Insider-Owned Growth Companies On The Chinese Exchange In June 2024

As of June 2024, the Chinese stock market has shown mixed signals, with the Shanghai Composite Index experiencing a decline despite positive developments in the property sector. In such an environment, identifying growth companies with high insider ownership might offer investors potential resilience and alignment of interests between shareholders and management. In assessing what makes a good stock under current market conditions, it's crucial to consider companies where insiders hold a significant stake. This often indicates confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's review some notable picks from our screened stocks.

Ninebot

Simply Wall St Growth Rating: ★★★★★☆

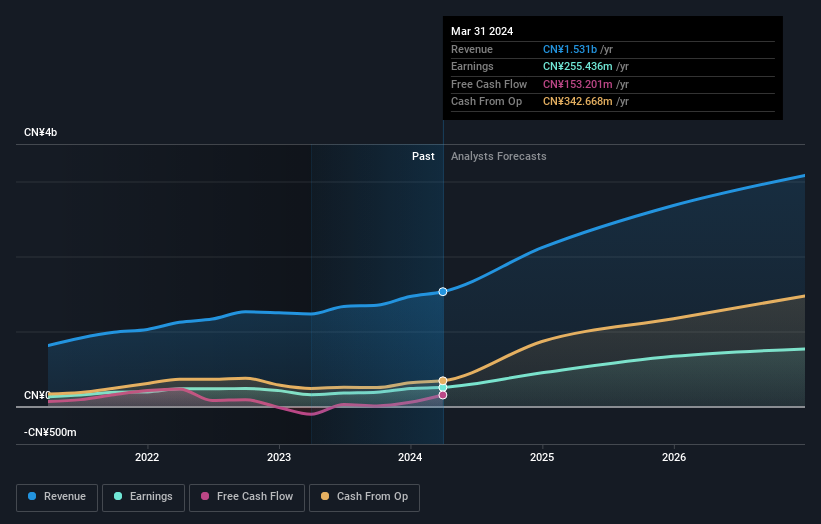

Overview: Ninebot Limited operates globally, specializing in the design, research and development, production, sale, and servicing of transportation and robot products with a market capitalization of approximately CN¥27.54 billion.

Operations: The company's revenue is derived from the design, development, production, sales, and servicing of transportation and robotic products globally.

Insider Ownership: 16.8%

Revenue Growth Forecast: 22.3% p.a.

Ninebot has demonstrated robust financial performance with a significant increase in quarterly and annual earnings, highlighted by its latest reports showing substantial growth in revenue and net income. The company's aggressive share repurchase program underscores confidence from management, aligning with high insider ownership trends. Despite some concerns about future Return on Equity, the forecast for rapid revenue and profit growth suggests strong potential in a competitive market. This positions Ninebot intriguingly among growth-oriented companies in China with substantial insider stakes.

Lepu Medical Technology (Beijing)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lepu Medical Technology (Beijing) Co., Ltd. is a company that specializes in the development, production, and sale of medical devices and pharmaceutical products, with a market capitalization of CN¥29.89 billion.

Operations: The revenue segments for this entity are not specified in the provided text.

Insider Ownership: 13.1%

Revenue Growth Forecast: 15.3% p.a.

Lepu Medical Technology (Beijing) Co., Ltd. is poised for strong growth with earnings expected to increase by 25.7% annually, outpacing the Chinese market's 22.8%. Despite a recent dip in quarterly revenue and net income, the company's aggressive buyback of over 9.96 million shares signals robust insider confidence. However, its Return on Equity is projected to remain modest at 11.8%, and its dividend coverage is weak, reflecting potential financial stress or reinvestment strategies.

Shenyang Xingqi PharmaceuticalLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenyang Xingqi Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of ophthalmic medications in China, with a market capitalization of approximately CN¥32.57 billion.

Operations: The company primarily generates revenue through the production and sale of ophthalmic medications within China.

Insider Ownership: 30.9%

Revenue Growth Forecast: 23.8% p.a.

Shenyang Xingqi Pharmaceutical Co., Ltd. has demonstrated robust growth, with a significant 35.15% annual earnings increase expected over the next three years, outstripping the Chinese market's forecast of 22.8%. Revenue is also set to rise by 23.8% annually, surpassing the market's 13.9%. However, its dividend sustainability is questionable as it's poorly covered by earnings and cash flow. Recent events include a dividend declaration and amendments to company bylaws, underscoring active corporate governance amidst growth.

Make It Happen

Investigate our full lineup of 398 Fast Growing Chinese Companies With High Insider Ownership right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:689009 SZSE:300003 and SZSE:300573.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance