JDW Sugar Mills And 2 Other Premier Dividend Stocks To Consider

As global markets navigate through a landscape marked by fluctuating inflation rates and varied central bank policies, investors continue to seek stable returns amidst the uncertainty. In this context, dividend stocks like JDW Sugar Mills often attract attention for their potential to offer regular income and relative stability. In choosing premier dividend stocks, it's crucial to consider factors such as the consistency of dividend payments, the financial health of the company, and how these stocks might fit into a broader investment strategy given current economic conditions.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.10% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.50% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 8.00% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.69% | ★★★★★★ |

Sonae SGPS (ENXTLS:SON) | 5.94% | ★★★★★★ |

Globeride (TSE:7990) | 3.76% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.95% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.42% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

JDW Sugar Mills

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JDW Sugar Mills Limited, along with its subsidiaries, engages in the production and sale of crystalline sugar and related by-products in Pakistan, boasting a market capitalization of PKR 30.10 billion.

Operations: JDW Sugar Mills Limited generates revenue primarily through its Sugar segment, which brought in PKR 98.43 billion, and also earns from its Corporate Farms and Co-Generation segments, contributing PKR 5.34 billion and PKR 5.23 billion respectively.

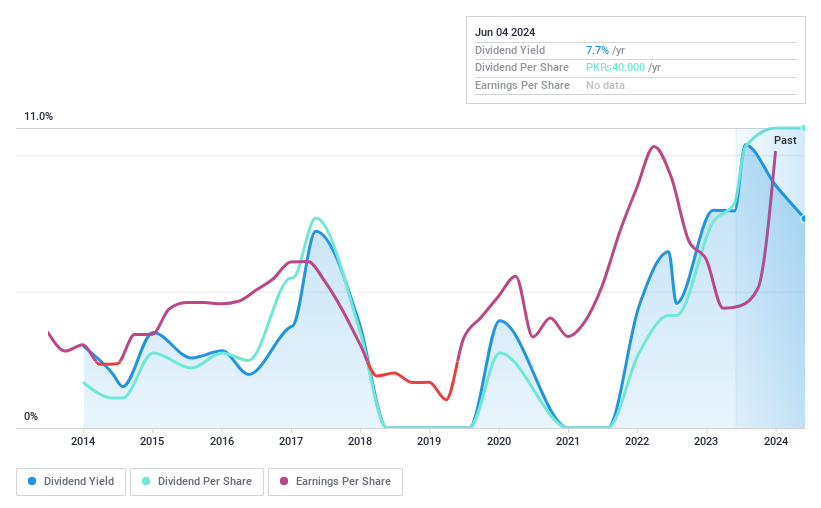

Dividend Yield: 7.7%

JDW Sugar Mills declared an interim dividend of PKR 20 per share following a strong financial performance, with second-quarter net income rising to PKR 2.94 billion from PKR 0.89 billion year-over-year and six-month sales reaching PKR 72.94 billion. Despite this, the company's dividend history has been marked by volatility and unreliability over the past decade. Although its P/E ratio at 4.2x is attractive relative to the broader Pakistani market, JDWS's dividend yield at 7.68% remains below the top quartile of Pakistani dividend payers, which stands at approximately 12.48%. The dividends are well-covered by earnings and cash flow, with payout ratios of 31.9% and cash payout ratio at a low of 10.1%, indicating sustainability from a financial perspective despite past inconsistencies in payment patterns.

Click here to discover the nuances of JDW Sugar Mills with our detailed analytical dividend report.

Our valuation report unveils the possibility JDW Sugar Mills' shares may be trading at a premium.

Solidwizard Technology

Simply Wall St Dividend Rating: ★★★★★★

Overview: Solidwizard Technology Co., Ltd. specializes in offering software, hardware, and consulting services primarily in Taiwan and China, with a market capitalization of approximately NT$4.73 billion.

Operations: Solidwizard Technology Co., Ltd. generates its revenues primarily through the sale of software, hardware, and the provision of consulting services in Taiwan and China.

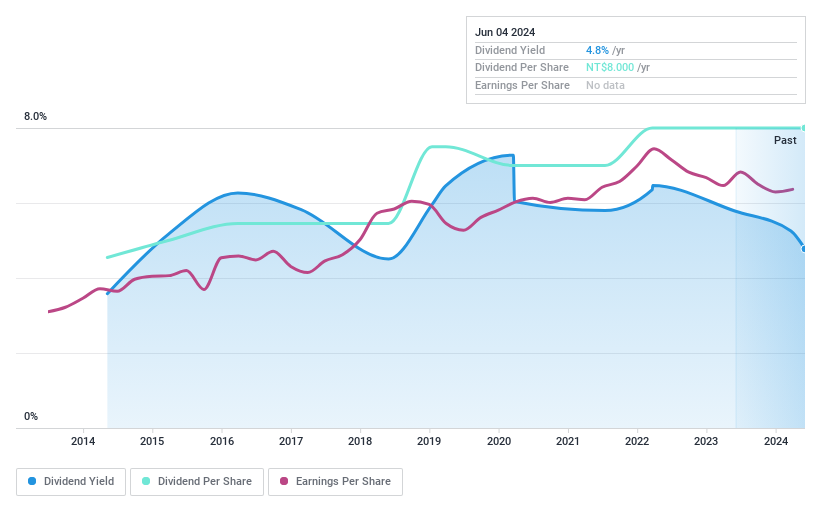

Dividend Yield: 4.8%

Solidwizard Technology recently affirmed a dividend of TWD 8 per share, payable on July 7, 2024. This follows a solid Q1 performance with sales up to TWD 390.58 million and net income at TWD 62.98 million. Despite recent board changes, the company maintains stable dividends supported by a payout ratio of 77.4% and cash payout ratio of 73.5%. Trading below its fair value by 4.3%, it offers an attractive yield of 4.78%, positioning it well in Taiwan's top dividend payers.

Mars Group Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mars Group Holdings Corporation operates in various sectors including amusement, automatic recognition systems, and hotel and restaurant industries primarily in Japan, with a market capitalization of approximately ¥61.99 billion.

Operations: Mars Group Holdings Corporation generates its revenues primarily from three sectors: amusement, automatic recognition systems, and hospitality services.

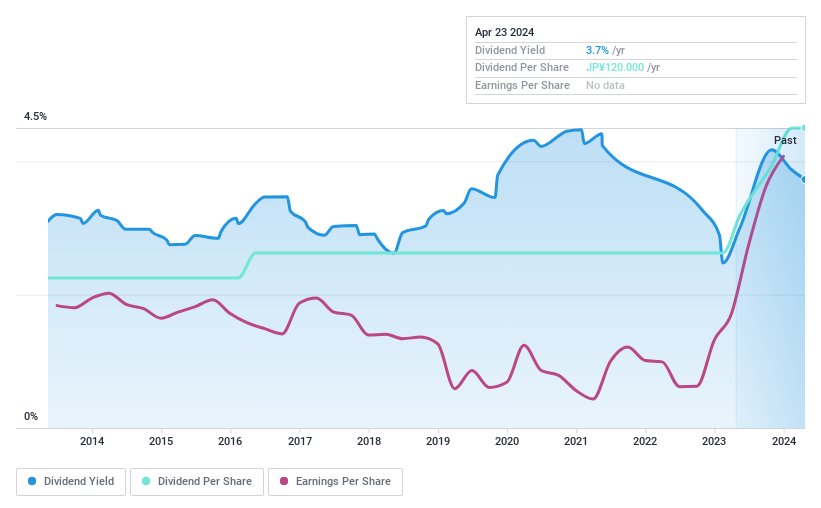

Dividend Yield: 3.1%

Mars Group Holdings has shown a mixed performance in dividend metrics. Despite a recent cut in annual dividend guidance from JPY 90 to JPY 75 per share, quarterly dividends saw an increase from JPY 35 to JPY 60. The company's dividends have been stable and reliably growing over the past decade, supported by a low payout ratio of 21% and cash payout ratio of 42.3%, ensuring sustainability. However, its dividend yield of 3.14% remains slightly below the top quartile in the Japanese market at 3.36%.

Summing It All Up

Dive into all 1937 of the Top Dividend Stocks we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KASE:JDWS TPEX:8416 and TSE:6419.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance