Indian Exchange Growth Leaders With High Insider Ownership In July 2024

The Indian stock market has shown robust growth, rising 1.5% in the past week and an impressive 46% over the last 12 months, with earnings expected to grow by 16% annually. In this flourishing environment, stocks with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.7% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Let's review some notable picks from our screened stocks.

Apollo Hospitals Enterprise

Simply Wall St Growth Rating: ★★★★★☆

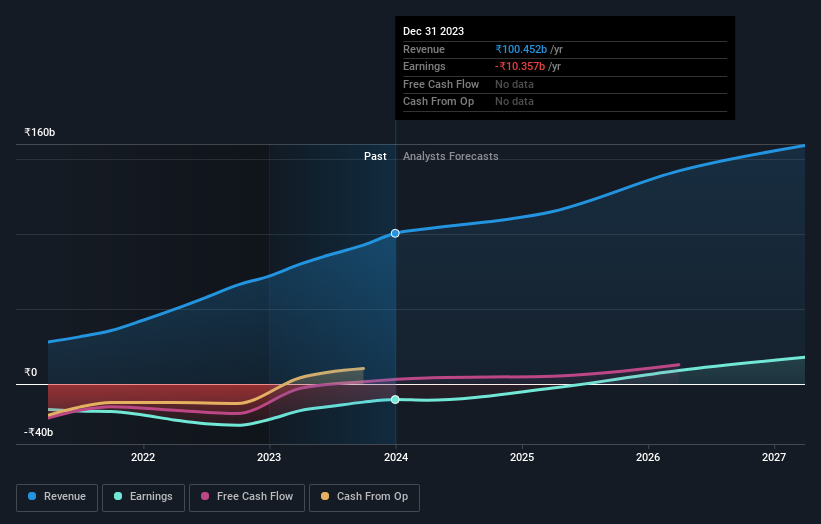

Overview: Apollo Hospitals Enterprise Limited operates a network of hospitals and healthcare services both in India and internationally, with a market capitalization of approximately ₹90.84 billion.

Operations: The company's revenue is primarily generated through Healthcare Services (₹99.39 billion), Retail Health & Diagnostics (₹13.64 billion), and Digital Health & Pharmacy Distribution (₹78.27 billion).

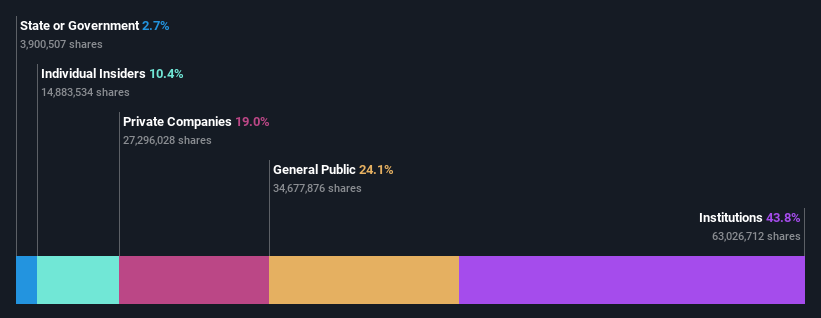

Insider Ownership: 10.4%

Earnings Growth Forecast: 33.2% p.a.

Apollo Hospitals Enterprise Limited, a significant entity in India's healthcare sector, is experiencing robust growth with its earnings forecast to increase by 33.2% annually, outpacing the broader Indian market's 15.8%. Despite not being the top contender for high insider ownership growth companies, its consistent profit expansion and strategic interest in acquisitions like Jaypee Healthcare highlight its proactive market stance. Recent executive shifts and substantial investments in digital health further underscore its adaptation to evolving industry dynamics.

Kalpataru Projects International

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kalpataru Projects International Limited specializes in engineering, procurement, and construction (EPC) services across various sectors including power transmission, buildings, water management, railways, oil and gas, and urban infrastructure both in India and globally, with a market capitalization of approximately ₹206.74 billion.

Operations: The company generates ₹191.48 billion from its Engineering, Procurement, and Construction (EPC) services and ₹2.80 billion from development projects.

Insider Ownership: 13.4%

Earnings Growth Forecast: 26.9% p.a.

Kalpataru Projects International Limited, while not a leader in high insider ownership growth companies in India, shows promising prospects with expected annual earnings growth of 26.89%, surpassing the Indian market's forecast of 15.8%. However, its financial health raises concerns as interest payments are poorly covered by earnings. Recent strategic moves include issuing redeemable Non-Convertible Debentures to optimize debt and securing significant new orders worth INR 23,330 million across various sectors, indicating proactive management and potential for substantial revenue generation.

One97 Communications

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited, operating under the brand name Paytm, offers payment, commerce and cloud, and financial services in India with a market capitalization of approximately ₹300.54 billion.

Operations: The company generates revenue primarily through data processing, which amounted to ₹99.78 billion.

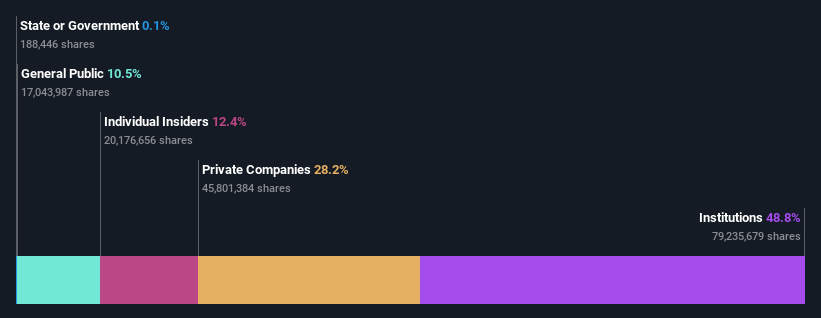

Insider Ownership: 19.5%

Earnings Growth Forecast: 60% p.a.

One97 Communications, known as Paytm, is navigating a complex growth trajectory. Despite its unprofitability forecast in three years, the company's revenue growth at 9.9% annually outpaces the broader Indian market. Recent strategic initiatives like launching 'Paytm Health Saathi' underscore its commitment to enhancing merchant partner services and expanding its value proposition. However, ongoing discussions about divesting its movie ticketing and events business to Zomato could signal strategic shifts impacting future operations and focus areas.

Summing It All Up

Explore the 84 names from our Fast Growing Indian Companies With High Insider Ownership screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:APOLLOHOSP NSEI:PAYTM and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance