Intra-Cellular (ITCI) Up as Second Depression Study Meets Goals

Intra-Cellular Therapies ITCI announced positive top-line results from Study 502, the second late-stage study that evaluated lumateperone 42 mg for the treatment of major depressive disorder (MDD).

The second phase III study evaluating lumateperone 42 mg, given once daily as an adjunctive therapy to antidepressants for MDD, met the primary endpoint. A statistically significant and clinically meaningful reduction in the Montgomery-Åsberg Depression Rating Scale (MADRS) total score was observed compared with placebo at week six.

MADRS is a metric showing the improvement of depressive symptoms in MDD patients compared with placebo after the treatment period.

Intra-Cellular also reported that the key secondary endpoint was also achieved by demonstrating a statistically significant and clinically meaningful reduction in the Clinical Global Impression Scale score, which is a measure of severity of illness compared with placebo at week six.

A numerical improvement upon treatment of MDD patients with lumateperone 42 mg in comparison with placebo was seen as early as after one week of dosing in the primary endpoint of the study. However, statistically significant efficacy was observed after two weeks of dosing in the primary endpoint of the study and after three weeks in the key secondary endpoint, which were maintained throughout the study.

Additionally, feedback from MDD patients, as measured by the Quick Inventory of Depressive Symptomatology Self Report (QIDS-SR-16), demonstrated that lumateperone 42 mg robustly improved depressive symptoms. The QIDS-SR-16 contains 16 items that evaluate symptom severity in depression as rated by the patients themselves.

The nine key symptoms of depression assessed by the QIDS-SR-16 are insomnia/hypersomnia, low mood, appetite/weight changes, impaired self-perception, concentration difficulties, loss of interest/pleasure, suicidal ideation, psychomotor agitation and fatigue.

We remind the investors that in April 2024, Intra-Cellular reported the success of its first late-stage Study 501 evaluating lumateperone 42 mg, which also achieved statistically significant and clinically meaningful results in the same primary and the key secondary endpoints.

Per the company, the success of both the phase III studies, Study 501 and Study 502, forms the basis for a regulatory filing seeking the label expansion of lumateperone as an adjunctive treatment of MDD. Intra-Cellular anticipates the submission of a supplemental new drug application for lumateperone in the United States to treat the MDD indication in the second half of 2024.

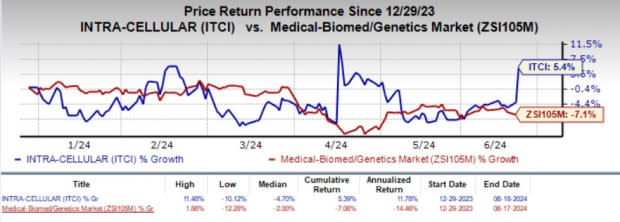

The stock climbed 9.6% on Jun 18 following the encouraging news. Year to date, shares of ITCI have gained 5.4% against the industry’s 7.1% decline.

Image Source: Zacks Investment Research

Please note that Intra-Cellular already markets lumateperone 42 mg in the United States under the brand name, Caplyta, which is the only marketed drug in the company’s portfolio. Caplyta was initially approved by the FDA in 2019 for the treatment of schizophrenia in adults. Later in 2021, Caplyta’s label was expanded to treat depressive episodes associated with bipolar I or II disorder in adults as monotherapy and adjunctive therapy with lithium or valproate.

Two other dosage strengths of Caplyta, 10.5 mg and 21 mg capsules, were also approved by the FDA and subsequently launched commercially in 2022 for special populations of patients. These new dosage strengths have expanded the eligible patient population for Caplyta.

Lumateperone was observed to be generally safe and overall well-tolerated in Study 502. Adverse events reported by Intra-Cellular in the study were mostly mild to moderate in severity and were resolved quickly. The safety data of lumateperone, seen in Study 502, is consistent with that observed in prior studies of the drug as a treatment for MDD, bipolar depression and schizophrenia.

If approved as an adjunctive treatment for MDD, the eligible patient population for Caplyta will be further expanded. This is expected to boost revenues for the company.

MDD is a common, albeit serious mood disorder that causes a persistent feeling of sadness or loss of interest. Approximately 21 million adults suffer from MDD each year in the United States.

We remind the investors that a third phase III study, Study 505, is also evaluating lumateperone 42 mg as an adjunctive therapy to antidepressants for the treatment of MDD. This additional registrational study is intended to support the regulatory filing seeking label expansion of the drug for this indication if needed.

Intra-Cellular Therapies Inc. Price and Consensus

Intra-Cellular Therapies Inc. price-consensus-chart | Intra-Cellular Therapies Inc. Quote

Zacks Rank & Stocks to Consider

Intra-Cellular currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Compugen CGEN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has remained constant at $2.89. During the same period, the consensus estimate for 2025 loss per share has remained constant at $2.73. Year to date, shares of ALXO have plunged 53.5%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has remained constant at $2.46. During the same period, the consensus estimate for 2025 loss per share has remained constant at $1.95. Year to date, shares of ANVS have plunged 71.6%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has increased from 2 cents to 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have lost 6.1%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

Intra-Cellular Therapies Inc. (ITCI) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance