continue to frequently change employers, take note—you’ll most likely be getting a smaller bump in pay from your new employer. When the Great Resignation was in full swing, the median pay raise people received when changing jobs reached more than 20%. But as of May 2024, median pay raises appear to have moderated to around 10% for J2J moves, below 2019 levels.

“This continued downward trend suggests the labor market is no longer as tight, and the balance of power between employer and employee has shifted back towards the hiring firm,” according to the report.

But it would benefit employers to keep employees from eyeing the door. Mars, Inc., the $50 billion global food and pet care giant, is a major company working toward retention.

“I would say to any young worker, explore the opportunities within your organization,” Shaid Shah, global president of Mars Food & Nutrition, told Fortune in a recent interview. “The grass always seems greener outside.” Mentorship for young employees is essential, as well as providing known opportunities for growth, he said.

Mars has “so many different aspects and dimensions to it, it has so many different variables of opportunity, and I think if you spent a whole career at Mars, you would probably get through only a fraction of them,” Shah said.

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance