Insider-Owned Growth Companies To Watch In July 2024

As global markets navigate through a period of relative calm and anticipatory adjustments ahead of key financial reports and economic updates, investors continue to assess opportunities for growth amidst evolving market dynamics. In this context, companies with high insider ownership can be particularly intriguing, as such alignment often suggests that those most familiar with the business are optimistic about its future prospects.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Vow (OB:VOW) | 31.8% | 97.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Let's review some notable picks from our screened stocks.

Jinan Shengquan Group Share Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jinan Shengquan Group Share Holding Co., Ltd. is a company that operates in the chemical industry, with a market capitalization of approximately CN¥17.18 billion.

Operations: The company generates its revenue from various segments in the chemical industry.

Insider Ownership: 29.8%

Revenue Growth Forecast: 16.3% p.a.

Jinan Shengquan Group Share Holding Co., Ltd. demonstrated a solid financial performance in the first quarter of 2024, with revenues and net income showing improvements from the previous year. Analysts predict significant earnings growth over the next three years, outpacing the broader Chinese market. Despite this optimism, revenue growth forecasts are less aggressive but still exceed market averages. The company's price-to-earnings ratio remains attractive compared to market norms, although concerns about shareholder dilution and a low forecasted return on equity suggest some caution is warranted.

Changchun BCHT Biotechnology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changchun BCHT Biotechnology Co. Ltd. is a biopharmaceutical company based in China, specializing in the R&D, production, and sale of human vaccines, with a market capitalization of approximately CN¥11.74 billion.

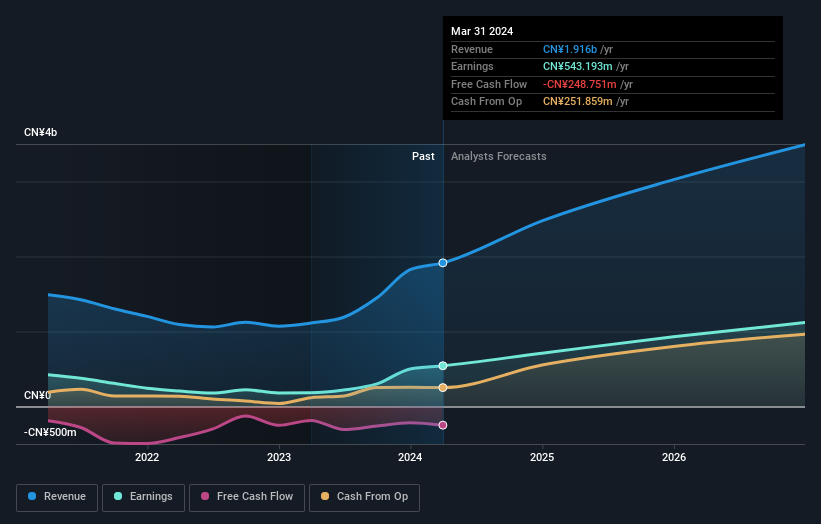

Operations: The company generates its revenue primarily from the biotechnology segment, amounting to CN¥1.92 billion.

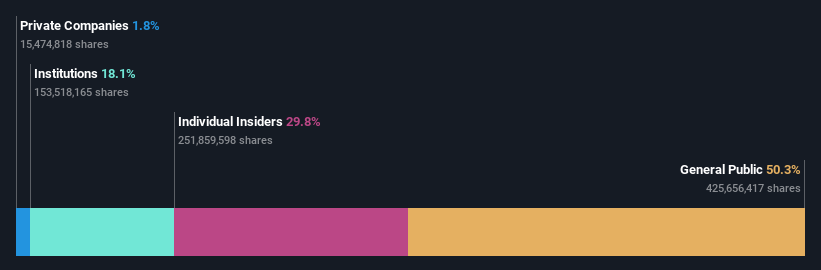

Insider Ownership: 31.7%

Revenue Growth Forecast: 21.1% p.a.

Changchun BCHT Biotechnology showcased robust first-quarter earnings in 2024, with substantial increases in sales and net income. The company's earnings are expected to grow significantly over the next three years, outpacing the Chinese market average. Despite high insider ownership, there has been no recent insider buying or selling. Its price-to-earnings ratio stands below the market average, indicating good value. However, its forecasted return on equity remains low compared to industry benchmarks.

Ganfeng Lithium Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ganfeng Lithium Group Co., Ltd. is a global manufacturer and seller of lithium products, operating across Mainland China, Asia, the European Union, North America, and other international markets with a market capitalization of approximately CN¥51.67 billion.

Operations: The company generates revenue primarily through the manufacture and sale of lithium products across various regions including Mainland China, the rest of Asia, the European Union, and North America.

Insider Ownership: 27.8%

Revenue Growth Forecast: 15% p.a.

Ganfeng Lithium Group has faced recent challenges, evidenced by a significant drop in Q1 2024 sales and a shift to net losses from profits year-over-year. Despite these setbacks, the company is expected to see its earnings grow by 29.63% annually, outpacing the broader Chinese market. However, its current dividend payout appears unsustainable given poor cash flow coverage. Additionally, there's been no recent insider buying which might raise concerns regarding confidence levels from those closest to the company.

Turning Ideas Into Actions

Unlock our comprehensive list of 1452 Fast Growing Companies With High Insider Ownership by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:605589SHSE:688276SZSE:002460 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance