Insider-Owned Growth Companies To Watch In June 2024

As global markets navigate through a landscape marked by fluctuating inflation rates and mixed economic signals, investors are keenly observing trends that could influence their strategies. In such an environment, growth companies with high insider ownership can be particularly intriguing, as significant insider stakes often signal confidence in the company's future prospects amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Medley (TSE:4480) | 34% | 28.8% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

Elliptic Laboratories (OB:ELABS) | 31.6% | 124.6% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

Vow (OB:VOW) | 31.8% | 97.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

We'll examine a selection from our screener results.

Zhejiang XCC GroupLtd

Simply Wall St Growth Rating: ★★★★★☆

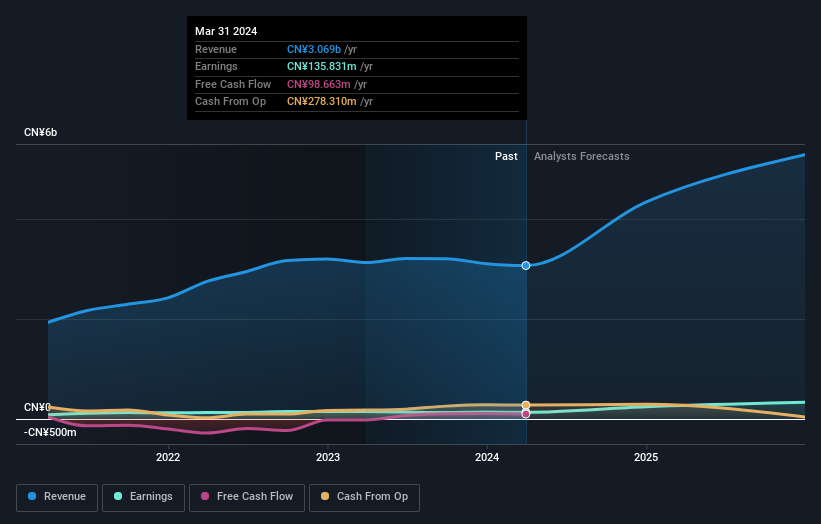

Overview: Zhejiang XCC Group Ltd specializes in the research, development, manufacture, and sale of bearings globally, with a market capitalization of approximately CN¥6.71 billion.

Operations: The company generates its revenue through the global research, development, manufacture, and sale of bearings.

Insider Ownership: 31.8%

Earnings Growth Forecast: 46.7% p.a.

Zhejiang XCC Group Ltd, despite a volatile share price and recent shareholder dilution, shows promising growth prospects with earnings forecasted to grow by 46.69% per year and revenue expected to increase by 29.5% annually, outpacing the Chinese market averages of 23.2% for earnings and 14% for revenue growth. However, the company's recent financials indicate a slight decline in both sales and net income compared to the previous year, underscoring some operational challenges amidst its growth trajectory.

Puya Semiconductor (Shanghai)

Simply Wall St Growth Rating: ★★★★★☆

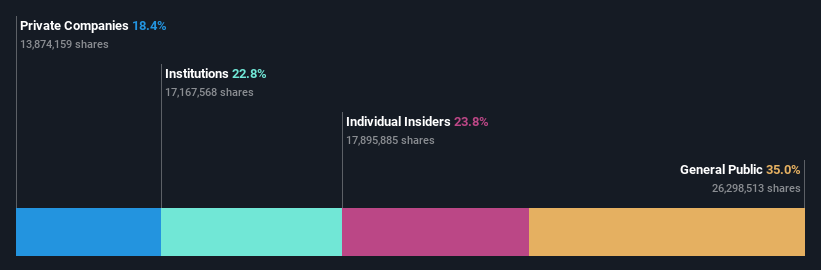

Overview: Puya Semiconductor (Shanghai) Co., Ltd. specializes in the design and sale of non-volatile memory chips and related derivative chips, operating both in China and internationally, with a market capitalization of approximately CN¥9.10 billion.

Operations: The company generates its revenue primarily from the integrated circuit segment, totaling approximately CN¥1.33 billion.

Insider Ownership: 23.8%

Earnings Growth Forecast: 52.7% p.a.

Puya Semiconductor (Shanghai) has demonstrated a robust recovery with its first-quarter sales doubling to CNY 404.93 million and swinging from a net loss to a profit of CNY 49.92 million year-over-year. This growth is supported by an expected annual revenue increase of 23.7% and earnings forecasted to surge by 52.7% annually, significantly outpacing the Chinese market's average. Despite these strong indicators, the company's return on equity is projected to remain modest at 12.5%, highlighting some efficiency challenges in capital utilization.

Dongguan Aohai Technology

Simply Wall St Growth Rating: ★★★★★☆

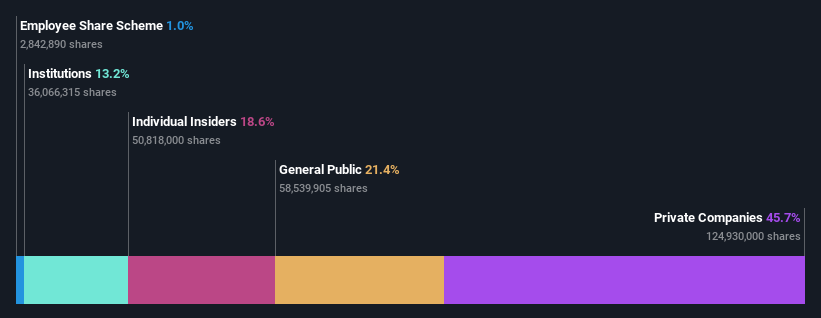

Overview: Dongguan Aohai Technology Co., Ltd. is a company that focuses on researching, developing, producing, and selling consumer electronics products both in China and internationally, with a market capitalization of approximately CN¥9.88 billion.

Operations: The company generates its revenue primarily from the manufacturing of computer, communications, and other electronic equipment, totaling approximately CN¥5.17 billion.

Insider Ownership: 18.6%

Earnings Growth Forecast: 25.3% p.a.

Dongguan Aohai Technology has seen consistent growth, with revenue increasing to CNY 5.17 billion and net income at CNY 440.94 million. The company's earnings are expected to grow by a significant 25.27% annually over the next three years, outpacing the CN market projection of 23.2%. Despite a low projected return on equity of 14.5% and dividends not well covered by cash flows, its price-to-earnings ratio stands attractively at 22.4x, below the market average of 31.3x, indicating good relative value compared to peers.

Turning Ideas Into Actions

Reveal the 1484 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603667SHSE:688766 and SZSE:002993.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance