JDE Peet's (AMS:JDEP) Will Pay A Dividend Of €0.35

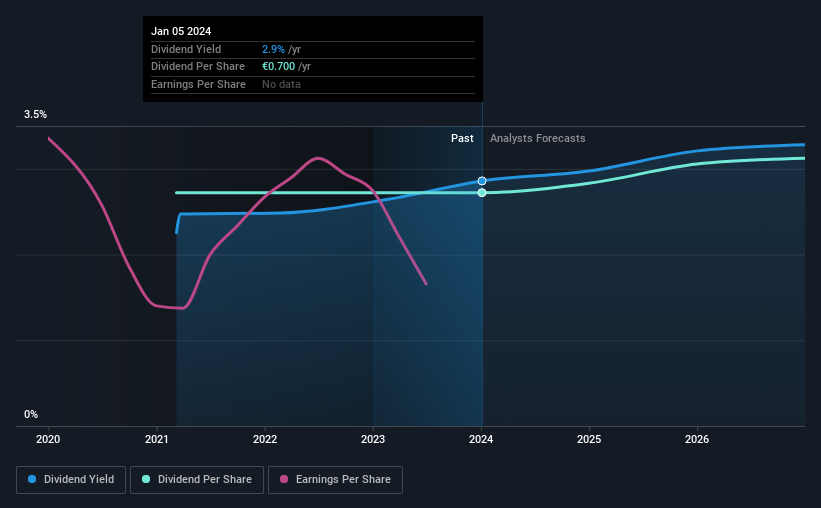

JDE Peet's N.V. (AMS:JDEP) has announced that it will pay a dividend of €0.35 per share on the 26th of January. This means that the annual payment will be 2.9% of the current stock price, which is in line with the average for the industry.

View our latest analysis for JDE Peet's

JDE Peet's' Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. The last payment made up 74% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

The next year is set to see EPS grow by 91.2%. If the dividend continues on this path, the payout ratio could be 39% by next year, which we think can be pretty sustainable going forward.

JDE Peet's Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The most recent annual payment of €0.70 is about the same as the annual payment 3 years ago. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Over the past three years, it looks as though JDE Peet's' EPS has declined at around 14% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Our Thoughts On JDE Peet's' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think JDE Peet's is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for JDE Peet's that investors need to be conscious of moving forward. Is JDE Peet's not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance