ImmunityBio (IBRX) Gains 17% in the Past Week: Here's Why

ImmunityBio’s IBRX commercial portfolio comprises its only marketed drug, Anktiva (N-803, or nogapendekin alfa inbakicept-pmln).

Anktiva, in combination with Bacillus Calmette-Guérin (BCG), got FDA approval in April 2024 for the treatment of patients with BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ (CIS), with or without papillary tumors.

ImmunityBio’s shares gained 16.7% in the past week following the announcement of insurance coverage for its drug across multiple states. Several healthcare plans now provide reimbursement for Anktiva, increasing patient access. Additionally, within just eight weeks since approval, several NMIBC CIS patients across the United States have already been treated with the immunotherapy.

Initial sales figures for the Anktiva/BCG immunotherapy are expected to be reported in ImmunityBio’s second-quarter earnings release in July or August.

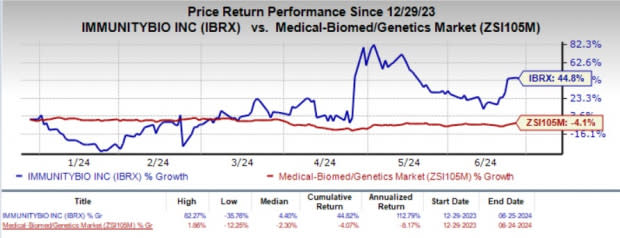

Year to date, shares of IBRX have rallied 44.8% against the industry’s 4.1% decline.

Image Source: Zacks Investment Research

Please note that Anktiva is a first-in-class IL-15 agonist immunotherapy for NMIBC. The drug enjoys the FDA’s Breakthrough Therapy designation in the United States. Its approval was based on significant safety and efficacy results from the late-stage study that evaluated Anktiva combined with BCG maintenance therapy in 77 NMIBC CIS patients.

Patients were treated for up to 37 months, with their tumor status regularly assessed through cystoscopy and urine cytology. The monitoring will continue for up to five years from the date each patient began treatment in the study.

The study reported a complete response rate of 62%, with the upper end of the confidence interval at 73%. As of November 2023, the duration of complete response (DOR) exceeded 47 months and is ongoing. These results are notable as they surpass the benchmark for meaningful clinical outcomes suggested by the International Bladder Cancer Group, particularly for responses lasting beyond 24 months.

ImmunityBio’s Anktiva launch in the United States is a significant milestone for the company as it marks the beginning of a new era in immunotherapy that goes beyond traditional checkpoint inhibitors, focusing instead on cytokines and natural killer (NK) cells. The drug’s unique mechanism of action harnesses the body's immune system by activating NK and killer T cells to target BCG-resistant tumor cells, leading to a robust and sustained immune response.

Anktiva induces the formation of memory T cells, which contributes to a prolonged DOR, thereby highlighting its potential to provide long-lasting efficacy in cancer treatment by leveraging the body's natural immune defenses.

Anktiva offers a significant advantage in its administration, as it can be administered by urologists in their offices and clinics without the need for special handling or equipment. This allows patients to receive treatment in familiar settings from their regular healthcare providers, further enhancing accessibility for eligible NMIBC patients. This ease of administration is expected to expand the therapy's reach, potentially increasing ImmunityBio's revenues in the upcoming quarters.

In a press release from early May, ImmunityBio announced that it has enough drug substance to produce 170,000 doses of Anktiva for both commercial and clinical study use. This substantial supply ensures that the company is well-prepared to meet the anticipated demand, further supporting the widespread adoption and utilization of Anktiva in treating NMIBC.

NMIBC is a type of bladder cancer that remains confined to the inner lining of the bladder and has not penetrated the muscle layer.

ImmunityBio is simultaneously evaluating Anktiva, either as a monotherapy or in combination with other agents, for other cancer indications and HIV in separate clinical studies across various stages of development.

ImmunityBio, Inc. Price and Consensus

ImmunityBio, Inc. price-consensus-chart | ImmunityBio, Inc. Quote

Zacks Rank and Stocks to Consider

ImmunityBio currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Compugen CGEN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has remained constant at $2.89. During the same period, the consensus estimate for 2025 loss per share has remained constant at $2.73. Year to date, shares of ALXO have plunged 55.9%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has remained constant at $2.46. During the same period, the consensus estimate for 2025 loss per share has remained constant at $1.95. Year to date, shares of ANVS have plunged 70.3%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has remained constant at 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have lost 8.6%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

ImmunityBio, Inc. (IBRX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance