Insider Buying: Gary Friedman Acquires 46,274 Shares of RH (RH)

On June 26, 2024, Gary Friedman, Chairman & Chief Executive Officer and 10% Owner of RH (NYSE:RH), purchased 46,274 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns 3,351,337 shares of RH.

RH, formerly known as Restoration Hardware, is a luxury brand in the home furnishings marketplace offering furniture, lighting, textiles, bathware, decor, outdoor and garden, as well as baby and child products.

The shares were acquired at a price of $216.1 each, valuing the transaction at approximately $10,000,000. This purchase reflects a significant investment by the insider in the company.

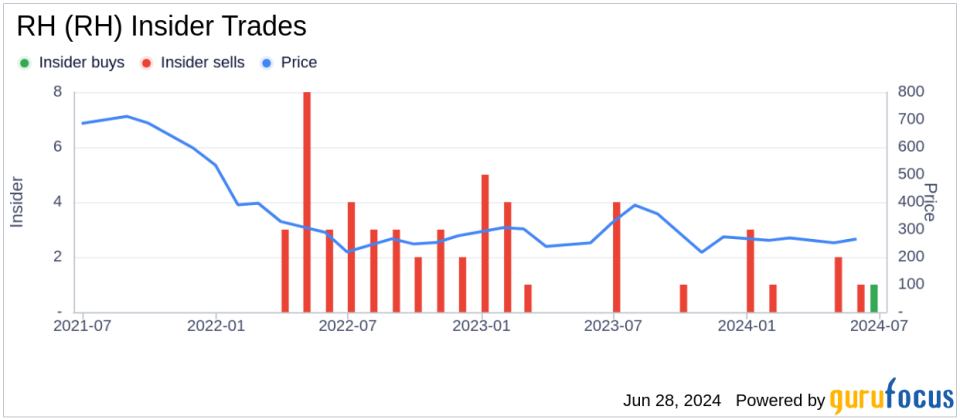

Over the past year, there has been a notable trend in insider transactions at RH. There has been only one insider buy, including the recent purchase by Gary Friedman, compared to eight insider sells. This pattern provides insight into the sentiment of those closest to the company's operations and future.

Regarding the company's valuation, RH currently has a market cap of approximately $4.41 billion. The stock's price-earnings ratio is 66.29, which is significantly higher than the industry median of 17.865. This high ratio suggests a premium valuation compared to its peers.

The GF Value of RH is estimated at $346.97 per share, indicating that the stock is currently undervalued with a price-to-GF-Value ratio of 0.62. This assessment labels the stock as a "Possible Value Trap, Think Twice," suggesting that investors should be cautious despite the apparent undervaluation.

This insider purchase could signal a belief in the company's potential to rebound or continue growing. Investors often look for insider buying as a positive indicator that those with the most insight into the company see value in the stock at current or lower prices.

For more detailed analysis and updates on insider transactions, and to understand how they align with the company's financial performance and market valuation, visit the official GuruFocus RH page.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance