Insider Sell: CEO Daniel Bartok Sells 13,120 Shares of Forestar Group Inc (FOR)

Forestar Group Inc (NYSE:FOR), a residential lot development company, has recently witnessed a significant insider sell by its CEO, Daniel Bartok. On November 30, 2023, Daniel Bartok sold 13,120 shares of the company, a transaction that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the insider's history, the company's business description, and the potential implications of this insider activity on the stock's valuation and price.

Who is Daniel Bartok?

Daniel Bartok serves as the Chief Executive Officer of Forestar Group Inc. His role at the helm of the company places him in a critical position to influence its strategic direction and operational performance. As CEO, Bartok is privy to in-depth knowledge of the company's projects, financial health, and future prospects, making his trading activities particularly noteworthy for investors seeking insights into the company's internal dynamics.

Forestar Group Inc's Business Description

Forestar Group Inc is a growth-oriented company that operates in the real estate sector, primarily focusing on residential lot development. The company aims to deliver sustainable value through the acquisition, entitlement, and development of land that is subsequently sold to homebuilders. Forestar's business model is designed to capitalize on the demand for residential lots in strategically selected markets, leveraging its expertise to create communities that meet the evolving needs of homebuyers and builders.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, particularly those involving high-ranking executives like CEOs, can provide valuable clues about a company's internal assessment of its stock's value. In the case of Forestar Group Inc, the insider transaction history reveals a pattern of selling rather than buying. Over the past year, Daniel Bartok has sold a total of 13,120 shares and has not made any purchases. This could signal that the insider perceives the stock's current price as potentially overvalued or that they are taking profits off the table.

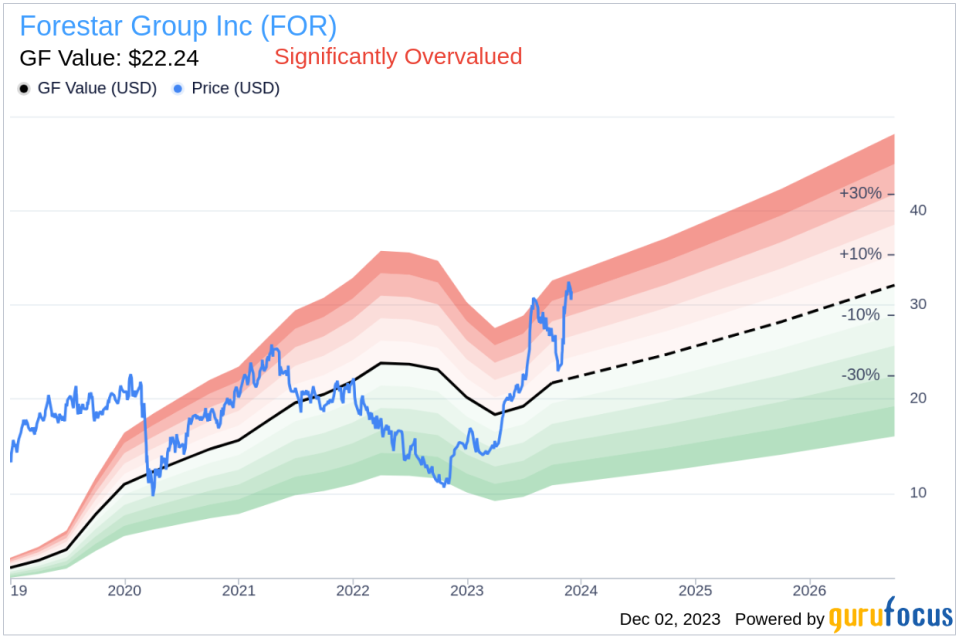

When examining the relationship between insider trading and stock price, it's crucial to consider the timing and context of the transactions. Bartok's recent sell occurred when the stock was trading at $31.25 per share, giving the company a market cap of $1.569 billion. This price level is significantly higher than the GuruFocus Value (GF Value) of $22.24, suggesting that the stock may be overvalued.

The price-earnings ratio of 9.44 is lower than the industry median of 12.97 and also lower than the company's historical median price-earnings ratio. While this could indicate that the stock is undervalued based on earnings, the price-to-GF-Value ratio of 1.41 points to the opposite conclusion, indicating that the stock is significantly overvalued.

The GF Value is a proprietary metric developed by GuruFocus to estimate a stock's intrinsic value. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. In the case of Forestar Group Inc, the GF Value suggests that the stock's current price exceeds its estimated intrinsic value.

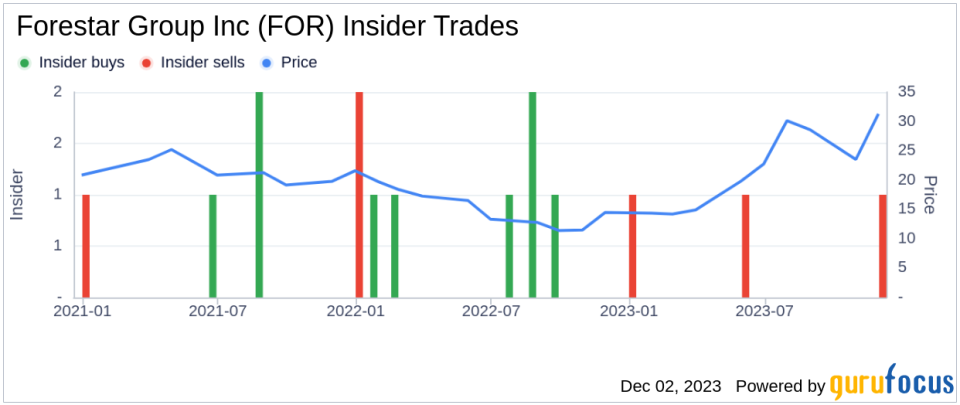

It's also important to consider the broader insider trend when analyzing the impact of insider sells on stock price. The following image shows the insider transaction history for Forestar Group Inc over the past year:

As depicted, there have been no insider buys and three insider sells over the past year, which could be interpreted as a lack of confidence from insiders in the stock's future appreciation. However, investors should also weigh other factors such as the company's financial performance, market conditions, and the insider's personal financial planning before drawing conclusions.

Valuation and Market Reaction

Forestar Group Inc's stock valuation, as mentioned earlier, appears to be at odds with its GF Value. The following image illustrates the stock's valuation in relation to its GF Value:

The stock's significant overvaluation based on the GF Value could be a contributing factor to the insider's decision to sell shares. If the market perceives the insider sell as a bearish signal, it could lead to a downward pressure on the stock price. Conversely, if investors believe the sell is unrelated to the company's fundamentals, the impact on the stock price may be minimal.

In conclusion, the recent insider sell by CEO Daniel Bartok of Forestar Group Inc warrants attention from investors and market analysts. While the sell could suggest that the insider believes the stock is overvalued, it is essential to consider the full spectrum of factors influencing stock valuation, including the company's financial health, industry trends, and broader market sentiment. As always, investors should conduct their due diligence and consider insider trading as one of many tools in their investment decision-making process.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance