Insider Sell Alert: Chief Corp Dev. & Strat. ...

EyePoint Pharmaceuticals Inc (NASDAQ:EYPT), a specialty pharmaceutical company committed to developing and commercializing therapies for eye diseases, has recently witnessed a significant insider sell by one of its top executives. Michael Pine, the Chief Corporate Development and Strategy Officer of EyePoint Pharmaceuticals, sold 45,000 shares of the company's stock on December 4, 2023. This transaction has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.Who is Michael Pine?Michael Pine serves as the Chief Corporate Development and Strategy Officer at EyePoint Pharmaceuticals Inc. In his role, Pine is responsible for shaping the company's strategic direction, identifying growth opportunities, and overseeing corporate development initiatives. His insights and decisions are crucial for the company's long-term success and expansion in the competitive pharmaceutical industry.About EyePoint Pharmaceuticals IncEyePoint Pharmaceuticals Inc is a biopharmaceutical company that specializes in the development of innovative drug delivery systems to treat serious eye diseases. The company's portfolio includes treatments for conditions such as uveitis, diabetic macular edema, and other eye disorders that can lead to blindness if left untreated. EyePoint Pharmaceuticals is dedicated to improving the lives of patients by providing sustained release drug delivery products that offer better efficacy and convenience over traditional eye medications.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe recent sell by Michael Pine is part of a broader pattern of insider transactions at EyePoint Pharmaceuticals Inc. Over the past year, Pine has sold a total of 45,000 shares and has not made any purchases. This one-sided activity raises questions about the insider's confidence in the company's future prospects.When analyzing insider transactions, it's important to consider the context and timing of the sells. Insiders may sell shares for various reasons, including personal financial planning, diversification, or other non-company related factors. However, when a pattern of consistent selling emerges, especially without corresponding buys, it can signal a lack of confidence in the company's stock or a belief that the stock may be overvalued.

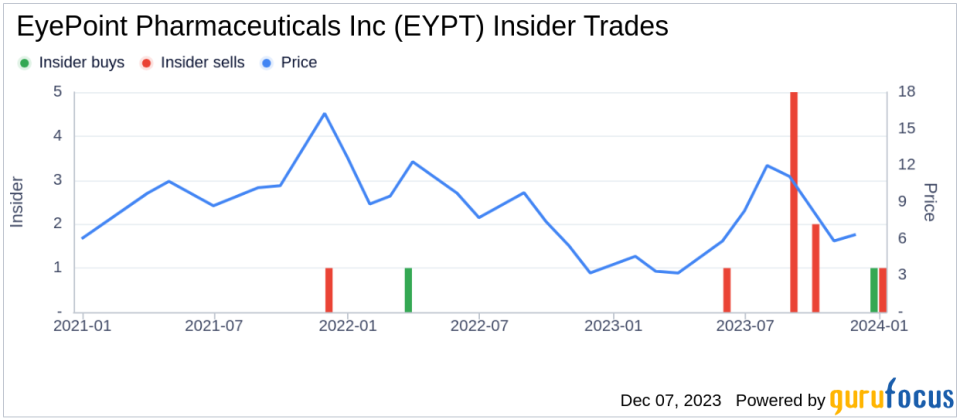

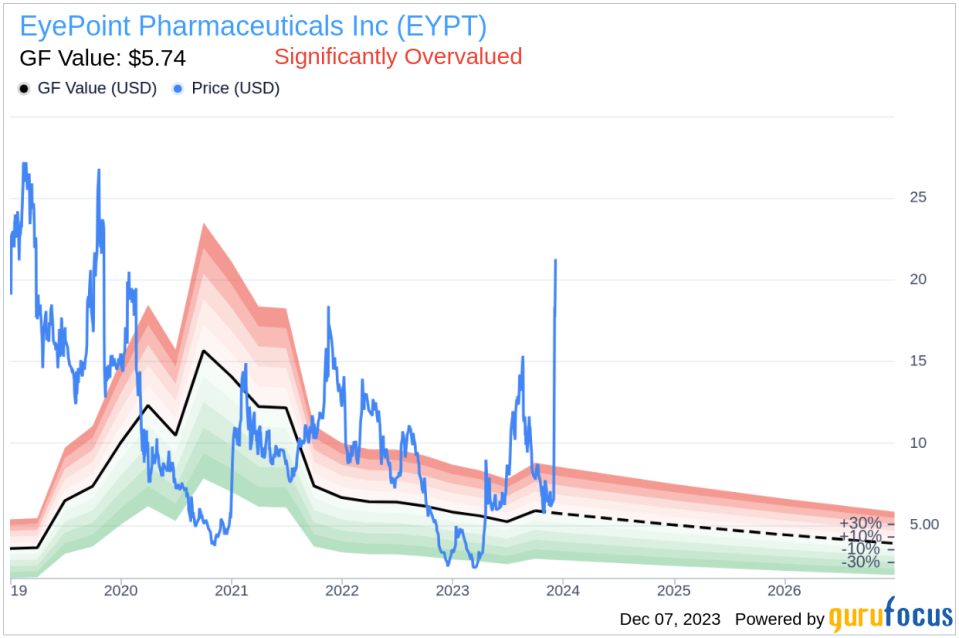

The insider trend image above illustrates the recent history of insider transactions at EyePoint Pharmaceuticals Inc. With 11 insider sells and only 1 insider buy over the past year, the trend suggests that insiders may have concerns about the stock's current valuation or future performance.Valuation and Market CapOn the day of Michael Pine's sell, shares of EyePoint Pharmaceuticals Inc were trading at $22, giving the company a market cap of $751.365 million. This valuation places the company in the mid-cap category, which often encompasses companies with significant growth potential but also higher volatility and risk compared to large-cap stocks.GF Value and Stock OvervaluationThe GF Value, an intrinsic value estimate developed by GuruFocus, is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. For EyePoint Pharmaceuticals Inc, the GF Value stands at $5.74, which is significantly lower than the current trading price of $22.

With a price-to-GF-Value ratio of 3.83, EyePoint Pharmaceuticals Inc is considered Significantly Overvalued according to GuruFocus's valuation model. This discrepancy between the stock's market price and its GF Value could be a contributing factor to the insider's decision to sell shares. It may indicate that the insider believes the stock's current price does not accurately reflect the company's intrinsic value and future growth prospects.ConclusionThe recent insider sell by Michael Pine at EyePoint Pharmaceuticals Inc is a noteworthy event that warrants investor attention. While insider sells can occur for various reasons, the pattern of sells without corresponding buys, coupled with the stock's significant overvaluation based on the GF Value, suggests that insiders may have reservations about the stock's current price levels.Investors should consider the insider trends and valuation metrics as part of their overall analysis when making investment decisions regarding EyePoint Pharmaceuticals Inc. It's also crucial to look at the company's fundamentals, industry trends, and broader market conditions to form a comprehensive view of the stock's potential risks and rewards.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance