ICICI Bank (IBN) is Now 18th Largest Bank Globally: Worth a Look?

On Jun 25, ICICI Bank IBN became the 18th largest bank globally in terms of market cap as it touched an all-time high of $28.84 per share. This Mumbai, India-based lender now has a market cap of approximately $101 billion, surpassing Switzerland’s largest bank UBS Group AG UBS, which has a market cap of almost $96 billion. Last year, UBS acquired Credit Suisse to become the biggest Swiss bank.

Also, IBN is now the second lender from India to cross the $100 billion market cap mark after HDFC Bank Limited HDB. HDB has a market cap of roughly $119 billion.

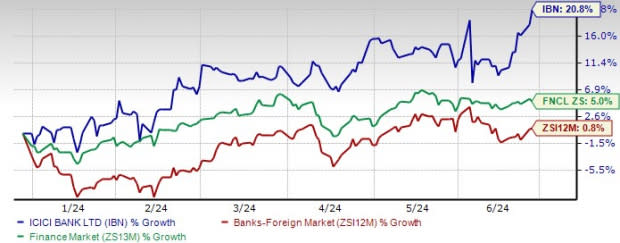

After a decent price performance last year, shares of ICICI Bank have soared 20.8% so far this year. The stock has also significantly outperformed the industry and the Zacks Finance sector, which jumped 0.8% and 5%, respectively, in the same time frame.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Factors Driving the ICICI Bank Stock

The first and foremost factor supporting ICICI Bank’s performance is India’s economic growth. The country continues to be a bright spot amid sluggish economic growth globally. The country’s GDP is expected to grow at a rate of almost 7% this fiscal year.

With such solid expected growth, demand for loans is likely to rise. This will benefit IBN.

Though ICICI Bank has wide international loan coverage, domestic loans represent a substantial part of its overall loans (97.2% as of Mar 31, 2024). The bank has been marketing retail deposits on a large scale, chiefly to lower its cost of funds and create a stable funding base. This makes the company well-positioned to deal with a challenging rate environment. At the end of fiscal 2024, retail loans grew 19%, while in fiscal 2023, retail loans soared 23%, and in both fiscal 2022 and fiscal 2021, the metric increased 20%.

Additionally, ICICI Bank is making commendable progress in improving digital banking services for retail and corporate clients. The company has been striving to provide superior end-to-end seamless digital services, personalized solutions and value-added features to enable data-driven cross-selling and up-selling opportunities.

The increasing adoption of IBN’s mobile banking app – iMobile Pay – is helping garner a solid market share. As of Mar 31, 2024, there were more than 10 million activations of iMobile Pay from non-ICICI Bank users. Also, the company’s digital platform for businesses – InstaBIZ – and the supply chain platforms have been witnessing tremendous growth in the past few quarters. By Mar 31, 2024, the company saw more than 3.5 million registrations by non-ICICI Bank account holders on InstaBIZ.

These initiatives are leading to a rapid rise in end-to-end digital sanctions and disbursements across various products. Driven by these efforts, ICICI Bank is successful in leveraging its technological initiatives to augment the contribution of non-interest income toward its top line.

In fiscal 2024, almost 35% of the company’s mortgage loan sanctions and 38% of its personal loan disbursements, by volume, were end-to-end digital. Thus, non-interest income continues to improve. The metric increased 15% in fiscal 2024, following a 13% rise in fiscal 2023 and 27% growth in fiscal 2022. Efforts to digitize operations and a surge in mobile banking transactions will likely continue to help the company garner more fee income going forward.

The Zacks Consensus Estimate for current fiscal year revenues and earnings per share is currently pegged at $13.14 billion and $1.52, respectively, implying an increase of 11.6% and 9.4% from the fiscal 2024 reported numbers.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Headwinds

Due to high inflation and tighter monetary policy across the globe, ICICI Bank’s asset quality might come under pressure. Its credit quality worsened in fiscal 2020 and fiscal 2021 due to the global and domestic economic slowdown, the coronavirus-related concerns and the significant slump in commodity prices.

While the bank recorded a decline in provisions over the last couple of years, the metric has remained high from pre-pandemic days. As of Mar 31, 2024, ICICI Bank held contingency-related provisions of INR131 billion ($1.6 billion). Also, the bank’s exposure to BB and below-rated borrowers, non-performing loans and unrated was 2% of total net advances as of the same date.

Also, based on the trailing 12-month price/tangible book, a commonly used multiple for valuing bank stocks, IBN is currently trading at 3.18X, well above the 2.90X five-year median and the 1.79X for the industry. This shows the stock is trading at a premium.

The Value Score of D also suggests stretched valuation in the near term.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

Final Thoughts

We can easily conclude that investors should not rush to buy IBN now as it is facing a few challenges. They should monitor the company’s developments closely and wait for a more appropriate entry point. The stock’s Zacks Rank #3 (Hold) supports our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

HDFC Bank Limited (HDB) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance