HSBC to Further Engage in Mergers, Disposals for Asia Expansion

As part of its plan to expand in Asia and serve wealthy customers, HSBC Holdings plc HSBC is looking to engage in mergers and get rid of the unprofitable units around the region. The move comes as the bank wants to perfect its growth strategy in order to deliver the best shareholder returns.

HSBC’s Asia-Pacific co-CEO, David Liao, said in an interview, “While organic growth will continue to be a core expansion strategy for HSBC, mergers, acquisitions and disposals will be a key strategy to expand in new markets and to strengthen our existing business lines. We will only conduct a deal when the targets can be fully integrated into our existing businesses. At the same time, we will dispose of businesses in markets that do not have the scale or growth potential.”

HSBC’s increased focus on shareholder returns partly reflects the bank’s new strategy to divert attention from the break-up call by Ping An Insurance Group.

Ping An Insurance Group, HSBC’s largest shareholder, had called for the bank to separately list its Asia arm in Hong Kong to push the lender to make structural changes to enhance its value.

Moreover, HSBC’s move to buy financial businesses is consistent with its plan of growing the wealth management, family office and private banking business across the fastest-growing region worldwide.

Liao stated, “Many entrepreneurs have established their businesses for decades and accumulated much wealth. HSBC has developed a range of private banking, family office, wealth management and insurance services to capture these growing opportunities.”

Consistent with its Asia expansion plans, HSBC has been undertaking several measures to bolster its performance. Recently, HSBC Asset Management agreed to acquire Singapore-based real estate private equity firm SilkRoad Property Partners.

In October 2023, HSBC, through its wholly-owned subsidiary, HSBC Bank (China) Company Limited, announced an agreement to acquire Citigroup’s C retail wealth management portfolio in mainland China.

As a result of the sale, Citigroup will transfer assets under management and deposits worth $3.6 billion, and associated wealth customers in 11 major cities to HSBC Bank China.

As HSBC intends to position itself as a top bank for high-net-worth and ultra-high-net-worth clients in Asia, the bank has re-launched its private banking business in India after eight years.

In 2022, HSBC acquired 100% of the issued share capital of AXA Insurance in Singapore and L&T Investment Management Limited.

HSBC raised its ownership stake in its China securities joint venture — HSBC Qianhai Securities Limited — to 90% from 51%.

Liao said, “This reflects HSBC's commitment to expand on the mainland as we believe the country will continue to open up its financial services sector, and the future growth will be huge.”

In addition to the above-mentioned mergers, HSBC has been continuously restructuring its operations to further improve operating efficiency. In 2020, the company announced its transformation plan to reshape underperforming businesses, simplify complex organizations and reduce costs.

In November 2022, HSBC signed an agreement to divest its Canada banking business to the Royal Bank of Canada RY (expected to close in the first quarter of 2024). Per the agreement, RY will acquire all issued common equity of HSBC Canada. The deal will increase RY’s market share in the Canada banking landscape, which is already dominated by a few large firms.

Moreover, HSBC has exited from the United States and Greece retail banking space, and is in the process of divesting retail banking operations in France and New Zealand, as well as fully exiting Russia.

HSBC’s Asia pivot story is already in progress. As part of its transformation plan, the company realized gross savings of $5.6 billion as of 2022-end, with cost to achieve a spend of $6.5 billion. The company expects to achieve an additional $1 billion of gross cost savings this year because of the actions undertaken in 2022.

Notably, HSBC’s brand, capital strength, extensive global network, and positioning enable it to continuously attract and retain clients. The company’s product and service leadership in alternative investments, foreign exchange, credit, investment advice and many other cross-border banking services help it widen its customer base.

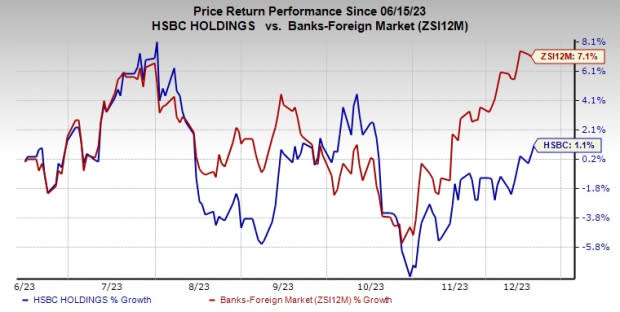

Over the past six months, shares of HSBC have gained 1.1% compared with the industry’s growth of 7.1%.

Image Source: Zacks Investment Research

Currently, HSBC carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance