Investors must 'work harder' with climate change, higher inflation affecting 30-year forecasts: Schroders

Schroders thinks investors will still be rewarded for taking more risk and investing in equities over the next 30 years.

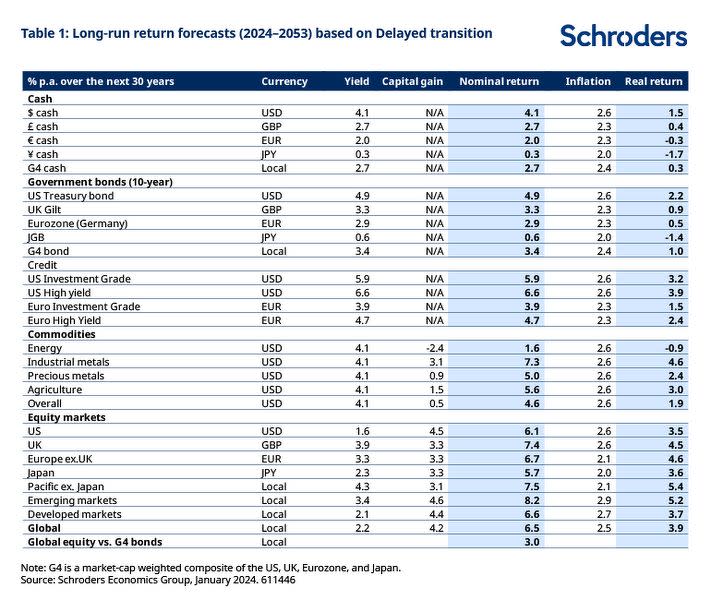

Climate change and higher inflation have affected Schroders’ 30-year return forecasts, underlining how investors will need to work harder, reads a Jan 25 report.

“This year, we are expecting higher returns across most asset classes in real and nominal terms, particularly among the fixed income markets,” say Schroders’ strategist Tina Fong and environmental economists Samar Khanna and Irene Lauro.

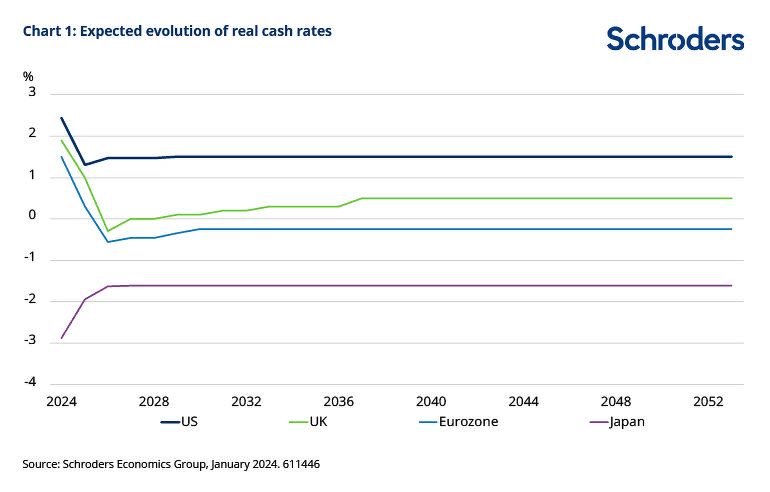

Policymakers are likely to keep interest rates higher in response to inflation being more persistent, they add. “This has been driven by major shifts in the three areas of decarbonisation, demographics and deglobalisation, known as the 3D Reset.”

As higher cash returns drive up returns on all fixed income assets, the risk premium for owning equities will be lower. So, equity investors will need to work harder given the challenges of making equities a more attractive prospect than cash and sovereign bonds, say the analysts.

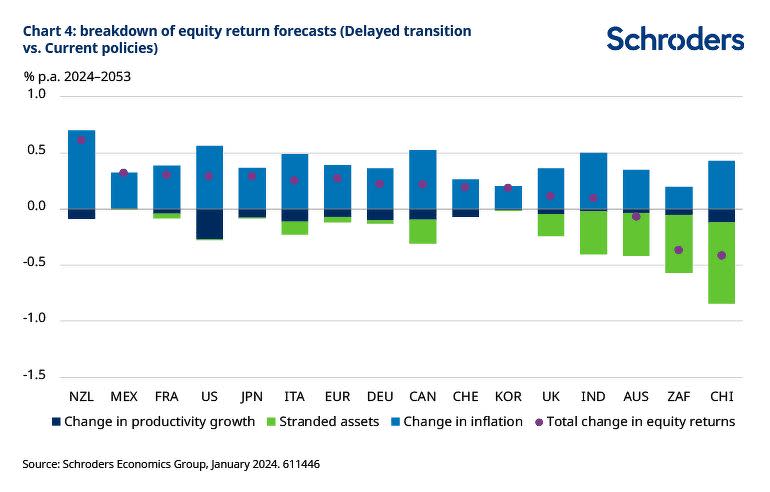

Meanwhile, the impacts of climate change on asset returns are “uneven”, they add, with winners and losers in different geographies. “Despite the substantial downgrades in emerging market returns from the incorporation of climate change, they are still expected to deliver higher returns than most of the developed markets.”

Labour market tightness

Central banks are likely to keep interest rates higher in response to inflation being more persistent.

In the near term, the tightness in the labour market is likely to keep prices and wages elevated for longer, according to Schroders. “Over the medium term, inflation could prove to be more persistent in the aftermath of the Covid-19 pandemic and the 3D Reset.”

By contrast, Schroders’ global equity return forecast has moved marginally lower this year. “This is primarily driven by weaker expected returns in the emerging markets and a marginal downgrade to the US equity forecast.”

In addition, this is on the back of the decline in dividend yields in these markets. Overall, Schroders forecasts that the risk premium for owning equities versus the major government bond markets has narrowed this year. “So, equity investors will need to work that bit harder.”

Incorporating impact of climate change

Schroders’ analysts say they adopt a three-step approach to incorporate climate change in their macroeconomic assumptions.

Firstly, Schroders measures physical impact. “We focus on the physical risk of climate change by examining the impact of temperature rises on output and productivity.”

Next, Schroders assesses the transition impact. “We consider the transition risk by evaluating the economic impact of actions taken to mitigate climate change and reach net-zero targets.”

Finally, Schroders accounts for stranded assets. “We account for the effects of stranded assets — where we factor in losses resulting from the write-off of coal, oil and gas reserves that can no longer be exploited and hence remain in the ground.”

Schroders’ three climate scenarios then describe how these three areas collectively impact productivity, economic growth and inflation for different economies. “These are crucial for estimating long-term asset returns.”

Delayed transition

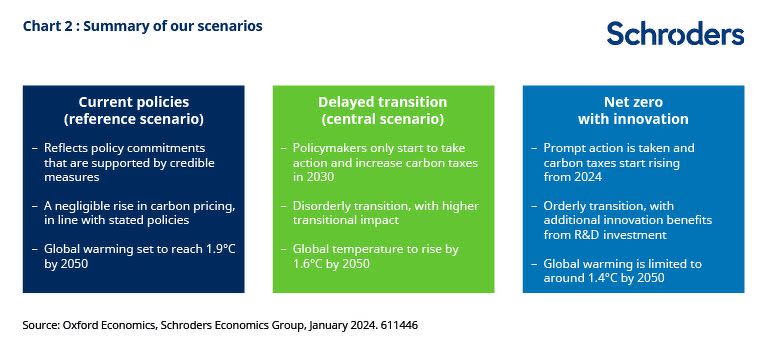

Schroders outlines three decarbonisation scenarios but notes that the “delayed transition” scenario is the most likely of the three. Thus, this forms Schroders’ central scenario.

Under this scenario, policymakers delay climate action until 2030 and then introduce aggressive policies over a short span of time to limit temperature increases to 1.6°C by 2050, resulting in a disorderly transition.

Meanwhile, Schroders’ “net zero with innovation” scenario examines the upside to this central scenario, where proactive policies spur greater innovation and productivity. This will result in an orderly transition to limit global warming to 1.4°C with comparatively lower economic pain.

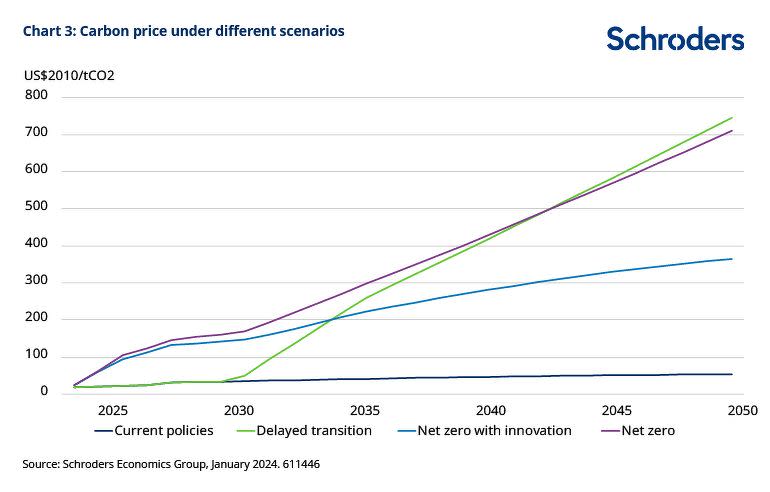

“In our scenarios, policymakers induce the transition to a low-carbon economy by raising carbon prices and internalising the cost of emissions,” say analysts. “Carbon prices can be considered as a proxy for mitigation policy ambition and effectiveness.”

The current policies — or Schroders’ reference scenario — presents a future where emissions do not peak till 2030. This reflects policy commitments supported by credible measures. This scenario also sees global warming set to 1.9°C by 2050.

Uneven impacts

Schroders anticipates investors will still be rewarded for taking more risk and investing in equities over the next 30 years. This is particularly so for emerging market equities.

“That said, the effects of policies to decarbonise economies will create challenges for the asset class, rewarding those best-placed to unpick them,” says Schroders.

Due to the costs involved, decarbonising economies will be inflationary. This is because carbon pricing is widely seen as the main policy approach required to incentivise the transition to renewable forms of energy.

The impact of climate change will also have more direct economic costs, say the analysts. “Some fossil fuel reserves will simply need to be left in the ground, for instance, becoming ‘stranded assets’.”

At the asset class level, Schroders expects a delayed transition will generally mean less growth and lower corporate earnings, productivity and so equity returns would be lower than otherwise.

“This will offset some of the benefits to equity returns from the higher inflation premium, and prove particularly consequential for emerging market equities, where the potential for losses from stranded assets is also greater,” they add. “Overall, the impact of climate change on asset returns are uneven with both winners and losers.”

Infographics: Schroders

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Schroders launches new multi-asset income fund, arranges exclusive distribution with HSBC

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance