Insider Sale: Director Julie Andrews Sells 15,625 Shares of RxSight Inc (RXST)

On June 14, 2024, Julie Andrews, Director at RxSight Inc (NASDAQ:RXST), executed a sale of 15,625 shares of the company at a price of $58 per share. This transaction was documented in an SEC Filing. Following this sale, the insider now owns 30,287 shares of RxSight Inc.

RxSight Inc specializes in the development and marketing of innovative optical solutions aimed at improving visual outcomes for patients undergoing cataract surgery. The company's flagship product, the Light Adjustable Lens, is the first and only FDA-approved intraocular lens that can be adjusted post-surgery to enhance vision correction.

Over the past year, the insider transaction history at RxSight Inc shows a pattern of more sales than purchases among insiders. There have been 36 insider sales and only 2 insider buys during this period. The insider, Julie Andrews, has not made any share purchases in the last year, only sales totaling 15,625 shares.

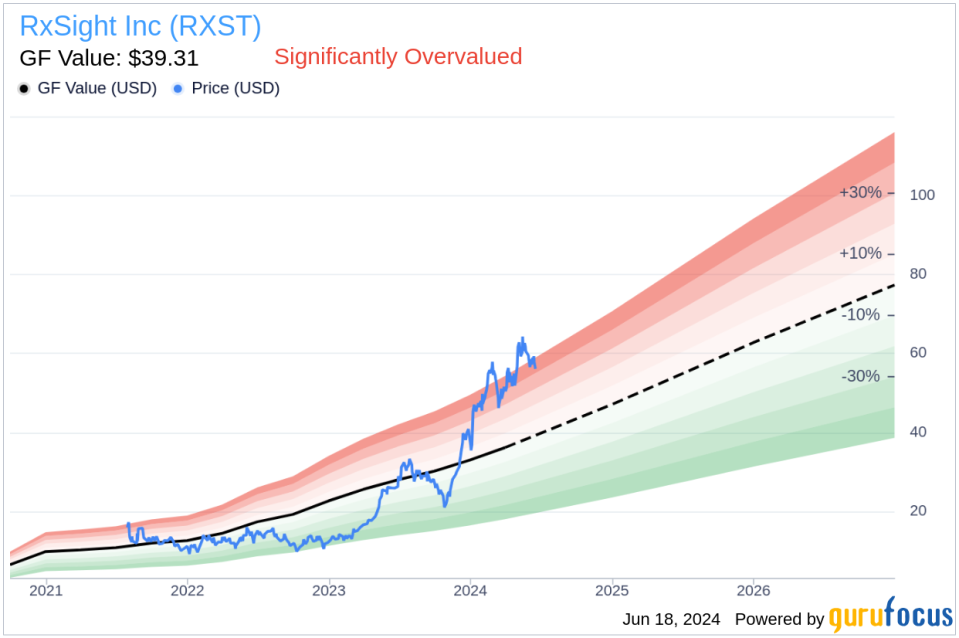

As of the date of the recent transaction, RxSight Inc shares were trading at $58, giving the company a market cap of approximately $2.20 billion. According to the GF Value, the intrinsic value of the stock is estimated at $39.31, indicating that the stock is significantly overvalued with a price-to-GF-Value ratio of 1.48.

The GF Value is determined by considering historical trading multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, along with a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance