iQIYI (NASDAQ:IQ investor three-year losses grow to 84% as the stock sheds US$124m this past week

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of iQIYI, Inc. (NASDAQ:IQ), who have seen the share price tank a massive 84% over a three year period. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 43% in the last year. More recently, the share price has dropped a further 28% in a month. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 3.6% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for iQIYI

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

iQIYI became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

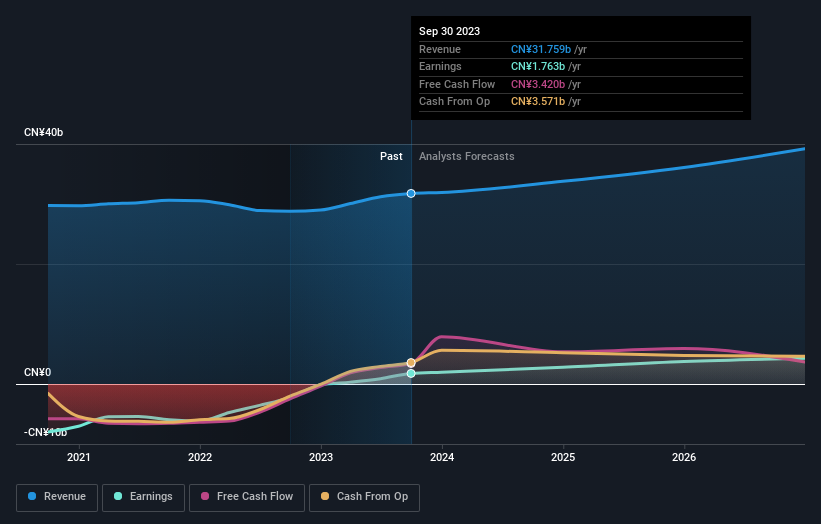

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

iQIYI is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling iQIYI stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Investors in iQIYI had a tough year, with a total loss of 43%, against a market gain of about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand iQIYI better, we need to consider many other factors. For instance, we've identified 2 warning signs for iQIYI that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance