Insider Sell: CEO Sundar Pichai Sells 22,500 Shares of Alphabet Inc (GOOG)

In a notable insider transaction, CEO Sundar Pichai sold 22,500 shares of Alphabet Inc (NASDAQ:GOOG) on December 6, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Sundar Pichai of Alphabet Inc?

Sundar Pichai has been at the helm of Alphabet Inc, the parent company of Google, since December 2019. Before becoming CEO of Alphabet, Pichai was the CEO of Google, a role he took on in August 2015. Under his leadership, Google has continued to expand its reach and influence, venturing into new markets and consistently driving innovation. Pichai's vision and management have been pivotal in maintaining Alphabet's position as a tech giant and a dominant player in the digital economy.

Alphabet Inc's Business Description

Alphabet Inc is a multinational conglomerate known primarily for its subsidiary Google, which specializes in internet-related services and products. These include search engines, online advertising technologies, cloud computing, software, and hardware. Alphabet also encompasses various other businesses, including Calico, Verily, Waymo, and others, which are exploring new frontiers such as life sciences, autonomous vehicles, and more. The company's diverse portfolio allows it to leverage its technological expertise and innovate across different sectors.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

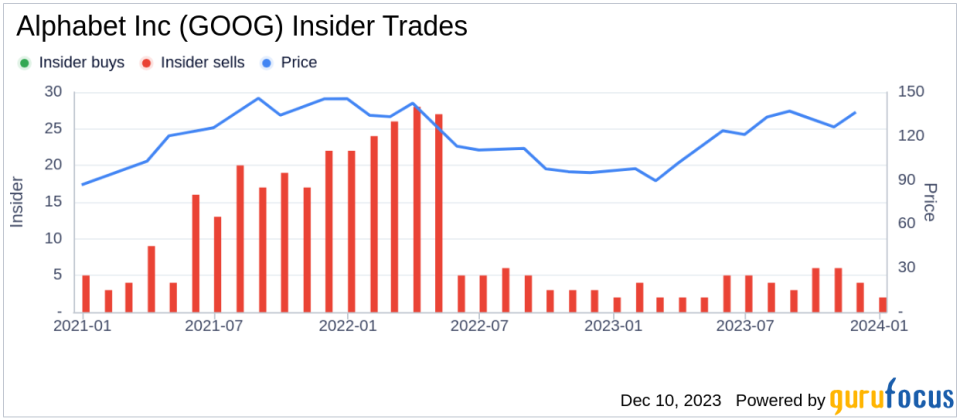

The insider transaction history for Alphabet Inc shows a pattern of more insider selling than buying over the past year. Specifically, there have been 46 insider sells and no insider buys. This could suggest that insiders, including executives and directors, may believe that the stock is fully valued or that they are diversifying their personal portfolios.

The recent sale by the insider, CEO Sundar Pichai, of 22,500 shares is significant both in terms of the number of shares and the timing. The sale occurred when the stock was trading at $132.17, giving Alphabet Inc a market cap of $1,698,981.09 million. This price is below the GF Value of $145.35, suggesting that the stock is fairly valued.

The price-earnings ratio of Alphabet Inc stands at 25.91, which is higher than the industry median of 20.88 but lower than the company's historical median price-earnings ratio. This indicates that while the stock may be trading at a premium compared to the industry, it is still below its historical valuation norms.The GF Value, which is an intrinsic value estimate, takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With a price-to-GF-Value ratio of 0.91, Alphabet Inc's stock appears to be fairly valued, neither undervalued nor overvalued.

Interpreting the Insider's Move

The insider's decision to sell shares can be influenced by various factors, including personal financial planning, diversification, and market outlook. While a single insider sale should not be viewed as a definitive indicator of a stock's future performance, a pattern of insider selling could warrant closer scrutiny by investors.It is also important to consider the context of the sale. If the insider continues to hold a significant number of shares after the sale, it may indicate continued confidence in the company's future. Conversely, if the sale represents a large portion of the insider's holdings, it could signal a lack of confidence or a bearish outlook.

Conclusion

Investors should monitor insider transactions as part of a broader investment strategy. While Sundar Pichai's sale of 22,500 shares of Alphabet Inc is noteworthy, it is essential to analyze this action within the larger financial and market context. Given Alphabet Inc's current valuation and the stock's performance relative to its GF Value, the company appears to be fairly valued at present.As always, investors should conduct their due diligence and consider a multitude of factors, including insider transactions, financial metrics, industry trends, and broader market conditions, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance