Insider-Owned Growth Companies To Watch In July 2024

As global markets continue to navigate through varying economic signals, with growth stocks outperforming amidst falling interest rates and a narrow market advance, investors are keenly watching insider-owned growth companies. These firms, often led by founders and management teams heavily invested in their own stock, can offer unique resilience and alignment of interests in uncertain times.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Medley (TSE:4480) | 34% | 28.7% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 54% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 11.9% | 59.8% |

We'll examine a selection from our screener results.

Gan & Lee Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★☆

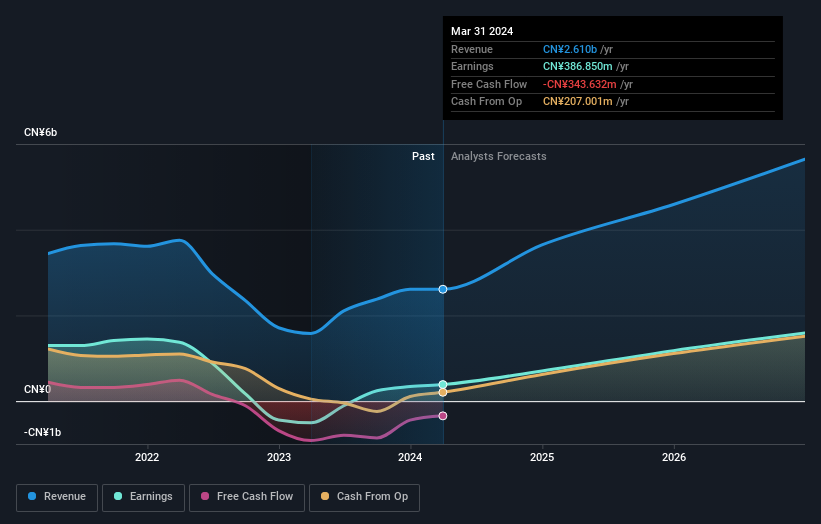

Overview: Gan & Lee Pharmaceuticals, a biopharmaceutical firm based in China, specializes in the research, development, production, and sales of insulin analog active pharmaceutical ingredients (APIs) and injections, with a market capitalization of approximately CN¥26.94 billion.

Operations: The company generates CN¥2.61 billion primarily from the development, production, and sales of insulin and related products.

Insider Ownership: 36.1%

Gan & Lee Pharmaceuticals recently turned profitable, with a significant increase in net income from a loss last year to CNY 340.07 million this year. The company's earnings are projected to grow by 45.5% annually, outpacing the Chinese market's average of 22.1%. However, shareholder dilution occurred over the past year, and its forecasted Return on Equity is relatively low at 9.7%. Recent inclusion in an index and high-profile conference presentations highlight its growing industry presence.

Thunder Software TechnologyLtd

Simply Wall St Growth Rating: ★★★★☆☆

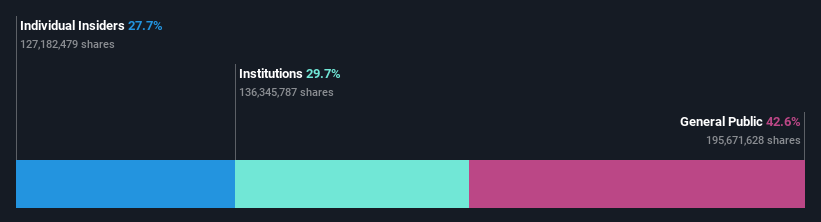

Overview: Thunder Software Technology Co., Ltd. specializes in operating-system products across markets in China, Europe, the United States, and Japan, with a market capitalization of approximately CN¥19.96 billion.

Operations: The company generates revenue from its operating-system products across various global markets.

Insider Ownership: 27.7%

Thunder Software Technology Co., Ltd. has demonstrated a robust growth trajectory with its earnings expected to increase by 24.7% annually, surpassing the Chinese market's growth rate of 22.1%. However, the company faces challenges such as declining net profit margins, down from 14.3% to 7.4%, and a lower-than-average forecasted Return on Equity of 8.8%. Recent governance changes include the election of new directors, potentially influencing future strategic directions amidst financial adjustments like reduced dividends and repurposed share buybacks.

Quanta Computer

Simply Wall St Growth Rating: ★★★★★☆

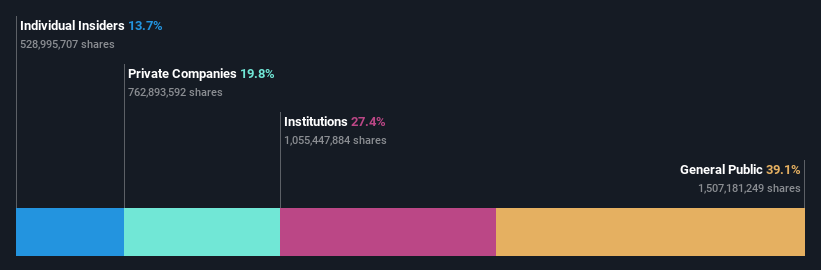

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, operating across Asia, the Americas, and Europe with a market capitalization of NT$1.30 trillion.

Operations: The company's primary revenue of NT$2.38 billion is generated from the electronics sector.

Insider Ownership: 13.7%

Quanta Computer's earnings are set to grow by 19.6% annually, outpacing the Taiwanese market forecast of 18.3%. Despite this strong growth, it falls just short of being considered significant. The company also expects a substantial revenue increase at 32.4% yearly, significantly higher than the market's 11.9%. Recent strategic partnerships, like with Obsidian Sensors for advanced thermal imaging in cars and Bloom Energy for sustainable power solutions at new facilities, underscore its innovative edge and expansion strategy.

Summing It All Up

Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1444 companies by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603087 TWSE:2382 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance