Indian Exchange Growth Companies With A Minimum Of 19% Insider Ownership

The Indian stock market has shown robust performance recently, with an impressive 8% rise over the past week and a significant 43% climb over the last year. In this context, companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.4% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Here we highlight a subset of our preferred stocks from the screener.

Sansera Engineering

Simply Wall St Growth Rating: ★★★★☆☆

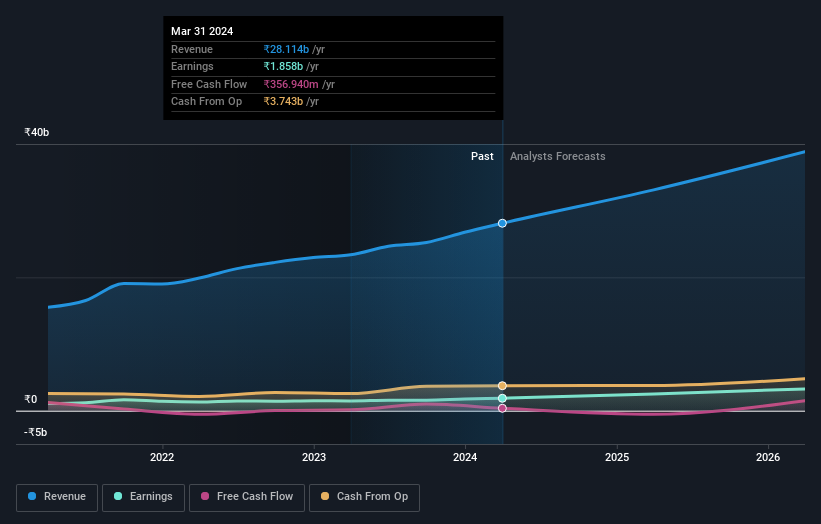

Overview: Sansera Engineering Limited specializes in manufacturing and selling high-precision components for both automotive and non-automotive sectors across India, Europe, the United States, and globally, with a market capitalization of ₹63.04 billion.

Operations: The company generates ₹28.11 billion from the manufacture of precision-engineered components.

Insider Ownership: 35.2%

Sansera Engineering, a company with high insider ownership, is positioned for robust growth with earnings forecasted to increase by 27.49% annually. Recent financial results underscore this trend, showing a significant year-over-year revenue and net income increase in Q4 2024. Despite these strengths, the company faces challenges due to its high debt levels. Additionally, Sansera's recent dividend announcement reflects confidence in its financial health and commitment to shareholder returns.

Tega Industries

Simply Wall St Growth Rating: ★★★★★☆

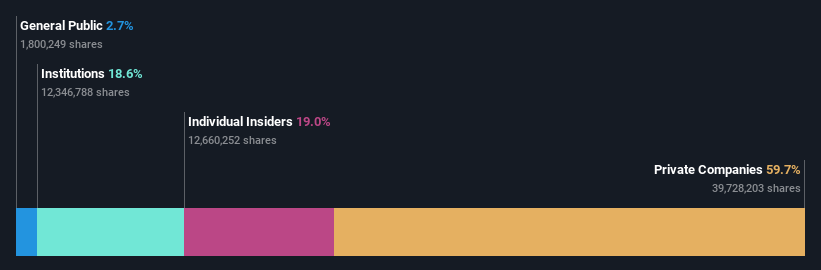

Overview: Tega Industries Limited specializes in designing, manufacturing, and installing process equipment and accessories for the mineral processing, mining, and material handling sectors, with a market capitalization of approximately ₹111.95 billion.

Operations: The company generates revenue primarily from two segments: equipment, which brings in ₹2.06 billion, and consumables, accounting for ₹12.91 billion.

Insider Ownership: 19%

Tega Industries, with high insider ownership, demonstrates strong growth potential. Recent board appointments and management interactions suggest a strategic focus on leadership and global expansion. The company reported a revenue increase to INR 15.15 billion and net income of INR 1.94 billion for FY 2024, indicating robust financial health. Earnings are expected to grow by 23.32% annually, outpacing the Indian market's forecast growth rate, reflecting Tega's competitive edge in its sector.

Dive into the specifics of Tega Industries here with our thorough growth forecast report.

Our valuation report unveils the possibility Tega Industries' shares may be trading at a premium.

VA Tech Wabag

Simply Wall St Growth Rating: ★★★★☆☆

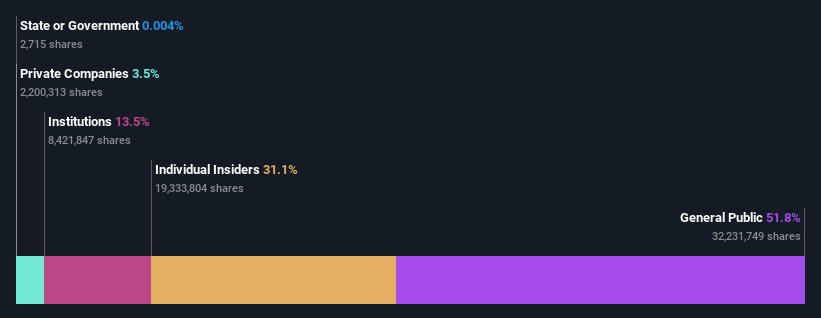

Overview: VA Tech Wabag Limited specializes in the design, supply, installation, construction, and operational management of drinking water, waste and industrial water treatment, and desalination plants both in India and internationally, with a market capitalization of approximately ₹72.85 billion.

Operations: The company's revenue from the construction and maintenance of water treatment plants totals ₹28.56 billion.

Insider Ownership: 31.1%

VA Tech Wabag, a company with high insider ownership, reported a significant increase in net income to INR 2.46 billion for FY 2024 from INR 130 million the previous year. Despite slightly lower sales and revenue compared to last year, the company's earnings per share surged impressively. Looking ahead, VA Tech Wabag is expected to see its earnings grow by approximately 20.81% annually over the next three years, outperforming the broader Indian market's growth projections. However, its share price has been highly volatile recently.

Next Steps

Click this link to deep-dive into the 80 companies within our Fast Growing Indian Companies With High Insider Ownership screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:SANSERA NSEI:TEGA and NSEI:WABAG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance