Insider-Owned Growth Leaders To Watch In July 2024

As global markets navigate through a mix of quiet trading periods and anticipatory adjustments ahead of key economic events, investors continue to seek stable yet promising opportunities. High insider ownership in growth companies often signals strong confidence from those who know the business best, making such stocks potentially attractive in the current climate of cautious optimism.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

Let's dive into some prime choices out of from the screener.

Shanghai Golden Bridge InfoTechLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Golden Bridge InfoTech Ltd (ticker: SHSE:603918) specializes in multimedia information systems and industry solutions and services within China, with a market capitalization of approximately CN¥4.22 billion.

Operations: The company's revenue is derived from multimedia information systems and industry-specific solutions and services.

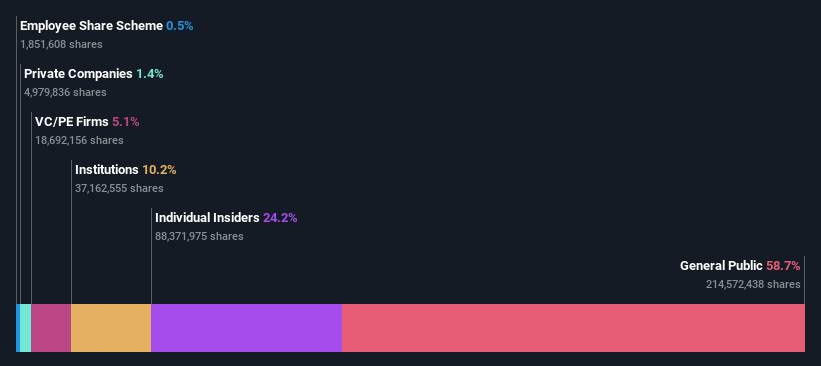

Insider Ownership: 24.2%

Earnings Growth Forecast: 96.3% p.a.

Shanghai Golden Bridge InfoTechLtd is navigating a challenging period, with a significant revenue drop to CNY 61.67 million and a net loss of CNY 30.33 million in Q1 2024, contrasting sharply with profits from the previous year. Despite these setbacks, the company is poised for robust growth, with earnings expected to surge by an impressive rate annually and revenues projected to increase at 39.4% per year—outpacing the Chinese market average significantly. This growth trajectory underscores its potential as a high insider ownership growth entity.

Wuxi Boton Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors globally, with a market capitalization of approximately CN¥6.05 billion.

Operations: The company generates revenue from its operations in industrial bulk material handling and mobile Internet sectors.

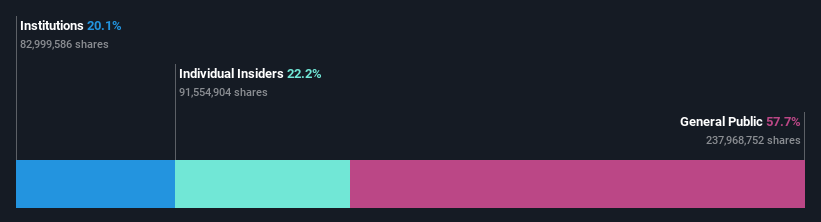

Insider Ownership: 22.2%

Earnings Growth Forecast: 37.1% p.a.

Wuxi Boton Technology, with recent board changes and consistent dividend payouts, reflects active governance and shareholder return commitment. Despite trading at a significant discount to its estimated fair value, the company's earnings are expected to grow by 37.11% annually, outpacing the Chinese market forecast of 22.2%. However, its projected revenue growth of 14.3% per year is moderate and Return on Equity is anticipated to be low at 9.9% in three years, suggesting mixed financial health indicators.

Micro-Star International

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Micro-Star International Co., Ltd., primarily engaged in the manufacturing and sales of motherboards, interface cards, notebook computers, and other electronic products across various global markets, has a market capitalization of approximately NT$151.65 billion.

Operations: The company's revenue from computers and peripherals totaled approximately NT$186.97 billion.

Insider Ownership: 20.6%

Earnings Growth Forecast: 27.5% p.a.

Micro-Star International, amid recent executive changes, showcases robust insider engagement, crucial for potential investors focusing on governance. The company reported a slight increase in quarterly earnings with TWD 47.63 billion in sales and TWD 2.49 billion net income. Expected to see significant profit growth at 27.55% annually over the next three years, it outpaces Taiwan's market forecast of 18.2%. However, its revenue growth is slower than the market expectation and dividend coverage by cash flows appears weak.

Turning Ideas Into Actions

Reveal the 1455 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603918 SZSE:300031TWSE:2377 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance