Instarem Amaze Card Review: How It Works & Best Credit Cards To Link

Between all the multi currency credit cards, prepaid debit cards with 0% foreign transaction fees and cashback credit cards, consumers like us are spoilt for choice. Instarem’s Amaze Card is the newest kid on the super crowded block.

So how does the Amaze Card manage to stand out? Let’s find out!

What is the Instarem Amaze Card?

The Amaze Card is kind of like a VPN (virtual private network) for your credit cards.

If you know, you know – a VPN allows you to get around region restrictions to watch certain shows or stream the World Cup in Singapore without paying exorbitant prices.

What if you apply that concept to your credit cards?

In the same way you’d get around paying exorbitant prices for a show that you really want to watch, you’d use the Instarem Amaze card to get away from paying unnecessary foreign transaction fees for your overseas online purchases.

Of course, VPNs are somewhat in grey legal territory. But the Instarem Amaze card is a fully legit method, regulated by the Monetary Authority of Singapore (MAS).

How does the Instarem Amaze Card work?

It’s quite simple – much like a VPN, you can link up to 5 Mastercard-issued credit or debit cards to your Instarem Amaze card. There are no top-ups involved, and you don’t have to wait for the card itself to arrive in your mailbox.

Here are the summary of the Instarem Amaze card benefits:

Core Mechanics:

Link up to 5 Mastercard-issued credit or debit cards

No-top ups required (unlike YouTrip, Wise, Revolut, BigPay or GrabPay)

Follows Mastercard’s forex rate – no markups

Benefits:

Get 1% cashback on top of your linked credit or debit card rewards

Transact in unlimited currencies

Real-time transaction tracking

Uncapped maximum spending limit, but max of $25,000 per transaction

SimplyGo enabled; use as public transport card in Singapore or when travel becomes a thing again

Illustration: Instarem Amaze Card vs Credit Card vs Multi-currency Debit Card

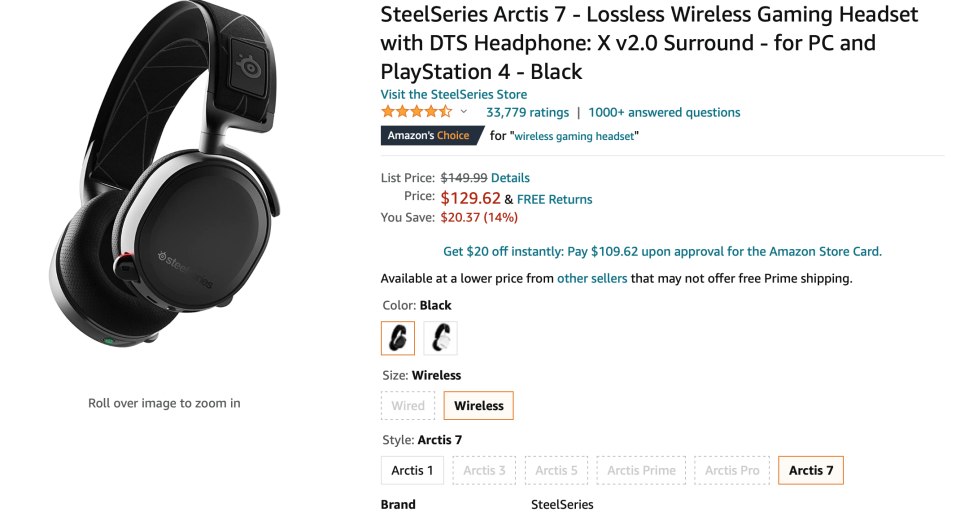

Anyone who knows me, knows that I’m a bit of a gaming nerd. Just like how my character is kitted out in the 1337est of gear, so too shall the person playing it. Coincidentally, my gaming mates have been complaining about my headphone’s mic quality, so I’m in the market to get a new pair of gaming headphones.

Shopping online on Amazon US

Specifically, I’ve got my eye on this pair of SteelSeries Arctis 7 Wireless Headphones that costs US$129.62:

However, this *is* MoneySmart. Of course I’d be price-comparing the headphones against different cards:

Card | Instarem Amaze Card | Citi Cashback+ Credit Card | BigPay | YouTrip |

Issuer | Mastercard | Mastercard | VISA | Mastercard |

Exchange rate | 1.34593 | 1.34593 | 1.34579 | 1.34593 |

Fees | None | 3.25% foreign transaction fee | None | None |

Rewards | 1% cashback | 1.6% cashback | 30 AirAsia BIG points | None |

Price on checkout (SGD) | $174.46 | $180.12 | $174.44 | $174.46 |

Effective price (SGD) | $172.71* | $177.24 | $174.44 | $174.46 |

*Assuming you’re using a no-rewards debit card

Slight note about the Citi Cashback+ credit card exchange rates; I wasn’t sure if Citibank had their own rates, so I just followed the standard Mastercard-issued rate.

Everyone knows that straight up cashback is better than points, which is why you’d want to use the Instarem Amaze card. The above mentioned price you pay with the said card is if you were paying it with a no-reward debit card, but if you stacked it with a cashback credit card like the Citi Cashback+ credit card, you’d be able to get 1% + 1.6% cashback!

Shopping online on Taobao

What’s a gaming rig without a proper monitor stand? I find the ones on Amazon kinda meh, so I’ve looked towards Taobao for this. Of course, there are cheaper or better alternatives out there but this particular one speaks to my soul. Here’s the price comparison:

Card | Instarem Amaze Card | Citi Cashback+ Credit Card | BigPay | YouTrip |

Issuer | Mastercard | Mastercard | VISA | Mastercard |

Exchange rate | 0.21164 | 0.21164 | 0.21156 | 0.21164 |

Fees | None | 3.25% foreign transaction fee | None | None |

Rewards | 1% cashback | 1.6% cashback | 20 AirAsia BIG points | None |

Price on checkout (SGD) | $103.16 | $106.52 | $103.21 | $103.16 |

Effective price (SGD) | $102.13 | $104.81 | $103.21 | $103.16 |

However, on Taobao’s credit card days – in the case of Citibank, it’s on Wednesdays. You will actually get a better deal with $10 off by just paying directly with your Citi Cashback+ card with a minimum purchase of $100.

What you need to know about Instarem’s Amaze Card cashback mechanics

The 1% cashback is the main difference and advantage that the Amaze card has over its competitors like BigPay, Revolut, Wise (formerly TransferWise) and YouTrip. However, it’s not without strings – you can only earn that cashback on a quarterly basis.

This cashback only applies to transactions that are $5 and above, and you need to accumulate at least $500 in transactions for that given quarter.

There’s also a cap on how much cashback you can earn: it’s $100 per quarter. Also, you won’t earn cashback if you were to make top-ups to other e-wallets or get refunds from your online purchases.

It still beats nothing, though. Its competitors – BigPay, Revolut, Wise (formerly TransferWise) and YouTrip – offer no cashback on their similar card offerings.

That being said, you might still want to compare all the remittance providers if you’re interested in sending money across borders, like remitting money from Singapore to Malaysia.

How to sign up for Instarem’s Amaze Card

The good thing about having such a fintech product is that you don’t have to wait for the physical card to start shopping online. You can just get your details verified via Singpass and start shopping once it’s approved. You’ll have to wait for the card itself to arrive in your mailbox if you want to use it for public transport commutes, though.

Best credit cards to pair with the Instarem Amaze Card

The best way to take advantage of the Instarem Amaze card cashback is to pair it with another cashback credit card.

Citi Cashback+ Mastercard

MoneySmart Exclusive

No Expiry on Cash Back Earned

Citi Cash Back+ Mastercard®

MoneySmart Exclusive:

Get $350 Cash via PayNow OR an Apple AirPods Pro (worth $379) OR an ErgoTune Classic Ergonomic Chair (worth $399) when you spend a minimum of $500 within 30 days! T&Cs Apply.

Valid until 28 Feb 2022

More Details

Cash Back Features

Flat 1.6% cashback on all your purchases, no minimum spend

No caps on the cashback you can earn, and cashback earned does not expire

Cashback earned will be stored and specified in the monthly statement

Redeem your cashback with the Citi Pay with Points feature via Citibank Online or the Citi Mobile App or SMS. Redemption requires 7 working days before it’s reflected on your statement

Cash rebates redemption: Send “RWDS last 4 digits of the card number ” to 72484 via SMS

Redemption values and codes: CSHBK10 for S$10, CSHBK20 for S$20, and CSHBK50 for S$50

For example, to redeem $10 cash rebate, the SMS should be: “RWDS XXXX CSHBK10”

General exclusions apply, for e.g. annual fees, instalments, bills, payments to educational, governmental, and financial institutions, insurance premiums, and more

Citibank’s Citi Cashback+ card is currently the highest cash back credit card that’s issued by Mastercard. It offers 1.6% cashback on most spends, and it comes with a sweet sign-up deal if you’re new to Citibank’s offering. It’s only beaten by the Amex-only UOB Absolute Cashback, which offers 1.7% cashback.

Standard Chartered Unlimited Cashback Mastercard

MoneySmart Exclusive

With 6-month Disney+ Subscription

Standard Chartered Unlimited Cashback Credit Card

MoneySmart Exclusive:

Apply and spend $250 to get an Apple AirPods (3rd Generation) [worth $269] or $250 Cash via PayNow. T&Cs apply.

Valid until 31 Mar 2022

More Details

Cash Back Features

1.5% cashback awarded for all eligible purchases, such as dining, online shopping, local and overseas spend

Cashback terms and conditions: General exclusions such as bills, payments to educational, financial, and governmental institutions, and GrabPay top up apply

This is the runner-up to the Mastercard cashback race, offering 1.5% cashback on all spending. To make up for that loss of 0.1% cashback that the Citi card has, it has a 2-year annual fee waiver.

Citi Rewards Mastercard

MoneySmart Exclusive

Earn Points for Online Spending

Citi Rewards Card

MoneySmart Exclusive:

Get $350 Cash via PayNow, Apple AirPods (3rd Generation) + $100 Cash via PayNow (worth $369) or a Nintendo Switch Gen 2 (worth $429) when you spend a minimum of $500 within 30 days! T&Cs Apply.

Valid until 14 Feb 2022

More Details

Key Features

10X Rewards on all online purchases (excludes travel-related transactions). Bank's T&Cs apply

10X Rewards on Ride-hailing, Shopping and Online spends. T&Cs apply

10X Citi Rewards program gives you an additional bonus of 9X Rewards points per S$1 spend on eligible categories on top of the base rate

10X Rewards capped at 10,000 Points per statement month and expires every 5 years

If you’re into points and rewards, your best bet is to get the Citi Rewards card. Getting this card means that you will entitle yourself to 10x rewards points, or the equivalent of 4 miles for every S$1 spent. Most cards’ conversions are about 2 to 3 miles for every dollar spent. However, there is a cap of 10,000 points per month.

–

Even though the multicurrency card and credit card landscape in Singapore is very crowded, Instarem offers an elegant solution to the card bloat that many of us have with the Amaze card. Hopefully, there would be more cards like this offering even more competitive cashback in the future, as well as a more consolidated solution to keeping tabs on each card’s statement.

Share this article with your friends and family before Instarem takes the cashback from the Amaze card away!

The post Instarem Amaze Card Review: How It Works & Best Credit Cards To Link appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Instarem Amaze Card Review: How It Works & Best Credit Cards To Link appeared first on MoneySmart.sg.

Original article: Instarem Amaze Card Review: How It Works & Best Credit Cards To Link.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance