Intel Targets China Export Market - What Investors Should Know

Intel Corp (NASDAQ:INTC) aims to maximize its chip exports to China, CEO Pat Gelsinger stated, cautioning that strict U.S. export controls might prompt China to develop its semiconductors.

At the Computex tech trade show in Taipei, Gelsinger emphasized Intel’s ongoing efforts to export products, including Gaudi GPUs for AI computing, to China, the Nikkei Asia reports.

He highlighted Intel’s technological advantage over Chinese rivals due to the absence of extreme ultraviolet lithography in China.

However, he warned that overly restrictive U.S. policies could backfire by pushing China to produce its chips.

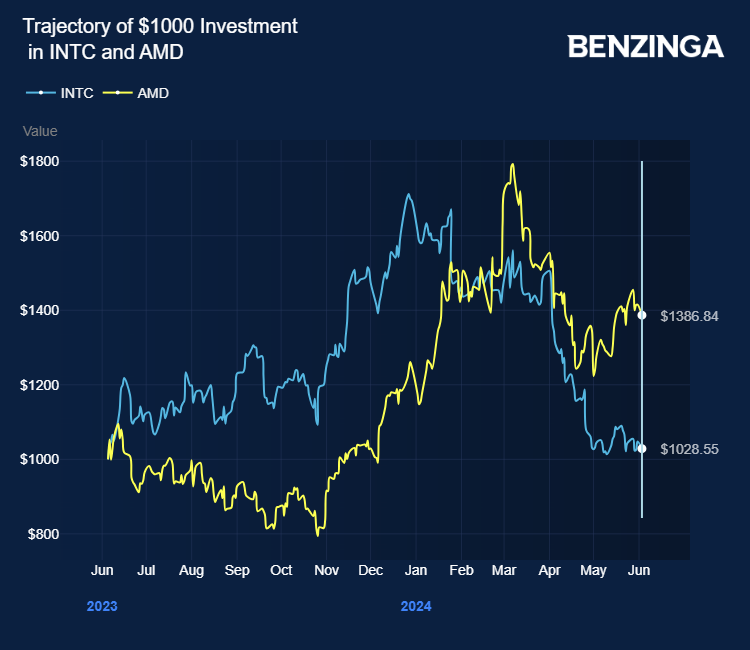

The U.S. has tightened export controls on advanced chips, affecting Intel and competitors like Advanced Micro Devices, Inc (NASDAQ:AMD)

and Nvidia Corp (NASDAQ:NVDA).

Despite this, China has made progress in its chipmaking capabilities, with companies like Huawei Technologies Co developing competitive chips.

Last week, Washington imposed advanced semiconductor tech sanctions on the Middle East, triggering a selloff in the broader sector.

Meanwhile, Intel prepared itself to tackle the AI frenzy as it competed with AMD for the AI PC market share. Intel also faced competition in the data center market, which Nvidia currently dominates.

Intel expects its Gaudi 3 chip to outperform Nvidia’s H100.

Intel stock gained close to 2$ in the last 12 months. Investors can gain exposure to the stock via REX FANG & Innovation Equity Premium Income ETF (NASDAQ:FEPI) and First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL).

Price Action: INTC shares traded higher by 1.22% at $30.67 premarket at the last check on Tuesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image: Shutterstock/ monticello

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Intel Targets China Export Market - What Investors Should Know originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance