Jacobs (J) to Manage $517 Million Austin ISD Capital Program

Jacobs Solutions Inc. J, a renowned leader in program management services, has been selected by the Austin Independent School District (“ISD”) in Austin, TX, to oversee a substantial capital improvement program. This program, valued at more than $2.4 billion, aims to revamp Austin ISD facilities by modernizing 25 schools, enhancing security measures, upgrading technology infrastructure, and ensuring regular maintenance.

Shares of Jacobs lost 2% on Sep 5 during the trading session but inched up 0.1% in the after-hour trading session on the same day.

Jacobs' selection as one of the three program managers responsible for leading segments of this ambitious project is a significant achievement for the company. Their five-year contract, worth approximately $517 million, places them in charge of developing 10 schools within the Austin ISD, which will involve overseeing essential upgrades such as heating, air conditioning, plumbing, roofing, and more.

Moreover, the project includes noteworthy enhancements like the establishment of school mental health centers and community pantries, developments of visual and performing arts and athletic facilities, improvements in early learning and special education classrooms, and the creation of new playgrounds and outdoor learning spaces.

This strategic partnership with Austin ISD holds great promise for Jacobs. The district, being the eighth largest in Texas with more than 73,000 students and situated in a rapidly growing metroplex, offers a substantial growth opportunity. Importantly, this collaboration also signifies a return to familiar territory for Jacobs, as they previously provided program management services for Austin ISD's "Children First Bond Program" between 1996 and 2001.

With this latest contract, Jacobs is poised to thrive, not only by contributing to the betterment of education infrastructure but also by boosting its financial prospects, making it an attractive stock for investors looking for long-term growth potential in the education sector.

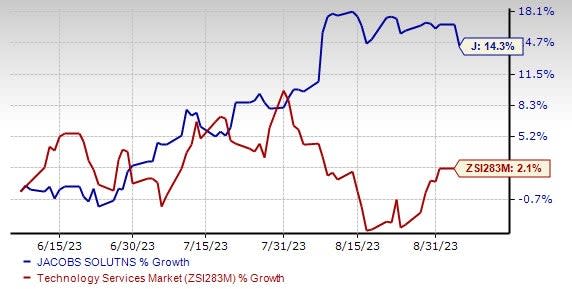

Price Performance

Image Source: Zacks Investment Research

In the past three months, shares of Jacobs have gained 14.3% compared with the industry’s 2.1% rise. A robust backlog level signals a growing demand for Jacobs' consulting services across various sectors, including infrastructure, water, environment, space, broadband, cybersecurity, and life sciences. Furthermore, the emphasis on enhancing efficiencies through digital and technological solutions, as well as strong project execution, positions the company favorably.

Zacks Rank & Key Picks

Jacobs currently carries a Zacks Rank #3 (Hold).

TriNet Group, Inc. TNET currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TNET delivered a four-quarter average earnings surprise of 84%. The company’s shares have rallied 61.4% year to date (YTD). The Zacks Consensus Estimate for TNET’s 2023 sales and earnings per share (EPS) indicates a decline of 4.7% and 2.7%, respectively, from the prior-year reported figures.

Parsons Corporation PSN currently flaunts a Zacks Rank of 1. PSN has a four-quarter average earnings surprise of 5.2%. The stock has gained 22.5% YTD.

The Zacks Consensus Estimate for PSN’s 2023 sales and EPS indicates growth of 18.7% and 23.2%, respectively, from the prior-year reported figures.

DocuSign, Inc. DOCU currently sports a Zacks Rank of 1. DocuSign has a trailing four-quarter earnings surprise of 25.6% on average. Shares of the company have declined 5.7% YTD.

The Zacks Consensus Estimate for DocuSign’s fiscal 2024 sales and EPS indicates growth of 8.1% and 24.1%, respectively, from the year-ago reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TriNet Group, Inc. (TNET) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Parsons Corporation (PSN) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance