Investors Aren't Entirely Convinced By Bio-Rad Laboratories, Inc.'s (NYSE:BIO) Revenues

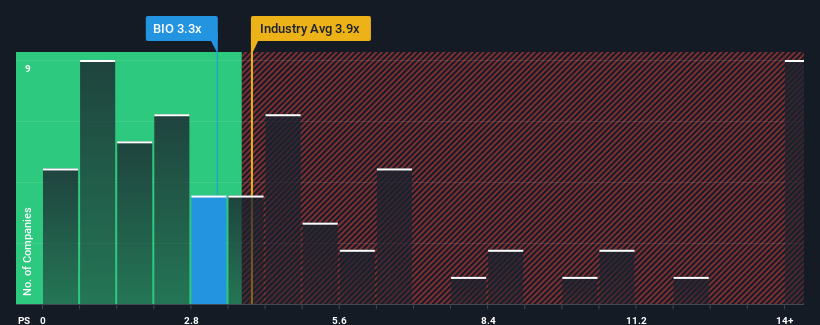

With a median price-to-sales (or "P/S") ratio of close to 3.9x in the Life Sciences industry in the United States, you could be forgiven for feeling indifferent about Bio-Rad Laboratories, Inc.'s (NYSE:BIO) P/S ratio of 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Bio-Rad Laboratories

How Has Bio-Rad Laboratories Performed Recently?

Bio-Rad Laboratories has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bio-Rad Laboratories.

How Is Bio-Rad Laboratories' Revenue Growth Trending?

In order to justify its P/S ratio, Bio-Rad Laboratories would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 3.0% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 0.4% as estimated by the six analysts watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 2.1%, that would be a solid result.

Even though the growth is only slight, it's peculiar that Bio-Rad Laboratories' P/S sits in line with the majority of other companies given the industry is set for a decline. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From Bio-Rad Laboratories' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bio-Rad Laboratories currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Bio-Rad Laboratories that you need to be mindful of.

If these risks are making you reconsider your opinion on Bio-Rad Laboratories, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance