Incyte (INCY) Q1 Earnings Miss Estimates, Revenues Up Y/Y

Incyte Corporation INCY reported first-quarter 2023 adjusted earnings of 37 cents per share, which missed the Zacks Consensus Estimate of 85 cents. The company recorded earnings of 55 cents per share in the year-ago quarter.

Total revenues came in at $808.6 million, up 11% year over year. The figure missed the Zacks Consensus Estimate of $871.2 million owing to higher commercial patient deductibles and acceleration of refills in December 2022.

Shares of Incyte have fallen 6.2% in the year-to-date period compared with the industry’s decline of 5.4%.

Image Source: Zacks Investment Research

Quarter in Detail

Jakafi’s (a first-in-class JAK1/JAK2 inhibitor approved for polycythemiavera, myelofibrosis and refractory acute graft-versus-host disease) revenues came in at almost $580 million, up 7% from the year-ago quarter’s number. This was primarily driven by growth in patient demand across all indications.

The newly approved medicine, Opzelura (ruxolitinib) cream, generated $57 million in sales. The figure grew almost 343% year over year owing to growth in patient demand and label expansion in the indication atopic dermatitis (AD).

In July 2022, the FDA approved Opzelura cream 1.5% for the topical treatment of non-segmental vitiligo in adult and pediatric patients aged 12 years and older. Opzelura is also approved by the FDA for the topical short-term and non-continuous chronic treatment of mild to moderate AD.

Net product revenues of Iclusig amounted to $27.6 million, up 6% from that reported in the year-ago quarter.

Pemazyre generated $22.4 million in sales, indicating a year-over-year increase of 25%.

Minjuvi's revenues came in at $6.5 million, up 46% from the prior-year quarter’s figure.

Jakafi is marketed by Incyte in the United States and by Novartis NVS as Jakavi outside the country. The drug’s royalty revenues from Novartis for commercialization in ex-U.S. markets surged 8% to $76.6 million.

Incyte also receives royalties from sales of Tabrecta (capmatinib) for the treatment of adult patients with metastatic non-small-cell lung cancer. Its partner, Novartis, has exclusive worldwide development and commercialization rights for Tabrecta. The drug’s product royalty revenues came in at $4.2 million, up 20% year over year.

Olumiant’s (baricitinib) product royalty revenues from Eli Lilly LLY totaled $34.1 million, down 29% year over year. This was due to a decrease in net product sales of Olumiant, used in the treatment of COVID-19.

Incyte has a collaboration agreement with Eli Lilly for Olumiant. The drug is a once-daily, oral JAK inhibitor discovered by Incyte and licensed to LLY. It is approved for several types of autoimmune diseases.

Adjusted research and development expenses were $375.6 million, up 15% from the year-ago quarter, owing to higher investments in late-stage pipeline development. Selling, general and administrative expenses amounted to $294 million, up 53% from the prior-year quarter’s number. This was due to expenses related to dermatology commercial organizations and activities to support the launch of Opzelura for the treatment of atopic dermatitis and vitiligo.

Pipeline and Regulatory Updates

Earlier in March, the FDA issued a complete response letter for ruxolitinib extended-release (XR) tablets for once-daily use in the treatment of certain types of myelofibrosis, polycythemia vera and graft-versus-host disease.

The company decided to discontinue two phase III trials — LIMBER-304 and LIMBER-313. This was because results of interim studies indicated that the assessments were unlikely to meet their primary endpoints in the intent-to-treat patient population.

Incyte also discontinued the development of parsaclisib in wAIHA, owing to challenging regulatory landscape associated with the PI3K class.

The company obtained an accelerated approval of Zynyz (retifanlimab-dlwr) for treating metastatic or recurrent locally advanced merkel cell carcinoma.

2023 Guidance Updates

Based on its first-quarter performance, Incyte updated its previously issued guidance for 2023. The company now expects Jakafi revenues in the range of $2.55-$2.63 billion (earlier $2.53-$2.63 billion).

Zacks Rank

Incyte currently carries a Zacks Rank #3 (Hold).

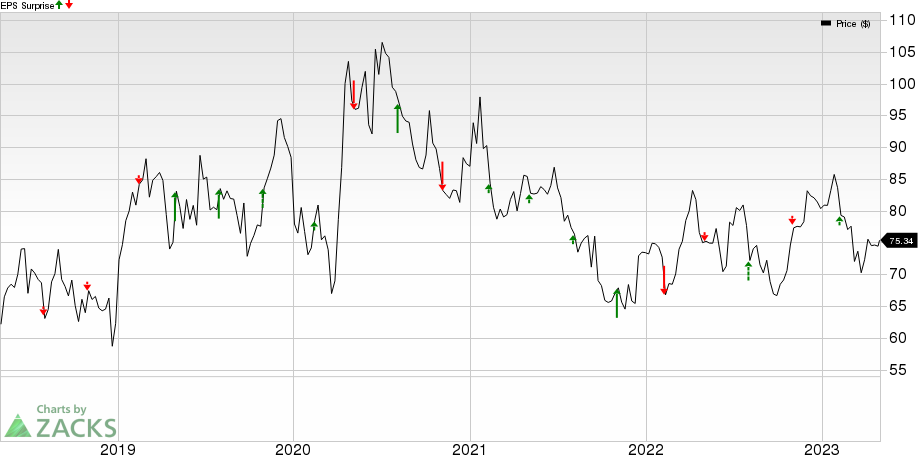

Incyte Corporation Price and EPS Surprise

Incyte Corporation price-eps-surprise | Incyte Corporation Quote

Stock to Consider

A better-ranked stock in the biotech sector is Ligand Pharmaceuticals LGND, which carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ligand Pharmaceuticals’ earnings per share has moved up from $3.30 to $4.16 for 2023 and from $3.10 to $4.58 for 2024, in the past 90 days. The stock has risen 14.9% in the year-to-date period.

Ligand Pharmaceuticals’ earnings missed estimates in three of the trailing four quarters and beat the same once, the average negative surprise being 10.07%. In the last reported quarter, LGND’s earnings beat estimates by 10.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance