Insider Dominated Growth Companies To Watch In June 2024

As global markets navigate through a landscape marked by fluctuating inflation rates and mixed economic signals, investors are keenly observing trends that might hint at future movements. In such an environment, growth companies with high insider ownership can be particularly intriguing, as significant insider stakes often align management’s interests with those of shareholders, potentially fostering long-term value creation amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Gaming Innovation Group (OB:GIG) | 22.1% | 36.2% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Elliptic Laboratories (OB:ELABS) | 31.6% | 124.6% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

We're going to check out a few of the best picks from our screener tool.

Shanghai GenTech

Simply Wall St Growth Rating: ★★★★★☆

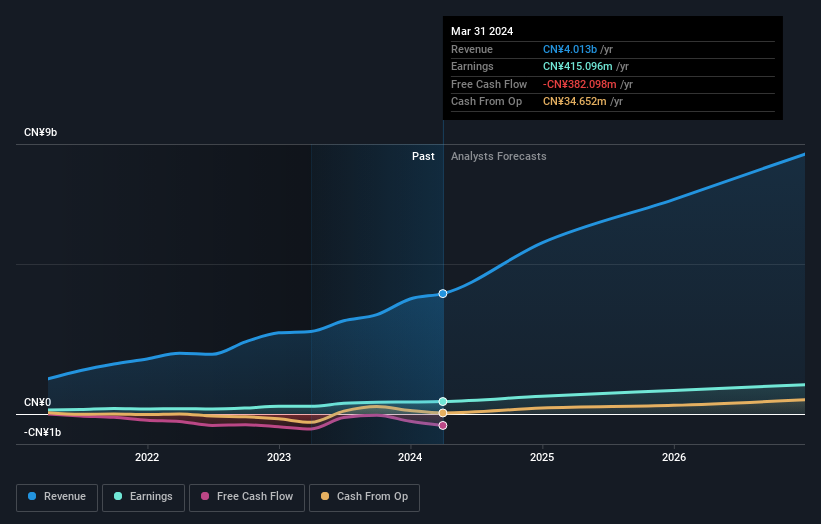

Overview: Shanghai GenTech Co., Ltd. specializes in delivering process critical system solutions to clients in high-tech and advanced manufacturing sectors across China, with a market capitalization of approximately CN¥9.61 billion.

Operations: The company generates revenue by providing process-critical system solutions to high-tech and advanced manufacturing sectors in China.

Insider Ownership: 13%

Earnings Growth Forecast: 29.2% p.a.

Shanghai GenTech, a growth-oriented company with high insider ownership, trades at a favorable price-to-earnings ratio of 23.1x compared to the broader Chinese market's 30.5x. Its earnings and revenue are both expected to outpace the market, with annual growth forecasts of 29.2% and 25.9%, respectively. However, concerns include shareholder dilution over the past year and dividends not well covered by cash flows. Recent financials show significant year-over-year gains in sales and net income for Q1 2024.

Wuhan Guide Infrared

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the research, development, production, and sale of infrared thermal imaging technology across Asia, with a market capitalization of approximately CN¥28.10 billion.

Operations: The company generates revenue through the development, production, and sale of infrared thermal imaging technology.

Insider Ownership: 27.2%

Earnings Growth Forecast: 72.7% p.a.

Wuhan Guide Infrared, despite its high insider ownership, faces challenges with declining profit margins and earnings per share. Its recent annual general meeting saw amendments to company bylaws and a reduced dividend payout. However, the company is poised for substantial growth with earnings expected to increase by 72.73% annually over the next three years, outpacing both revenue and market average growth rates in China. This suggests potential for recovery and value creation amidst current financial pressures.

BMC Medical

Simply Wall St Growth Rating: ★★★★★☆

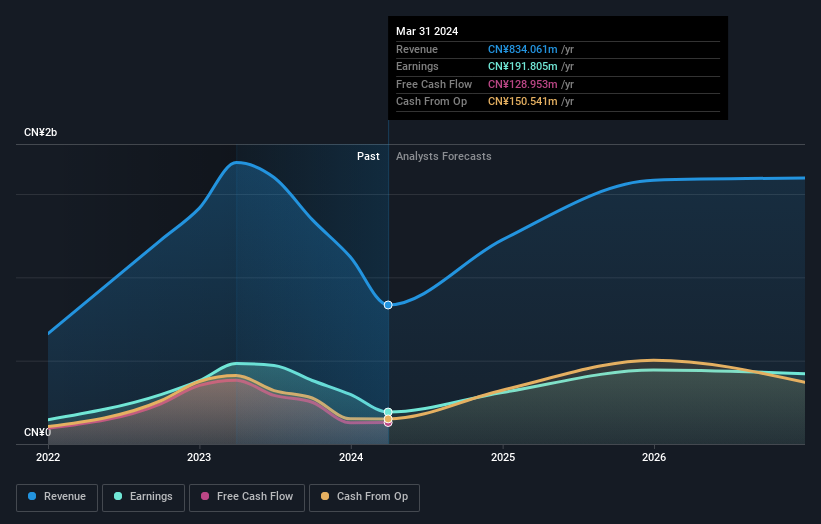

Overview: BMC Medical Co., Ltd. is a Chinese company specializing in the development, manufacturing, and supply of medical equipment and consumables for respiratory health, with a market capitalization of CN¥5.65 billion.

Operations: The company generates its revenue primarily from the surgical and medical equipment segment, totaling CN¥834.06 million.

Insider Ownership: 32.1%

Earnings Growth Forecast: 29.3% p.a.

BMC Medical, despite a challenging year with significant revenue and net income reductions, remains a compelling story of growth with projected earnings to increase by 29.27% annually. The company's recent buyback program underscores its commitment to shareholder value, targeting the use of repurchased shares for employee incentives. However, its unstable dividend track record and lower-than-benchmark return on equity highlight potential concerns in capital returns and operational efficiency.

Next Steps

Click here to access our complete index of 1477 Fast Growing Companies With High Insider Ownership.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688596 SZSE:002414 and SZSE:301367.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance