Insider-Owned Growth Giants On The US Exchange In June 2024

Over the past year, the United States stock market has experienced a robust increase of 22%, with earnings projected to grow by 15% annually. In this thriving environment, stocks with high insider ownership can be particularly appealing as they often signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Cipher Mining (NasdaqGS:CIFR) | 18.5% | 58.8% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 85.2% |

BBB Foods (NYSE:TBBB) | 23.6% | 99.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Here we highlight a subset of our preferred stocks from the screener.

Amazon.com

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amazon.com, Inc. operates as a global online retailer and provides advertising and subscription services, with a market capitalization of approximately $1.84 trillion USD.

Operations: The company generates revenue through three primary segments: North America ($362.29 billion), International ($134.01 billion), and Amazon Web Services (AWS) ($94.44 billion).

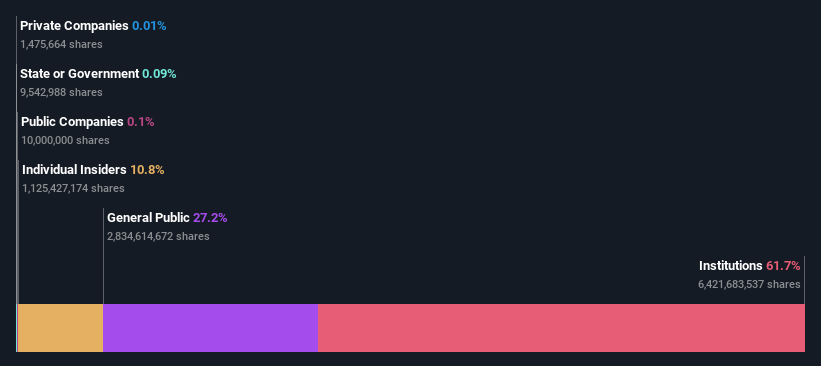

Insider Ownership: 10.8%

Earnings Growth Forecast: 21.4% p.a.

Amazon, while not a leader in high insider ownership among growth companies, continues to expand its market presence and strategic initiatives. Recent developments include potential acquisition talks with MX Player to enhance its streaming services and partnerships for carbon-free energy innovations. These moves illustrate Amazon's ongoing strategy to diversify and strengthen its core e-commerce and technological capabilities, aligning with broader industry trends despite some shareholder proposals not passing at recent meetings.

Duolingo

Simply Wall St Growth Rating: ★★★★★☆

Overview: Duolingo, Inc. is a mobile learning platform that offers language education services across the United States, the United Kingdom, and other international markets, with a market capitalization of approximately $8.25 billion.

Operations: The company generates revenue primarily through its educational software segment, which amounted to $583.00 million.

Insider Ownership: 15%

Earnings Growth Forecast: 46.4% p.a.

Duolingo, a growth-oriented company with significant insider ownership, has shown robust financial performance with its recent transition into profitability. In Q1 2024, Duolingo reported a net income of US$26.96 million, a sharp improvement from a net loss in the previous year. Analysts predict substantial growth in revenue and earnings over the next few years, exceeding market averages significantly. Despite recent insider board resignations not due to disagreements, Duolingo's stock is still trading well below estimated fair value, offering potential upside according to analysts' targets. Additionally, inclusion in multiple S&P indices reflects growing market recognition.

Dive into the specifics of Duolingo here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Duolingo's share price might be too pessimistic.

Spotify Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., a global provider of audio streaming subscription services, has a market capitalization of approximately $58.86 billion.

Operations: The company generates revenue primarily through two segments: Premium, which brings in €12.10 billion, and Ad-Supported, contributing €1.74 billion.

Insider Ownership: 18%

Earnings Growth Forecast: 40.4% p.a.

Spotify Technology has demonstrated a strong recovery with its Q1 2024 earnings, posting a net income of €197 million against a net loss the previous year and achieving sales of €3.64 billion. Despite no share repurchases this quarter, Spotify's strategic partnerships and new executive appointments signal ongoing operational enhancements. The company forecasts significant user growth and aims for €3.8 billion in revenue next quarter, reflecting robust business dynamics and potential for sustained growth amidst high insider ownership concerns due to recent dilution.

Key Takeaways

Embark on your investment journey to our 182 Fast Growing US Companies With High Insider Ownership selection here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:AMZN NasdaqGS:DUOL and NYSE:SPOT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance