ISA Holdings' (JSE:ISA) Upcoming Dividend Will Be Larger Than Last Year's

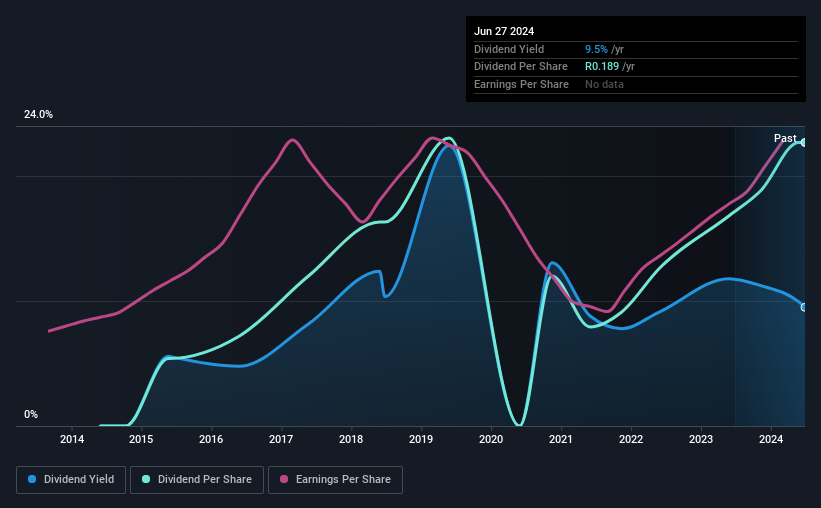

ISA Holdings Limited's (JSE:ISA) dividend will be increasing from last year's payment of the same period to ZAR0.112 on 22nd of July. This takes the dividend yield to 9.5%, which shareholders will be pleased with.

Check out our latest analysis for ISA Holdings

ISA Holdings Is Paying Out More Than It Is Earning

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, the company's dividend was much higher than its earnings. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Looking forward, EPS could fall by 0.3% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 106%, which is definitely a bit high to be sustainable going forward.

ISA Holdings' Dividend Has Lacked Consistency

Looking back, ISA Holdings' dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. Since 2015, the annual payment back then was ZAR0.045, compared to the most recent full-year payment of ZAR0.189. This works out to be a compound annual growth rate (CAGR) of approximately 17% a year over that time. ISA Holdings has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend's Growth Prospects Are Limited

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Although it's important to note that ISA Holdings' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

ISA Holdings' Dividend Doesn't Look Great

In summary, investors will like to be receiving a higher dividend, but we have some questions about whether it can be sustained over the long term. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 5 warning signs for ISA Holdings you should be aware of, and 3 of them are potentially serious. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance