HIMS Stock Tumbles: Here's Why It's a Buy Right Now

Hims & Hers Health (HIMS) has been one of my top stocks to buy in 2024, as it has a fantastic business model, high sales growth and a top Zacks Rank. I was even more delighted when HIMS announced that they would be joining the GLP-1 trend, by offering the drug through its platform.

GLP-1 Drug Mega-Trend

GLP-1 drugs for obesity and weight loss, which have shown to be extremely effective, are currently one of the most profitable and exciting trends in the market today. The market has been dominated by pharmaceutical giants Eli Lilly (LLY) and Novo Nordisk (NVO). However, I see significant opportunities for less mature companies like Hims & Hers Health to get involved.

While HIMS had been a strong performing stock this year, even before the GLP-1 announcement, this news is significant for the startup. The market for GLP-1 is expected to grow at a CAGR of 19.2% through 2029 and may reach a market size of $109 billion.

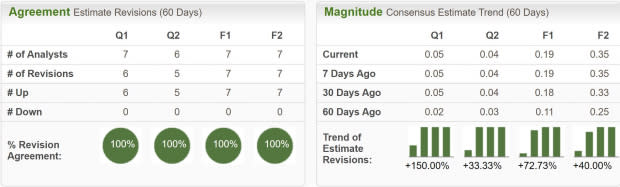

Hims & Hers Health (HIMS) already boasts a Zacks Rank #1 (Strong Buy) rating, reflecting the significant upward revisions to its earnings. However, if the company can capture even a portion of this market, sales and profits could be substantially higher.

Hedge Fund Sells HIMS Short

Short-seller Hunterbrook Capital is not as excited about the development and announced through its media arm Hunterbrook Media that they have taken a short position in the stock.

A Hunterbrook reporter shared that they were able to acquire a prescription after a brief survey and without a physician present for the process, which they understandably deem risky. Additionally, Hunterbrook is critical of the compounded GLP-1 drug that HIMS is marketing.

Because there is currently a supply shortage of GLP-1 drugs, some US pharmacies have been making alternative versions of the drug with slight tweaks, which aren’t directly reviewed by the FDA. Hunterbrook is critical of the pharmacy supplying the novel compound as well as the practice.

Hims was down 11% yesterday following the announcement and is ~25% off its recent highs.

Image Source: TradingView

Why I am Still Bullish HIMS Stock

The concerns that Hunterbrook notes are extremely founded and worthy of concern. These drugs need to be properly prescribed and patients need monitoring. Regarding the novel drug compounds, although there isn’t direct oversight from the FDA, the practice has been approved, so it is less of a concern.

I suspect that Hims & Hers Health will address these concerns. But most importantly, this activity show just how huge the demand for GLP-1 drugs are.

There is already a supply shortage, and it seems HIMS is selling the drug so quickly that they have simply automated the process. Again, that needs to be addressed, but so long as it is, and HIMS remains involved in the market, this is bullish to me.

The earnings revision trend is one of the most impressive that I have seen this year. Analysts have unanimously upgraded the stock over the last month, and the revisions are really significant across timeframes.

Image Source: Zacks Investment Research

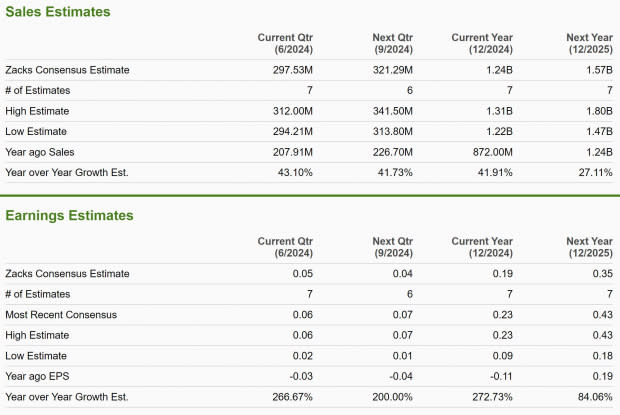

Sales and earnings growth forecasts are very strong as well. Sales are expected to jump 42% this year and 27% next year, while EPS are projected to climb 273% this year and 84% next year.

Image Source: Zacks Investment Research

Buying Opportunity in HIMS

While the recent short seller report raises valid concerns about Hims & Hers' GLP-1 prescription practices, the underlying demand for these drugs and the company's impressive growth trajectory make this a buying opportunity for long-term investors.

With established giants like Novo Nordisk and Eli Lilly dominating the market, Hims & Hers Health is well-positioned to capture a significant share of this rapidly growing space. If the company can address the issues raised by Hunterbrook and ensure patient safety, they stand to benefit tremendously from the GLP-1 mega-trend.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance