Insider-Owned Growth Stocks On The Japanese Exchange For July 2024

As Japan's stock markets experience a notable uptick, with the Nikkei 225 and TOPIX indices showing robust gains amid a weakening yen, investors are keenly observing market dynamics and potential opportunities. In this context, stocks with high insider ownership in growth companies can be particularly appealing, as they often signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.4% |

Medley (TSE:4480) | 34% | 28.7% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

Soracom (TSE:147A) | 17.2% | 54.1% |

Let's take a closer look at a couple of our picks from the screened companies.

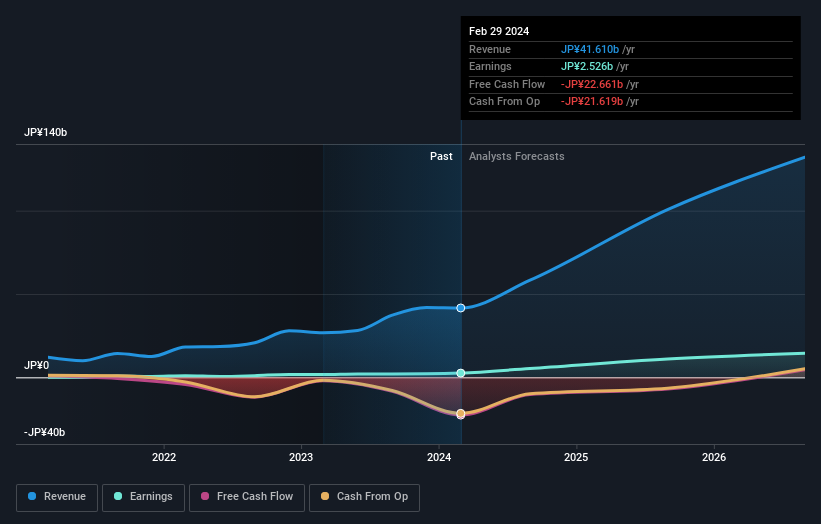

Kasumigaseki CapitalLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Kasumigaseki Capital Ltd, operating in Japan, specializes in real estate consulting with a market capitalization of approximately ¥159.01 billion.

Operations: The firm primarily focuses on real estate consulting in Japan.

Insider Ownership: 34.8%

Return On Equity Forecast: 37% (2027 estimate)

Kasumigaseki Capital Ltd. trades at a significant discount, 50.3% below its estimated fair value, suggesting potential undervaluation. Despite challenges like debt not well covered by operating cash flow and recent shareholder dilution, the company shows robust future prospects with expected high revenue growth at 33.7% per year and earnings forecast to increase by 44.65% annually. Its Return on Equity is also anticipated to be strong at 36.7%, indicating efficient management performance despite a highly volatile share price recently.

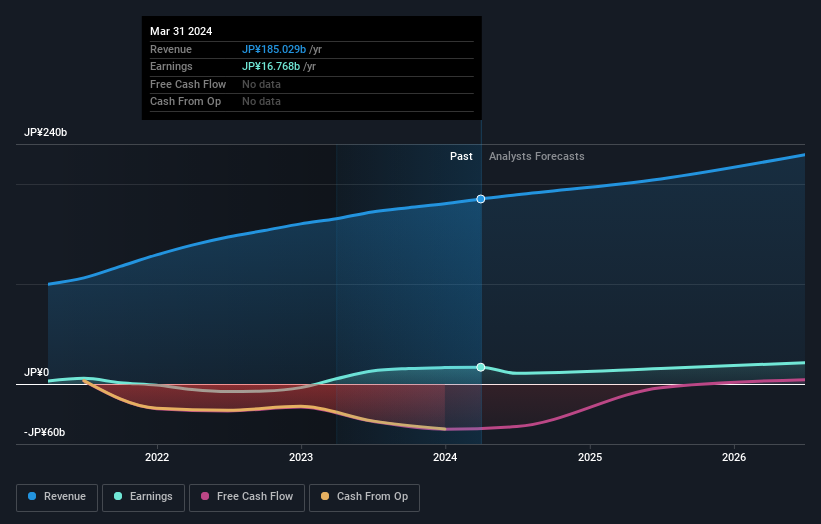

Mercari

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. is a company that designs, develops, and operates the Mercari marketplace applications in Japan and the United States, with a market capitalization of approximately ¥367.24 billion.

Operations: The firm operates marketplace applications primarily in Japan and the United States.

Insider Ownership: 36%

Return On Equity Forecast: 23% (2027 estimate)

Mercari, Inc. anticipates a solid financial year ending June 2024, with expected revenue of JPY 190 billion and an operating profit of JPY 16.5 billion. Despite lacking recent insider trading activity and experiencing high share price volatility, Mercari's earnings growth is projected at a robust rate of 18.9% annually, outpacing the Japanese market average. Additionally, its Return on Equity is expected to reach an impressive 22.9% in three years, highlighting effective management and promising profitability prospects.

Unlock comprehensive insights into our analysis of Mercari stock in this growth report.

Our valuation report here indicates Mercari may be overvalued.

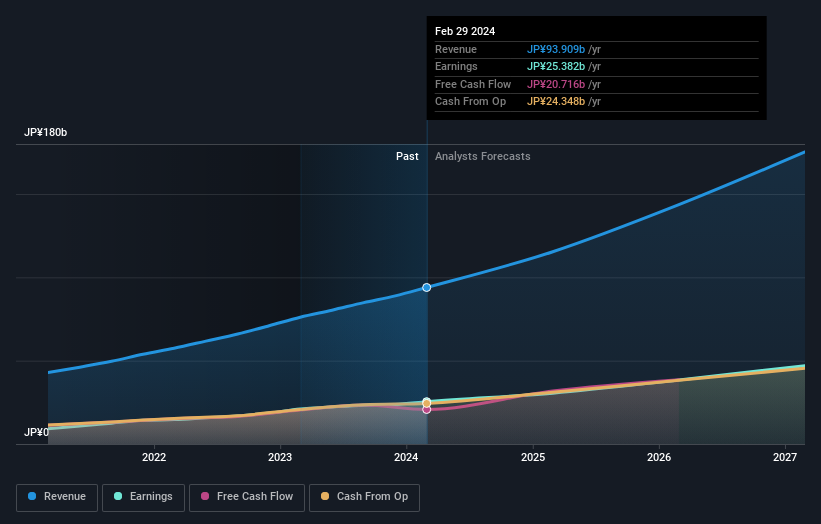

BayCurrent Consulting

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services across various sectors in Japan and has a market capitalization of approximately ¥549.99 billion.

Operations: The firm generates revenue through consulting services across diverse sectors in Japan.

Insider Ownership: 13.9%

Return On Equity Forecast: 33% (2027 estimate)

BayCurrent Consulting is trading at a significant discount, priced 51% below its estimated fair value. It's poised for robust growth with earnings and revenue forecast to expand by 18.4% and 18.3% per year respectively, outstripping the Japanese market projections of 8.8% and 4.2%. Despite this promising outlook, the company has a highly volatile share price but maintains high-quality earnings with substantial non-cash components. Recent actions include completing a share buyback program for ¥3.6 billion to enhance shareholder value.

Taking Advantage

Explore the 98 names from our Fast Growing Japanese Companies With High Insider Ownership screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3498 TSE:4385 and TSE:6532.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance