JetBlue Challenges Set to Continue Despite Icahn Backing

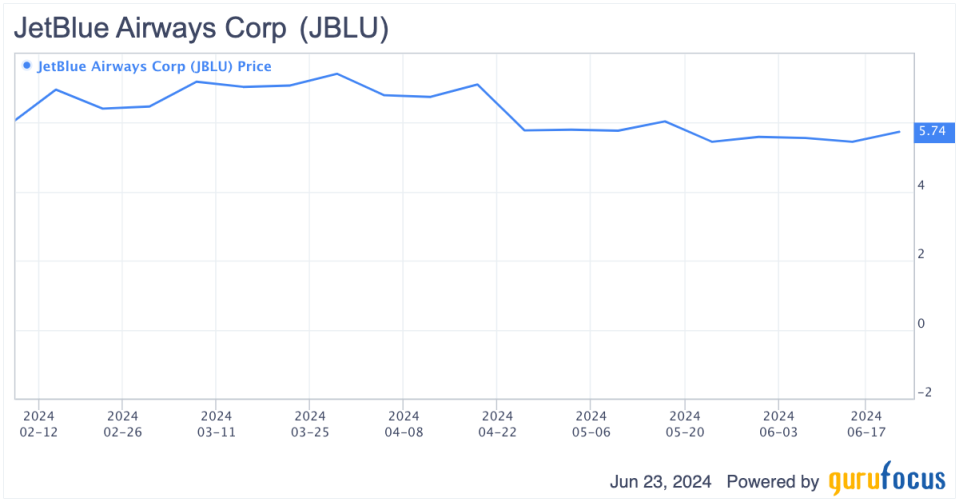

Investing guru Carl Icahn (Trades, Portfolio) recently acquired shares of JetBlue Airways Corp. (NASDAQ:JBLU). The move comes nearly 40 years after the renowned activist investor made a public splash by investing in TWA. JetBlue shares initially surged higher by roughly 21% after the position was made public on Feb. 12. Just a few days later, JetBlue announced that two Icahn representatives, Jesse Lynn and Steven Miller, would join its board of directors.

Despite this early victory for Icahn, JetBlue shares have recently traded lower and are now below where they were prior to the initial announcement of his investment.

The stock has languished as the company continues to struggle operationally and the airfare market has showed signs of weakness. The company has experienced a weakening credit profile and has recently been downgraded by major ratings agencies. Moreover, Icahn's previous experience with TWA should serve as a cautionary tale.

Financial and operational struggles

JetBlue has struggled financially of late and has been unable to deliver an annual profit since prior to the onset of the Covid-19 pandemic. Comparably, other larger airlines, such as United Airlines (NASDAQ:UAL), Alaska Air Group (NYSE:ALK), Delta Air Lines (NYSE:DAL) and Southwest (NYSE:LUV), have returned to profitability.

The company's poor financial performance over the past few years has been driven by a number of factors, including weak demand for business travel, distractions related to the Spirit (NYSE:SAVE) deal and operational challenges. Business travel for 2024 is expected to regain 95% of its 2019 levels, but potential growth remains limited due to general changes in how often business people need to travel. While JetBlue recently agreed to pay Spirit Airlines a termination fee of $69 million, the larger financial cost was the distraction that the deal created internally.

JetBlue initially announced plans to acquire Spirit Airlines in July 2022 and only abandoned the deal in 2024. Thus, a significant amount of company resources were spent pursuing the deal and attempting to come up with solutions to regulatory challenges. As a result, the airline lost focus on its core business.

It has routinely ranked among the worst of the major airlines in terms of on-time performance. For 2023, JetBlue ranked 17th among the top 20 global airlines in terms of on-time performance with an on-time rate of roughly 68%. Comparably, Delta, Alaska Air, American Airlines (NASDAQ:AAL) and United Airlines reported on-time performance of roughly 83%, 81%, 79% and 79% respectively. JetBlue has also been impacted by a manufacturing issue with some of its airplane engines, which have resulted in a number of aircraft being out of service.

Another headwind for JetBlue was the ending of a key codeshare agreement in mid-2023 with American Airlines that allowed customers to book codeshare bookings on the two airlines and had helped to limit competition between the two airlines on key routes. The agreement came to an end after the U.S. Department of Justice was able to obtain a favorable court ruling in a civil antitrust case.

Turnaround will be challenging

In response to recent challenges, JetBlue is now focused on implementing a turnaround plan to improve operational and financial performance. Key goals of the initiative include $300 million of new revenue initiatives, continued expansion of the TrueBlue program, and improved cost controls and capital allocation.

While JetBlue has made some progress on these initiatives, including achieving $100 million in cost savings and extending the life of its existing fleet, which has allowed for capital expenditure deferrals, the path to positive earnings remains challenging. Currently, consensus estimates call for the company to report a loss of 99 cents per share for fiscal 2024 and a loss of 13 cents per share for 2025. 2026 consensus estimates call for the company to report positive earnings per share of 42 cents.

Ultimately, I believe an operational turnaround for JetBlue will be challenging as the company operates in a highly competitive business and faces challenges due to its lack of scale compared to rivals. Peers such as United, American Airlines and Delta benefit from vastly larger operations, which allow for improved route and staffing optimization and larger revenue base to spread out fixed costs.

Moreover, JetBlue faces additional challenges in terms of its financing costs due to a weaker credit profile. On Feb. 15, S&P downgraded the company's credit rating to B from B+ and maintained its negative credit outlook due to weaker-than-expected credit metrics. Fitch followed with a downgrade from B+ to B on May 17 for similar reasons and noted that it expects JetBlue's Ebitdar leverage to be above 10 for 2024.

Valuation is not compelling relative to peers

Given JetBlue is expected to post negative earnings over the next few years, valuation metrics such as enterprise value-to-Ebitda and enterprise value-to-revenue are more appropriate than a traditional price-earnings valuation. On a forward enterprise value-to-Ebitda basis, the company trades at roughly 10. Comparably, peers such as Delta Air Lines, American Airlines and United Airlines trade at forward EV/Ebitda valuations of roughly 5, 4.80 and 3.60. The company's valuation premium to peers is driven by a view that JetBlue is likely to improve Ebitda margins significantly over the next few years, which will result in a valuation more in line with peers.

On an forward enterprise value-to-revenue basis, JetBlue currently trades at a multiple of 0.57. Comparably, Delta Air Lines, American Airlines and United Airlines trade at multiples of 0.78, 0.57 and 0.51. Thus, on a relative basis, its current valuation is not highly attractive compared to peers. I believe JetBlue should trade at a discount to peers given the recent profitability and operational challenges it has faced.

Icahn's TWA experience is cautionary tale

Icahn initially invested in TWA in 1986 and later took the struggling airline private in 1988 in a highly leveraged buyout. Following this, he proceeded to oversee the destruction of the airline. In 1991, the billionaire guru sold TWA's London routes to American Airlines for $445 million. TWA was forced to file for bankruptcy the following year. TWA emerged from bankruptcy in 1993, only to file again in 1995. As part of an effort to reduce its debt, much of which was owed to Icahn, TWA agreed to the Karabu ticket agreement, which was an eight-year agreement which gave Icahn the right to buy certain tickets at 55 cents on the dollar and resell them to customers at a higher price. It was later estimated that this transaction cost TWA $100 million per year. In 2001, TWA filed for bankruptcy for a third time and ultimately was sold to American Airlines.

While Icahn himself managed to do well with his TWA transactions, as much of the initial buyout was financed with debt from other parties, most other stakeholders did not fare well during his involvement with the company.

Given JetBlue's high debt load of roughly $5 billion, I do not believe a leveraged buyout led by Icahn or any other party is feasible. Thus, investors buying the stock based on Icahn's involvement are hoping he can lead a turnaround of the airline or lead a sale process to another airline. Icahn's experience at TWA suggests he may not be well positioned to spearhead a turnaround effort.

Potential upside catalyst

One potential upside catalyst for JetBlue shares would be U.S. regulatory regime change related to the outcome of the 2024 U.S. elections. If Donald Trump were to return to the White House, it is possible that he would favor a more relaxed antitrust regulatory approach which could benefit JetBlue. Under a more relaxed regulatory regime, JetBlue could become an attractive takeover target for a larger airline such as Southwest or Alaska Air.

Conclusion

JetBlue has faced significant operational and financial challenges over the past several years and is unlikely to return to profitability anytime soon. The financial struggles of the company have led credit ratings agencies to downgrade their rating of JetBlue.

While Icahn's involvement in the stock was initially viewed positively by public markets, based on his prior experience with TWA, I am skeptical that he will be able to lead a turnaround at JetBlue.

Despite recent challenges, JetBlue does not trade at an attractive valuation relative to peers based on key metrics and thus, I do not view the stock as undervalued at current levels.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance