Japanese banks must learn to lure Southeast Asia's youth

Going abroad is easier than making a go of a business overseas; the Japanese may need to emulate a family-run Singapore bank.

Few things excite bankers more than a youthful consumer market, which Japan has long stopped being. And although a Tokyo financier never had much of a chance in Shanghai because of historical reasons, even China’s population has aged.

Southeast Asia, where the Japanese are seen favorably as the region’s largest infrastructure investor, is a more natural choice for basking in robust credit demand and high profitability. But going abroad is easier than making a go of a business overseas. For the latter, the Japanese may need to emulate a family-run Singapore bank.

Japan’s banks have struck a series of deals in the region over the past decade. The latest, announced two weeks ago, is from Bank of Ayudhya Pcl, a Thai unit of Mitsubishi UFJ Financial Group Inc. The lender, also known as Krungsri, will acquire consumer finance businesses of Netherlands-based Home Credit NV in Indonesia and the Philippines for about 474 million euros ($673.74 million).

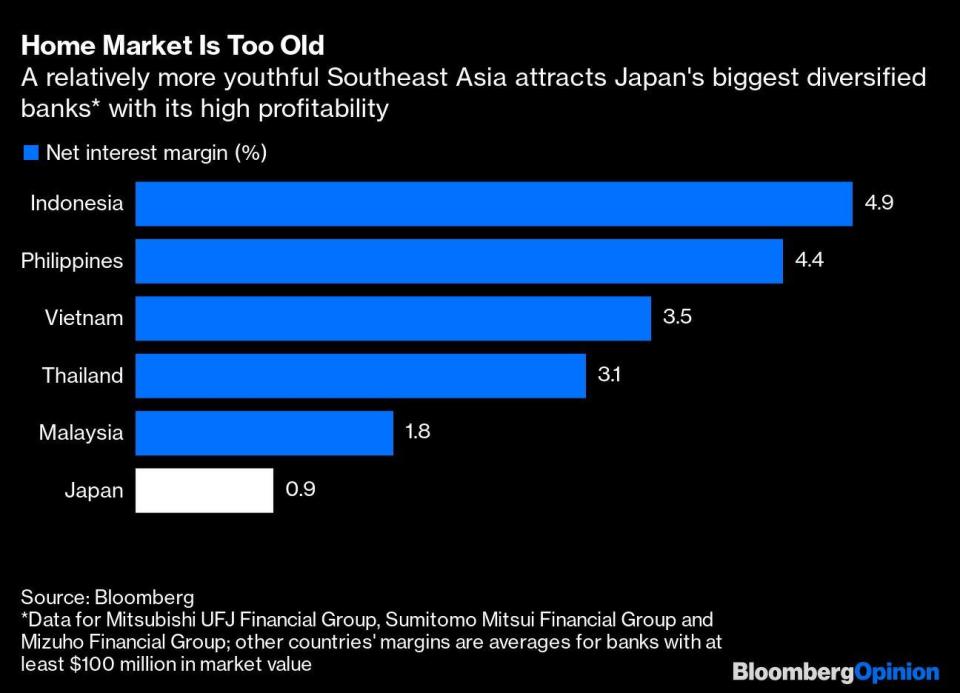

When Shinzo Abe became prime minister in December 2012, and the Bank of Japan set out to inflate the moribund economy through unprecedented monetary easing, interest rates on new loans for large Japanese lenders were 0.88%. They are currently 0.58%. Local banks were right in betting that they needed to be in economies with better demographics. Net interest margins in Indonesia are a mouth-watering 5%; in the Philippines, they average almost 4.5%. Even a more mature banking market like Thailand holds out the promise of 3%.

The Japanese came early. Starting in 2013, Sumitomo Mitsui Financial Group Inc. acquired 40% of Indonesia’s PT Bank Tabungan Pensiunan Nasional, or BTPN; it later took full control and merged its Indonesian unit with BTPN. Last year, SMFG bought 49% of Vietnamese financier FE Credit. It recently decided to raise the small stake it had picked up in Philippine lender Rizal Commercial Banking Corp. in 2021.

MUFG, the larger rival, has been more aggressive. It bought Krungsri in 2013, only a few months after snapping up a stake in Vietnam Joint Stock Commercial Bank for Industry and Trade, known as VietinBank. In 2016, it took 20% of Security Bank Corp., a Philippine lender. It acquired most of Indonesia’s Bank Danamon in 2019, and merged another of the country’s lenders, PT Bank Nusantara Parahyangan, or BNP, with Danamon. Through Krungsri, it purchased the consumer finance unit of Vietnam’s Saigon-Hanoi Commercial JSB last year. Now, MUFG and Sumitomo Mitsui are both circling around PT Bank Pan Indonesia.

However, for all their frenetic dealmaking, the Japanese haven’t come anywhere close to creating a banking behemoth with a unified Southeast Asian imprint. That’s where Singapore’s United Overseas Bank has stolen a march, though it has taken the lender controlled by the family of the 93-year-old billionaire Wee Cho Yaw more than a decade. In 2010, Chief Executive Wee Ee Cheong — the elder Wee’s son — realised that UOB needed a common technology platform to serve the banks his father and he had acquired in the region during the previous two decades.

That’s when the younger Wee’s team started building just such a platform — not an easy task given the differences in financial regulation from one country to another. That investment should pay off now as UOB bulks up in non-Singaporean markets by acquiring the consumer assets of Citigroup Inc. in Indonesia, Malaysia, Thailand and Vietnam, its first big M&A deal in 16 years. The Thai and Malaysian takeovers were concluded last month; the other two will be completed by the end of next year.

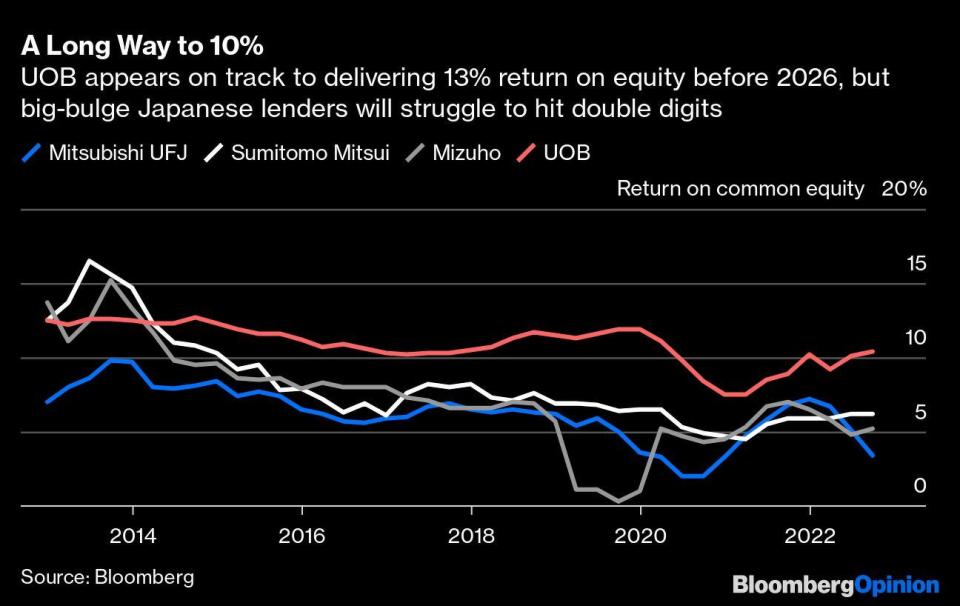

Since 2019, UOB has trailed its larger state-owned rival DBS Group Holdings in profitability. But the bank’s rising heft across Southeast Asia, particularly in retail banking, means improved access to low-cost deposits, a slew of wealth-management opportunities, and a real shot at boosting its return on equity to 13% ahead of the 2026 target, according to Bloomberg Intelligence.

Those are enviable figures for the Japanese institutions. But deals alone won’t get them to the pot of gold. Just before the pandemic, MUFG made a splashy US$700 million bet on Grab when it saw how the fintech, born as a regional ride-hailing startup, was using customer data to make loans.

Meanwhile, UOB was deploying the learning from its tech platform to start TMRW, a virtual-only bank in Thailand. It’s now mining the TMRW data — the branchless lender has since expanded to Indonesia — to make the rest of the group’s digital offerings more appealing to Gen Z customers. UOB has earmarked $500 million for the project; the goal is to double the number of retail customers it serves online across Southeast Asia to 7 million.

Smartphones are pushing regulators in the region to integrate their retail payments markets. An individual or business can already collect money instantaneously and nearly free of cost from another participant of the same national banking system. In a few years, the same capability will become available in cross-border transfers, too. All the more reason for the Japanese to raise their game.

To be able to open their checkbooks wide on acquisitions — and write down billions of dollars when they drop in value — may be business as usual for big-bulge Tokyo lenders. But for a credible string-of-pearls strategy, they need to work on the string: platform integration.

Granted, MUFG’s Japanese client base in Thailand, previously served by its Bangkok branch, became a key client segment for Krungsri. But just migrating old customers to a new entity can’t be the end goal. For real success in Southeast Asia, the Japanese have to be more in sync with the young population of these markets, a secret they can learn from a father-son banker duo in Singapore.

Infographics: Bloomberg

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

ADDX fractionalises venture debt fund by Temasek subsidiary and UOB

JP Morgan downgrades DBS to 'neutral' as future earnings growth already priced in

Perennial Holdings secures $3 bil green loan to refinance 8 Shenton Way

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance