Should Investors Buy Nike's (NKE) Stock for a Rebound Ahead of Earnings?

Seeing as Nike NKE is the dominant retailer as it relates to sports apparel, investors may be wondering if it’s time to buy stock in the “Just Do It” company for a rebound ahead of its fiscal fourth quarter results after market hours on Thursday, June 27.

Despite its industry leadership and market dominance, Nike’s stock has dropped -13% this year on concerns of slower revenue growth particularly among digital sales in what it says is a challenging macro environment and a need to revamp its product life cycle.

Image Source: Zacks Investment Research

Q4 Preview

Based on Zacks estimates, Nike’s Q4 sales are expected to slightly increase to $12.88 billion versus $12.83 billion in the comparative quarter. However, a considerable bump is expected on Nike’s bottom line with Q4 EPS projected to expand 28% to $0.85 compared to $0.66 per share a year ago.

Nike has surpassed earnings expectations for three straight quarters but has only exceeded sales estimates in two of its last four quarterly reports. Of course, Wall Street will be looking for updates on Nike’s strategy for new product lines including in its Converse segment with it noteworthy that Converse sales for Q4 are expected to dip -5% to $557 million.

Image Source: Zacks Investment Research

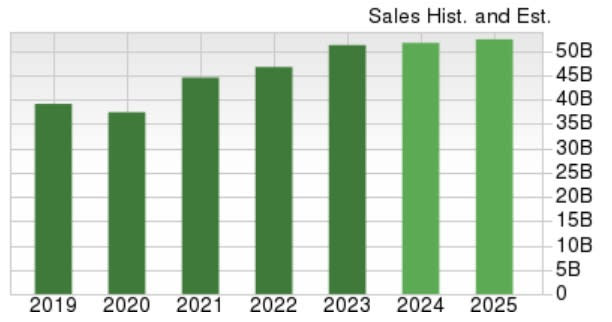

Slower Sales Growth

Nike’s total sales are currently forecasted to rise roughly 1% in fiscal 2024 and FY25 with projections edging toward $52 billion. In comparison, its chief competitor Adidas ADDYY is projected to see its top line expand by 5% this year to $24.36 billion with another 8% sales growth expected in FY25.

Image Source: Zacks Investment Research

Checking Nike’s P/E Valuation

Notably, Nike trades at 24.2X forward earnings which is near its Zacks Shoes and Retail Apparel Industry average and pleasantly below Adidas at 69.7X. Furthermore, Nike’s EPS is expected to increase 18% in FY24 and is projected to rise another 2% in FY25 to $3.90 per share.

Image Source: Zacks Investment Research

Bottom Line

Nike’s stock currently lands a Zacks Rank #3 (Hold) ahead of its Q4 report. To that point, reaching or exceeding expectations will be critical for a rebound in Nike's stock but more importantly, will be the ability to offer positive guidance that hopefully shows concerns of slower sales growth are overdone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Adidas AG (ADDYY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance