Japanese Exchange Growth Leaders With Up To 24% Insider Ownership

Amid a backdrop of mixed weekly returns and ongoing monetary policy adjustments, Japan's market landscape presents a nuanced picture for investors. The Nikkei 225 Index experienced a slight decline, while the broader TOPIX Index saw gains, reflecting varied investor sentiment and economic indicators. In this context, understanding the intrinsic value and growth potential of companies with significant insider ownership can offer insights into firms that potentially have more skin in the game, aligning leadership interests closely with shareholder value during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27.2% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.5% |

Medley (TSE:4480) | 34% | 24.4% |

Soracom (TSE:147A) | 17.2% | 59.1% |

freee K.K (TSE:4478) | 24% | 82.6% |

Let's take a closer look at a couple of our picks from the screened companies.

DaikokutenbussanLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daikokutenbussan Co., Ltd. operates discount stores and has a market capitalization of approximately ¥119.08 billion.

Operations: The company generates its revenue through the operation of discount retail stores.

Insider Ownership: 24.7%

Daikokutenbussan Ltd., a company with high insider ownership, shows promising growth metrics in the Japanese market. Recently, it announced a dividend of JPY 33 per share and expects significant increases in net sales to JPY 270.48 billion and profits to JPY 6.19 billion for FY ending May 2024. Earnings have surged by over 70% last year with forecasts suggesting robust annual growth of approximately 28.9% over the next three years, outpacing the broader Japanese market's average. However, its revenue growth at around 10.6% annually is modest compared to its earnings expansion.

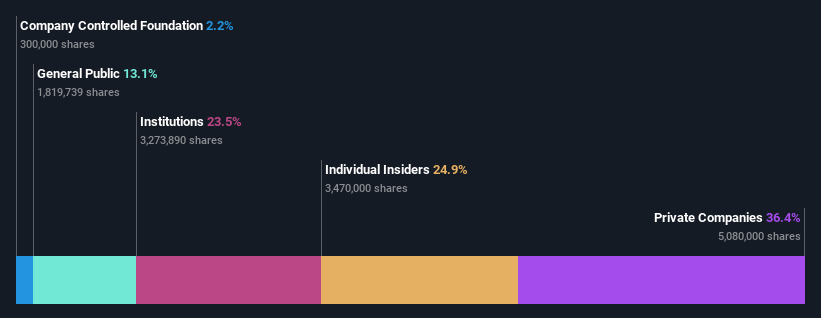

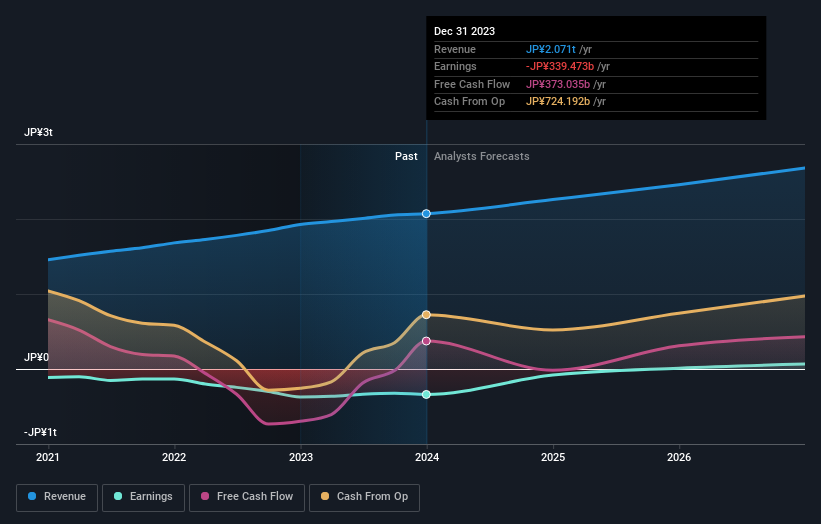

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving customers globally, with a market capitalization of approximately ¥1.75 trillion.

Operations: The company generates revenue through its operations in e-commerce, fintech, digital content, and communications sectors globally.

Insider Ownership: 17.3%

Rakuten Group, a growth-oriented company with high insider ownership in Japan, is positioned for significant operational expansion. Recently, the firm projected double-digit revenue growth for 2024, excluding its securities division. Despite trading at a substantial discount to its estimated fair value and expecting robust earnings growth of 87.6% annually, concerns linger due to its low forecasted return on equity of 8.8%. Additionally, Rakuten successfully raised US$1.99 billion through a high-yield bond offering in April 2024.

Click to explore a detailed breakdown of our findings in Rakuten Group's earnings growth report.

Upon reviewing our latest valuation report, Rakuten Group's share price might be too pessimistic.

Capcom

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a Japanese company that specializes in planning, developing, manufacturing, selling, and distributing home video games, online games, mobile games, and arcade games globally with a market capitalization of approximately ¥1.21 trillion.

Operations: The company generates revenue from the sale and distribution of home video games, online games, mobile games, and arcade games across various international markets.

Insider Ownership: 11.5%

Capcom, a Japanese growth company with high insider ownership, has shown promising performance with an 18.1% increase in earnings over the past year. Its revenue and earnings growth are forecasted to outpace the Japanese market at 5.7% and 8.8% per year respectively. Despite this, its annual profit growth is not considered significantly high. Recent activities include a successful presentation at GDC 2024 and a strategic stock split in March, enhancing shareholder value without substantial insider trading reported recently.

Make It Happen

Explore the 109 names from our Fast Growing Japanese Companies With High Insider Ownership screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:2791 TSE:4755 and TSE:9697.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance