Jiangsu JIXIN Wind Energy Technology And 2 Other Prominent Dividend Stocks

As global markets navigate through varying economic signals, Chinese stocks have shown mixed responses, particularly influenced by recent declines in home prices and a modest uptick in retail sales. In this context, dividend stocks like Jiangsu JIXIN Wind Energy Technology offer investors potential resilience and income generation amidst market fluctuations. A good dividend stock typically combines stable earnings with a consistent payout history, qualities that can be particularly appealing in the current economic environment where investors are looking for safer, yield-generating opportunities.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.52% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.67% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.76% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.56% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.13% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.62% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.73% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.42% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.57% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Jiangsu JIXIN Wind Energy Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu JIXIN Wind Energy Technology Co., Ltd. is a company that specializes in the development and manufacturing of wind energy technologies, with a market capitalization of approximately CN¥2.70 billion.

Operations: Jiangsu JIXIN Wind Energy Technology Co., Ltd. does not provide specific details on revenue segmentation in the provided text.

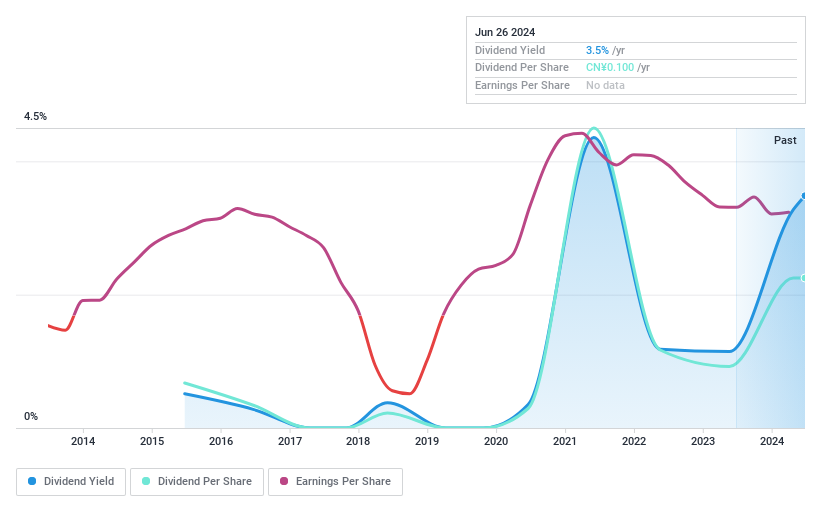

Dividend Yield: 3.5%

Jiangsu JIXIN Wind Energy Technology offers a dividend yield of 3.48%, ranking in the top 25% in the Chinese market, despite its unstable and volatile dividend history over the past nine years. The dividends appear sustainable, with a payout ratio of 72.6% covered by earnings and a cash payout ratio of 27%. Recent financials show steady growth with Q1 revenue reaching CNY 236.69 million and net income at CNY 12.34 million, indicating improved profitability which could support future dividends.

Zhejiang Huada New Materials

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Huada New Materials Co., Ltd. is a company based in China that specializes in the development, production, and sale of multi-functional color coated and hot-dip galvanized aluminum sheets, with a market capitalization of approximately CN¥3.42 billion.

Operations: Zhejiang Huada New Materials Co., Ltd. primarily generates its revenue from the production and sale of multi-functional color coated and hot-dip galvanized aluminum sheets in China.

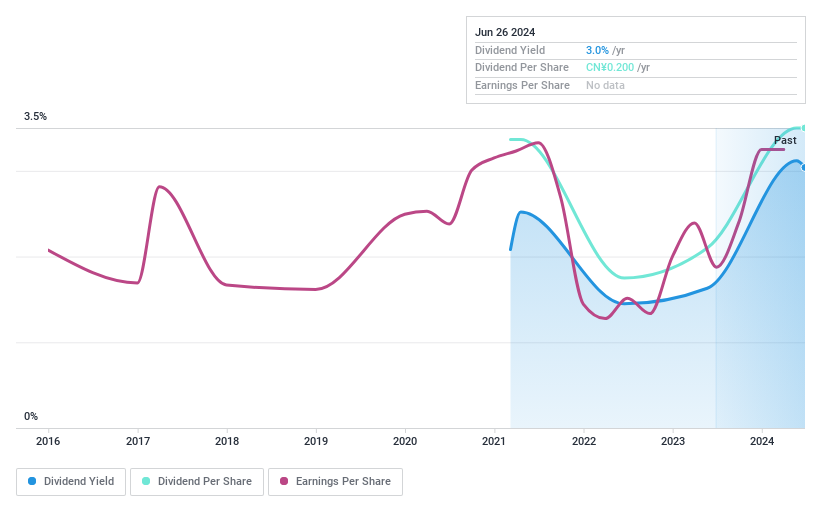

Dividend Yield: 3%

Zhejiang Huada New Materials has demonstrated a mixed performance in dividend reliability, with a history of volatile payments despite a current yield of 3.04%, placing it in the top quartile for dividend yields within its market. Recent earnings show modest growth with net income slightly increasing to CNY 71.08 million from CNY 70.96 million year-over-year, and dividends are well-covered by both earnings and cash flow, with payout ratios at 30.8% and 49% respectively. However, its short history of only three years of dividend payments suggests caution for those seeking long-term stability.

Hefei Meyer Optoelectronic Technology

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hefei Meyer Optoelectronic Technology Inc. is a company engaged in the development, production, and sale of optoelectronic products, with a market capitalization of approximately CN¥14.38 billion.

Operations: Hefei Meyer Optoelectronic Technology primarily generates revenue through the production and sales of photoelectric detection equipment, totaling CN¥2.35 billion.

Dividend Yield: 4.2%

Hefei Meyer Optoelectronic Technology has maintained stable dividends for a decade, offering a yield of 4.15%, ranking in the top 25% in its market. However, its dividend sustainability is questionable due to a high cash payout ratio of 104.1% and earnings coverage at 85.6%. Recent financials show a decline with Q1 revenue dropping to CNY 331.4 million from CNY 406.96 million year-over-year, and net income falling to CNY 100.9 million from CNY 125.03 million, reflecting potential pressures on future payouts despite recent affirmations of dividends at the AGM on April 23, with CNY 7 per ten shares distributed on May 17, highlighting ongoing commitment to shareholder returns amidst challenging conditions.

Summing It All Up

Unlock our comprehensive list of 230 Top Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:601218 SHSE:605158 and SZSE:002690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance