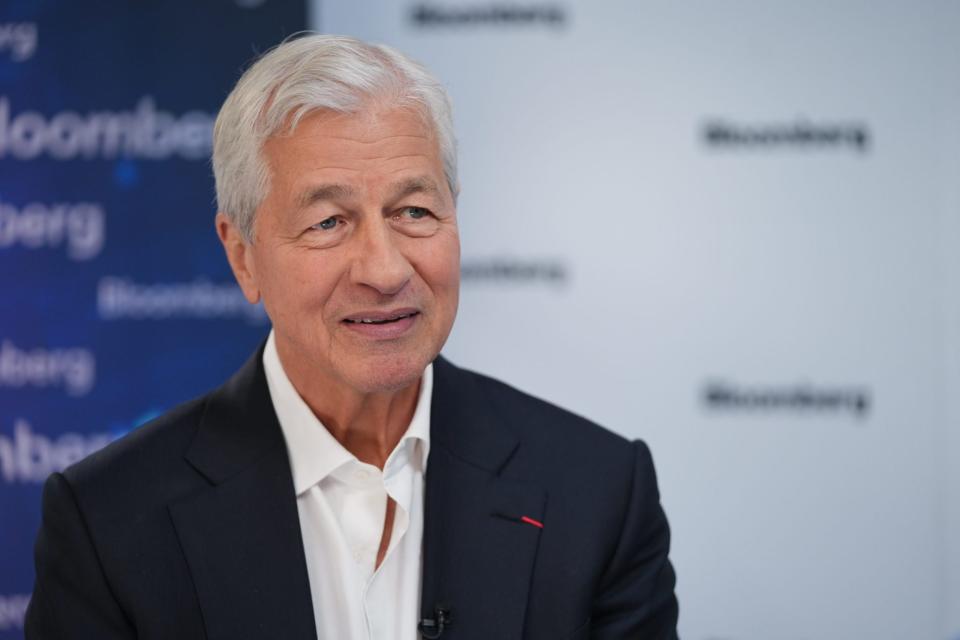

Jamie Dimon shocks Wall Street, hinting at his retirement in the next five years and reciting a laundry list of red flags about the global economy

Jamie Dimon caught all of Wall Street’s attention on Monday. In a series of public remarks made at JPMorgan Chase’s investor day, Dimon painted a bearish picture of the global economy and hinted his retirement is nearer than many had anticipated.

During his speech, a concerned Dimon issued a laundry list of red flags about the global economy: inflation that won’t seem to go away, a U.S. government prone to profligate spending, and a geopolitical landscape that’s among the most volatile he’s seen.

On top of that macro uncertainty—which is notable if it’s worrying a steady hand like Dimon’s—mention of his eventual retirement risked unbalancing the company he’s run for 18 years. The prospect of a JPMorgan without Dimon at the helm is daunting enough, but even more so now considering how rocky the economy is at the moment. In his speech, Dimon warned against potential threats he’d highlighted in the past, making for a worrisome outlook that was more dire than the sum of its parts.

“I’m cautiously pessimistic,” Dimon said.

Dimon’s succession planning has garnered much attention from investors, employees, and observers. During his time in the top job, Dimon turned JPMorgan into the country’s largest bank, overseeing a sprawling empire of financial services. As such, the prospect that he might not be there to steer the company has many stakeholders questioning what its future without him might look like. And on Monday, he hinted that eventuality might be closer than previously expected.

“The timetable isn’t five years anymore,” Dimon said at the New York City–based bank’s annual investor meeting.

In the past, Dimon repeated he plans to retire within five years so many times that it became a running joke in financial circles.

“My statement stays the same, it’s five years,” Dimon said back in 2020 when asked when he planned to step down. “When and if we ever set an actual retirement date, we’ll let you know.”

But on several occasions, those five years came and went with him still in the top job. Just a year ago, Dimon said he had little interest in stepping down because he felt his “intensity is the same.” He reiterated that point on Monday, albeit hinting that his usual five-year timeline had been shortened. JPMorgan’s stock dipped 4.5% on Monday after the news. Bank of America said the revelation caused JPMorgan’s stock to dip because of “investor anxiety about the issue.”

By Tuesday, the stock had recovered slightly, but remained below Monday’s high.

JPMorgan’s ‘strong candidates’ for CEO

Now, Dimon and the JPMorgan board seem to be addressing succession planning with an added focus. If Dimon were to leave the CEO job, it’s likely he would remain as board chair. When reached for comment, a JPMorgan spokesperson pointed Fortune to Dimon’s comments from Monday, in which he replied “we’ll see” about whether he would stay on as chair.

With regards to succession planning, Dimon hinted at the strong bench of talent JPMorgan has at its disposal. “The whole operating committee…they all know all parts of the company,” Dimon said. “How many companies can say that?”

Others took note of that fact as well. In an analyst note, UBS said there “were a number of strong candidates with vast experience across the bank.” Two of the frontrunners—Marianne Lake, current CEO of JPMorgan’s consumer bank, and Jennifer Piepszak, who heads up the commercial and investment bank—started their new roles in January, giving them the diverse experiences Dimon touted. “We sense investors think of Piepszak and Lake as likely among the strongest contenders for the job, when the time comes,” UBS said.

Keeping a close eye on the economy

In recent months, Dimon has been vocal that many of the macroeconomic indicators had him worried. He has been especially concerned with the national debt, which he sees as a ticking financial time bomb for the U.S.

"Somewhere along that journey—and I don't know if it's six months, six years, or 16 years—it will be a problem," Dimon said during the investor day.

The ballooning national debt dovetails with persistent inflation and dwindling excess savings for consumers and small businesses alike—both issues that Dimon believes the global institutions have been lackadaisical about addressing. Just last week he was harping on inflation, saying analysts were overestimating its stickiness. “The chance of inflation staying high or rates going up are higher than people think,” Dimon told Bloomberg.

All that comes against a geopolitical backdrop that has Dimon worried to a degree he’s never been before in his career. The war in Ukraine rages on. In the Middle East, conflicts show little sign of abating—in fact they appear to be ratcheting up—and tensions between China and the U.S. risk spilling over into a genuine trade war.

“Now may be the most dangerous time the world has seen in decades,” Dimon said in October, less than a week after Hamas’s attacks in Israel that kicked off the ongoing war.

Whoever succeeds Dimon will have to grapple with the litany of issues he sees facing the world. And while that might be a tall order, he leaves behind a strong company with diversified lines of business and an enviable balance sheet that’s flush with cash.

“What is easier to predict is that Mr. Dimon will be handing over to his successor a best-in-class global banking franchise that has been battle-tested over multiple cycles,” Bank of America said in its analyst note.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance