Should investors invest into these STI-tracked ETFs? PhillipCapital takes a closer look

The team estimates that the implied value for Nikko AM Singapore STI ETF is $3.69 and $3.73 for the SPDR Straits Times Index ETF.

The Phillip Research team has taken a closer look at two exchange-traded funds (ETFs) that are tracking the benchmark Straits Times Index (STI).

Both the Nikko AM Singapore STI ETF and the SPDR Straits Times Index ETF are locally created with the primary aim to closely emulate the performance of the STI before expenses.

“They present investors with a chance to diversify their holdings across Singapore's leading companies and engage Singapore’s long-term growth potential through a single, cost-effective transaction,” says the team.

In an unrated report dated Jan 4, the team estimates that the implied value for the Nikko AM Singapore STI ETF is $3.69 while the SPDR Straits Times Index ETF's implied value is $3.73. The values are derived from the weighted average consensus target price upside/downside percentage of the STI’s component stocks.

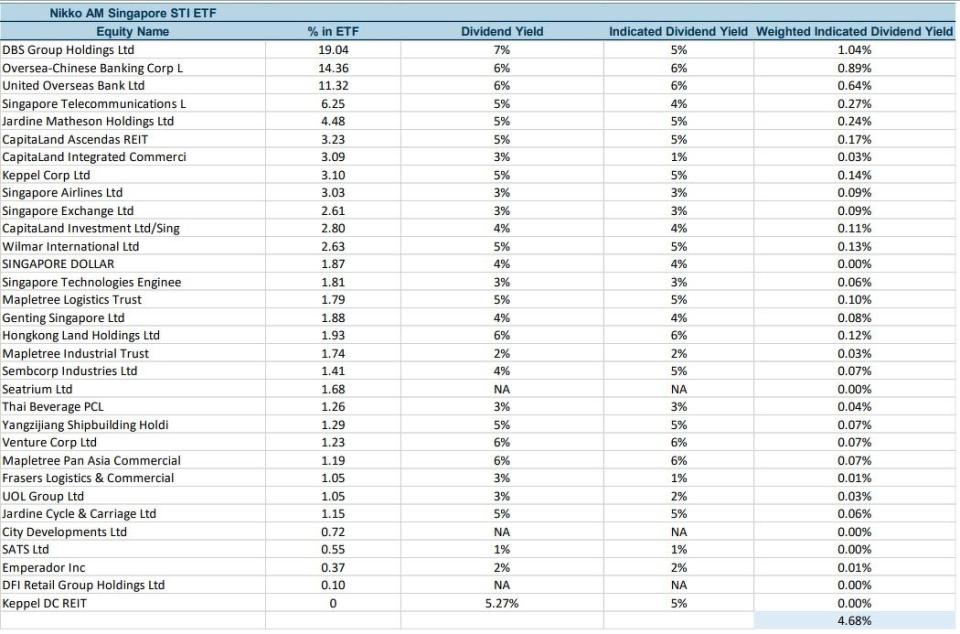

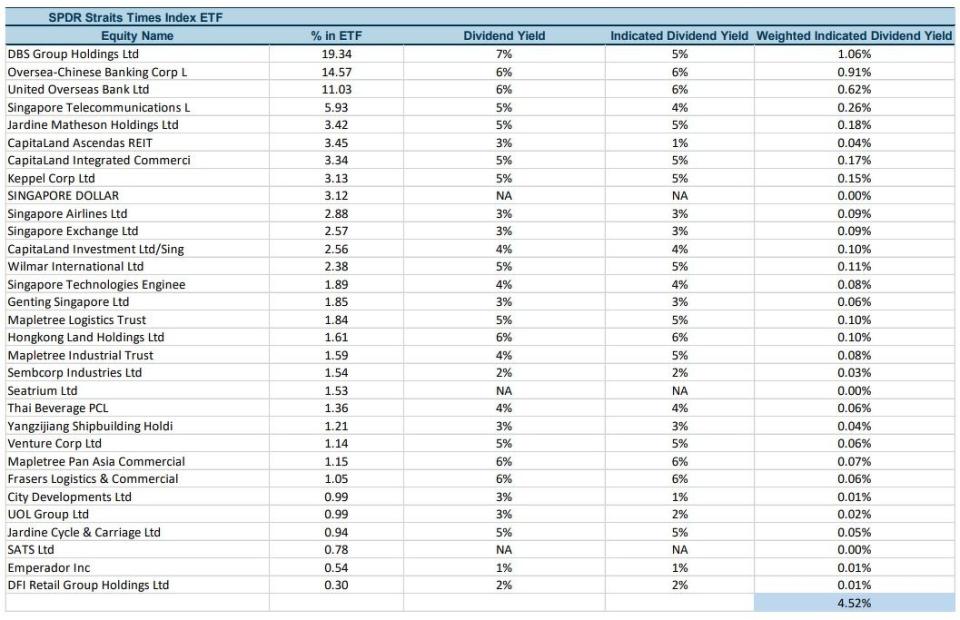

About half of the holdings in both ETFs are in Singapore’s three banks, DBS Group Holdings D05, Oversea-Chinese Banking Corporation O39 (OCBC) and United Overseas Bank U11 (UOB). The dividend yields for banks are currently attractive at 5.7% with upside surprises due to excess capital ratios and the push towards higher returns on equity (ROEs).

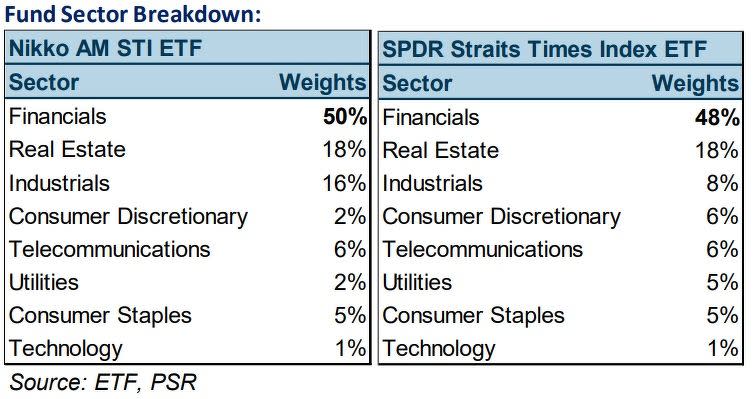

Real estate is the second highest sector featured in both ETFs, at 18% each.

“Singapore's real estate market is known for its stability, transparency, and well-regulated environment. Strong governmental policies contribute to a secure investment landscape. Despite occasional fluctuations, Singapore's real estate market has shown resilience over time, offering long-term capital appreciation. Limited land supply and steady demand often support property values,” explains the team. Singapore also has a strong rental market, which means investment properties can provide steady income stream through rental yields, particularly in prime locations.

The industrials sector stood third, with a 16% weightage in the Nikko AM STI ETF and 8% in the SPDR Straits Times Index ETF. This is attributable to Singapore’s strategic location in Southeast Asia, which makes it a key hub for logistics, manufacturing, and trade.

Both ETFs distribute their dividends on a semi-annual basis at an average yield of 3.30%, which is attractive compared to the Singapore 10-year government bond’s 3% yield, says the team.

As at 3.28pm, the STI is trading 30.45 points lower or 0.95% down at 3,167.51 points.

See the tables below for the sector breakdown and weighted dividend yield per stock within the ETF.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

PhillipCapital highlights Yoma’s response to challenging macro environment in an unrated report

OCBC sees possible recovery in property stocks and REITs ahead of anticipated end to rate hike cycle

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance