The Interpublic Group of Companies Inc's Dividend Analysis

Exploring the Dividend Sustainability and Growth Prospects of IPG

The Interpublic Group of Companies Inc (NYSE:IPG) has recently declared a dividend of $0.33 per share, which is scheduled for payment on June 18, 2024, with the ex-dividend date marked as June 4, 2024. As we approach this date, it is an opportune moment to delve into the company's dividend history, yield, and growth rates. Utilizing data from GuruFocus, this analysis will evaluate the sustainability and potential growth of IPG's dividends.

Overview of The Interpublic Group of Companies Inc

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

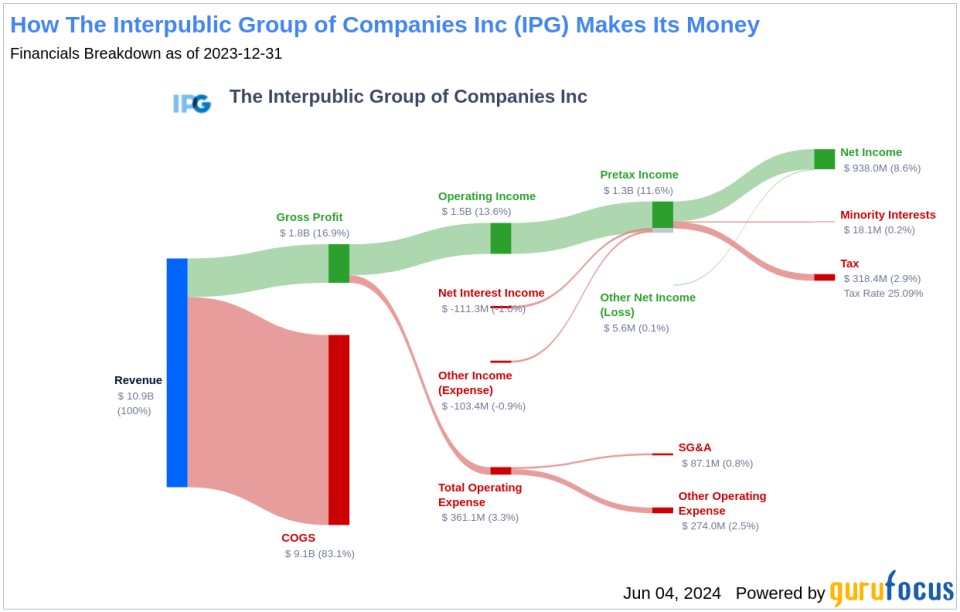

The Interpublic Group of Companies Inc is a global leader in the advertising sector, offering a diverse array of services including traditional advertising, digital marketing, and public relations. With a strong presence in over 100 countries, IPG generates approximately 65% of its revenue from the United States and 17% from the UK and Europe, highlighting its broad geographic footprint and client base.

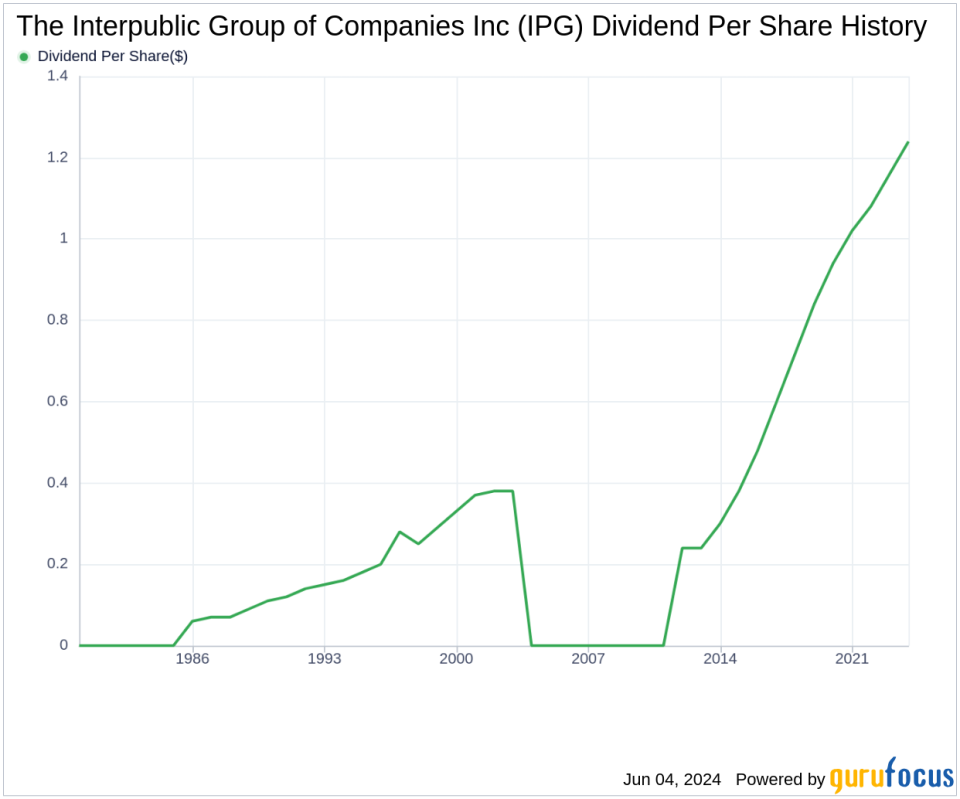

A Look at IPG's Dividend History

Since 2011, The Interpublic Group of Companies Inc has maintained a reliable dividend payment schedule, distributing dividends quarterly. Remarkably, IPG has increased its dividend annually since 2011, earning it the status of a dividend achiever. This consistent increase is a testament to the company's financial health and commitment to returning value to shareholders.

Detailed Analysis of IPG's Dividend Yield and Growth

The Interpublic Group of Companies Inc currently boasts a trailing dividend yield of 4.05% and a forward dividend yield of 4.24%, indicating expectations of rising dividend payments over the next year. Over the past three years, IPG's annual dividend growth rate was 6.70%, which accelerated to 7.80% over a five-year period, and impressively reached 14.90% over the past decade. As of today, the 5-year yield on cost for IPG stock is approximately 5.90%.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

The sustainability of a dividend is crucial for investors, and the dividend payout ratio is a key indicator of this sustainability. The Interpublic Group of Companies Inc's payout ratio stands at 0.44 as of March 31, 2024, suggesting a balanced approach between distributing earnings as dividends and retaining funds for future growth. Additionally, IPG's profitability rank is 9 out of 10, reflecting strong earnings capabilities relative to its peers. This robust profitability, evidenced by consistent net income over the past decade, supports the sustainability of its dividends.

Future Growth Prospects

For dividends to be sustainable, a company must exhibit strong growth metrics. The Interpublic Group of Companies Inc's growth rank of 9 out of 10 indicates a promising growth trajectory. The company has demonstrated robust revenue growth, with a 3-year revenue growth rate of approximately 7.00% annually, outperforming about 56.16% of global competitors. Furthermore, IPG's 3-year EPS growth rate of 12.80% and 5-year EBITDA growth rate of 12.30% further underscore its growth potential and ability to sustain dividends.

Conclusion and Next Steps

The Interpublic Group of Companies Inc presents a compelling case for investors seeking stable and growing dividends. With a consistent track record of dividend increases, a reasonable payout ratio, and strong growth metrics, IPG stands out as a potentially lucrative investment for dividend-focused portfolios. For further exploration of high-dividend yield opportunities, GuruFocus Premium users may utilize the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance