Insider Sell Alert: President Eugenie Levin Sells 39,076 Shares of SEMrush Holdings Inc (SEMR)

In a notable insider transaction, President Eugenie Levin sold 39,076 shares of SEMrush Holdings Inc (NYSE:SEMR) on December 1, 2023. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its executives.

Who is Eugenie Levin of SEMrush Holdings Inc?

Eugenie Levin has been a key figure at SEMrush Holdings Inc, serving as the company's President. Levin's role at SEMrush involves overseeing the company's strategic initiatives and operations, contributing to its growth and market position. With a deep understanding of the company's business and market dynamics, Levin's trading activities are closely watched by investors for indications of the company's health and future performance.

SEMrush Holdings Inc's Business Description

SEMrush Holdings Inc is a leading global provider of online visibility management and content marketing SaaS solutions. The company's platform enables businesses to optimize their online presence across various marketing channels, including search engines, social media, and content marketing. SEMrush's suite of tools and analytics helps marketers to conduct competitive research, keyword research, SEO optimization, and more, making it an essential service for businesses looking to enhance their digital marketing efforts.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

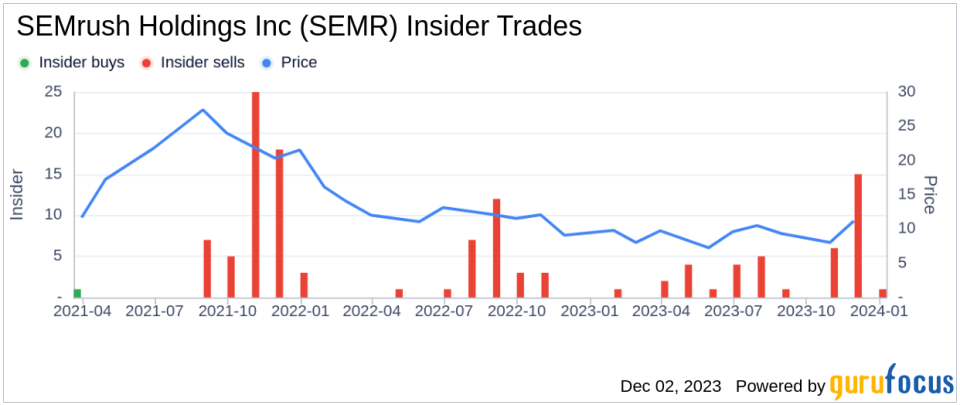

Insider transactions, particularly those involving high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. In the case of SEMrush Holdings Inc, the insider transaction history over the past year shows a significant imbalance between sells and buys. With 41 insider sells and no insider buys, this could signal a lack of confidence among insiders about the company's future stock price appreciation.

On the day of the insider's recent sale, shares of SEMrush Holdings Inc were trading at $10.93, giving the company a market cap of $1.599 billion. This price point is notably below the GuruFocus Value (GF Value) of $15.96, suggesting that the stock may be undervalued. The price-to-GF-Value ratio of 0.68 indicates that the stock could be a possible value trap, and investors should think twice before making an investment decision.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. While the current price suggests that SEMrush Holdings Inc is trading below its intrinsic value, the insider selling trend may raise questions about the stock's potential to reach the GF Value estimate.

The above insider trend image reflects the recent selling pattern, which could be interpreted in several ways. Insiders might be selling for personal financial planning reasons that are not directly related to their outlook on the company. Alternatively, the consistent selling could indicate that insiders believe the stock is fully valued or that there may be headwinds on the horizon that could affect the company's performance.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current market price is significantly lower than the GF Value, which could attract value investors looking for potential bargains. However, the insider selling trend may temper enthusiasm, as it suggests that those with the most intimate knowledge of the company's prospects are choosing to reduce their holdings.

Conclusion

President Eugenie Levin's sale of 39,076 shares of SEMrush Holdings Inc is a significant event that warrants attention from the investment community. While the stock appears undervalued based on the GF Value, the lack of insider buying and the prevalence of insider selling over the past year could be a red flag. Investors should consider the potential reasons behind the insider's decision to sell and weigh this against the company's fundamentals and market valuation before making any investment decisions.

As with any insider transaction, it is important to view this event in the context of broader market conditions, the company's performance, and other factors that may influence stock prices. Investors are encouraged to conduct their own due diligence and consult with financial advisors to fully understand the implications of insider trading patterns on their investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance