Japan continues on growth streak even as rest of APAC commercial property sales contracted in 1Q2024

In the face of the Bank of Japan’s recent exit from its negative interest rate regime in March, it remains to be seen whether multifamily yields can be sustained at their low levels (Photo: Bloomberg)

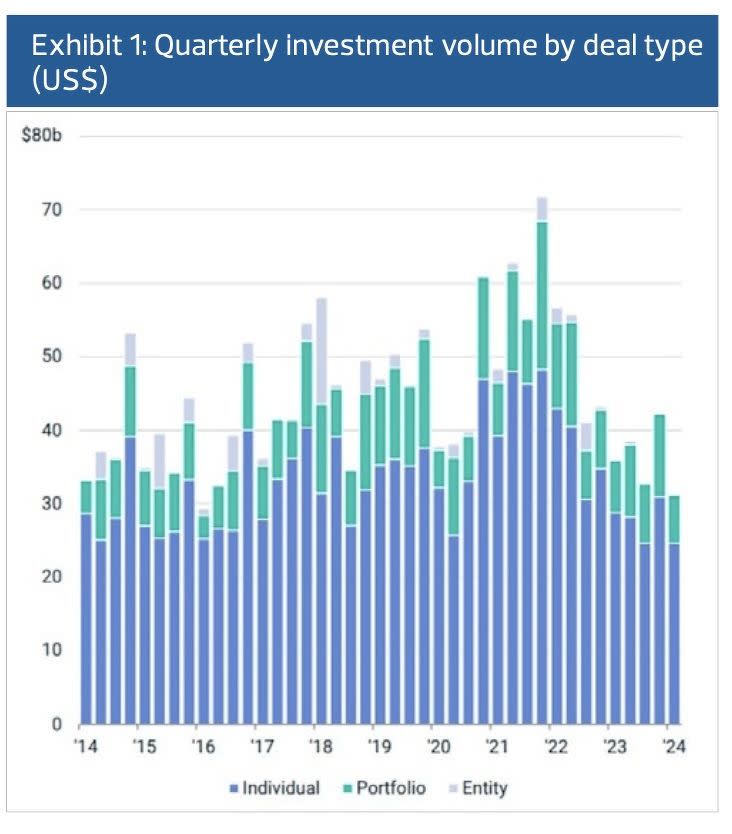

Trading of commercial property contracted in 1Q2024, weighed down by the high interest rate environment and a retreat from apartment, office and seniors housing deal activities.

While the first quarter of 2024 marked a continuation of last year’s slowdown in commercial real estate transaction activity, deal activity in Asia Pacific’s data centre sector started briskly, fuelled by a burgeoning appetite for assets powering the digital economy.

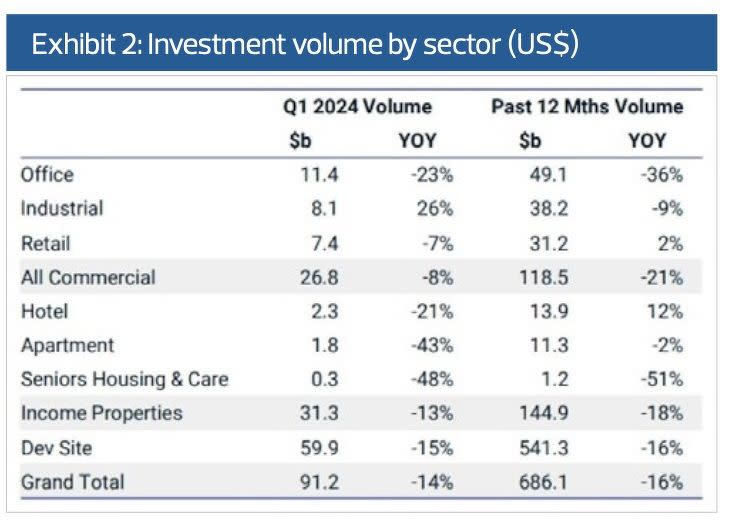

For 1Q2024, deal volume fell by 13% y-o-y to US$31.3 billion ($42.1 billion). While the pace of decline was steeper than a quarter ago, it was more gradual than the previous five. Japan was one of the bright spots, with a recovery in office investment and strong acquisition momentum for other sectors indicating that recent tweaks to the Bank of Japan’s interest rate policy have had little impact on investor sentiment.

Read also: Singaporeans overtake US as biggest group of cross-border investors in Asia Pacific in 2023: MSCI

While Japan has been the standout market for some time, other markets in Asia Pacific have shown resilience in both deal activity and performance returns.

Activity is stabilising for many major markets, while returns in 2023 were still positive for many sectors despite the high interest rate environment. Initial signs in 2024 so far point to investors continuing to focus on growth areas like data centres and emerging living sectors

Interest in growth sectors across Asia Pacific remained strong, with acquisitions of standing data centre assets totalling more than US$1.6 billion in the first quarter alone, surpassing both the first and second halves of 2023.

Source: MSCI Real Assets

Retail sector a bright spot

The retail sector is another bright spot for the region amid the sluggish dealmaking environment. Following several quarters of subdued activity, appetite for retail has started to pick up in recent quarters — this points to a trend of investors seeking value in the sector that has seen the most substantial repricing in the region.

The retail deal activity ended the quarter at US$7.4 billion, which accounted for nearly a quarter of total commercial real estate sales in the quarter — the highest proportion that the sector has notched for any single quarter over the past five years.

Office volume continued its decline across most of Asia Pacific, falling more than 20% from the first three months of last year. This was the only sector where deal activity over the past 12 months remained significantly lower than in prior periods, dragged down by muted activity in markets like Singapore, Hong Kong and Osaka.

Read also: APAC commercial property sales plunge 40% y-o-y in 2Q2023: MSCI

Acquisition momentum in Japan’s multifamily sector slows

While acquisitions of apartments fell by over 40%, investors continued to gain exposure to the sector through conversions of hotel properties. In addition to Singapore, this trend spanned several markets. For Japan multifamily, acquisition momentum slowed further. Yield compression has slowed in Tokyo’s CBD and held firm in other major cities. In the face of the Bank of Japan’s recent exit from its negative interest rate regime in March, whether multifamily yields can be sustained at their low levels remains to be seen.

While there were concerns over waning foreign appetite and domestic liquidity late last year, Seoul’s office market continues defying the odds, at least for now. Offices remain the most invested sector and a spate of new deals was announced in March, which was helped by price reductions — albeit sometimes only marginal — from contract to deal closure.

Source: MSCI Real Assets

Industrial sector driven by Japan and China

Activity in the industrial sector continued to be driven by Japan and China, where borrowing costs remained low. Logistics portfolios were traded in both markets. For Australia and South Korea, further yield decompression for industrial assets has helped spur activity, which remained on level terms with last year.

Cross-border flows into Asia Pacific commercial real estate have remained subdued. While flows from outside the region increased slightly, this was balanced out by dampened activity from regional investors.

On a four-quarter rolling basis, the share of cross-border investment remained just under 25%, the lowest level in 10 years. Still, the fact that investment from global players has stopped falling — for now — is a positive sign. Interestingly, several of these investors did deals in multiple markets.

Hong Kong’s deal activity showed a mixed picture

After a period of subdued activity, Hong Kong’s retail sector began to pick up on yield expansion stimulating deal activity, with a string of shopping centre deals in the first quarter. On the other hand, stubborn pricing has held back a recovery in appetite for high street shops and offices.

Read also: Commercial investment in Singapore up 74% in 2Q2022: MSCI

One exception to this rule was selling a newly completed office building in the CBD of Hong Kong Island. The price for the half-vacant office came to just over HK$8,000 ($1,380) per sq ft, substantially lower than other en bloc office deals in recent years. Hong Kong office yields compressed marginally in 2023 but began moving upward again this year.

Lion City deals boosted by suburban malls

In Singapore, the retail sector came out on top. Office market activity (including strata sales) has slowed significantly, meaning the number of office deals over the past year fell below both industrial and retail.

Focus has shifted to the residential and co-living sectors, with three hotels acquired for conversion in the first quarter of 2024.

Meanwhile, suburban malls have continued to transact over the past few quarters despite pricing being near peak levels and yields still in line with longer-term averages.

The biggest deal in the first quarter was the sale of a fully occupied mall that traded at a yield of close to 4% and a price some 18% over its last known appraised value in mid-2022.

China commercial real estate remained active

Activity in China slowed 19% from the 1Q 2023 tally, but it remained the biggest market over the past 12 months, with US$40 billion of assets traded.

There were strong year-over-year gains in volume for both industrial and retail, while the office sector continued to languish.

Investment in Shanghai offices fell by almost two-thirds, putting its office market behind Beijing in the first quarter. Shanghai took the crown for the biggest retail market, with almost US$900 million in deal volume.

Japan boosted by office and industrial investment

Japan’s strong run in 2023 continued as the market came out on top in the first quarter of 2024. Recent tweaks to the Bank of Japan’s interest rate policy appear to have had little impact on investor sentiment, as the first-quarter tally of JPY1.35 trillion (US$11.2 billion) was broadly in line with the five-year average of JPY1.44 trillion. Tokyo held its position at the summit of Asia Pacific’s list of top metros, with over US$5 billion transacted in the first quarter alone.

Notably, Japan’s office sector finished the financial year on a high note after a slowdown in investment appetite over the previous nine months. The drought of cross-border interest in Tokyo offices was halted in early 2024 when five floors of a Marunouchi office tower were acquired for more than JPY40 billion.

Japan’s industrial sector flourished, with multiple major logistics and data centre deals in the quarter. In the multifamily market, a 29-asset residential portfolio was sold to a consortium of offshore investors.

South Korea’s logistics sector picks up

South Korea bounced back in the first quarter, as volume surged by over 80% from last year’s low base. However, activity was down by about 30% compared with the five-year average.

Still, Seoul remains one of the few office markets globally where major deals are still being struck despite the high interest rate environment. Office volume over the past 12 months was slightly higher than the 12 months before. Meanwhile, the pipeline remained strong, with deals for eight offices, each priced over US$100 million, outstanding as of the end of March.

Recovery in investment activity expected to be drawn out

As we examine 2Q2024, various indicators suggest that the decrease in investment activity is approaching its lowest point. The deal pipeline — the stock of outstanding deals where a contract has been signed but has yet to be completed — has remained relatively stable over the past few quarters. In addition, yield expansion has started to taper off for key institutionally focused sectors, such as Korean and Australian offices and warehouses. Nearing the bottom, however, does not imply an imminent recovery.

For most markets outside Japan and China, yield spreads to borrowing costs remain thin or negative. Many deals that could have generated sizable returns before 2022 would no longer be as attractive under current debt costs.

A lot still rides on the timing and magnitude of US-led interest rate cuts and in recent weeks, the question has become whether these will even happen. It is clear, though, that this trough will likely be bumpy.

Benjamin Chow is the Head of Real Assets Research for Asia at MSCI (Credit: MSCI)

MSCI Real Assets’ Asia Pacific Capital Trends report was released on May 20, 2026

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Singaporeans overtake US as biggest group of cross-border investors in Asia Pacific in 2023: MSCI

APAC commercial property sales plunge 40% y-o-y in 2Q2023: MSCI

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance