Higher mortgagee sale listings at auctions in 3Q2023 amid tough economic conditions

A strata-titled terrace house in The Teneriffe was sold for $3.52 million, recording the highest premium of 9% among all properties auctioned in 3Q2023 (Picture: Albert Chua The Edge Singapore)

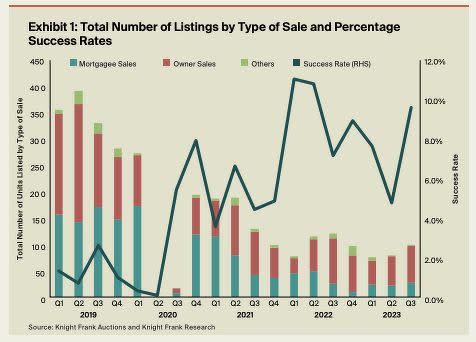

SINGAPORE (EDGEPROP) - Auction listings rose 24.4% q-o-q to 102 in 3Q2023, up from 82 in 2Q2023, according to an October report by Knight Frank Singapore. This is inclusive of repeat listings and excludes properties sold outside of auction. On a y-o-y basis, listings declined 17.1% from the 123 recorded in 3Q2022.

The higher q-o-q number of listings in 3Q2023 was underpinned by an increase in both mortgagee and owner listings. In 3Q2023, there were 29 mortgagee and 70 owner sale listings, up from 22 and 57 listings respectively in the previous quarter.

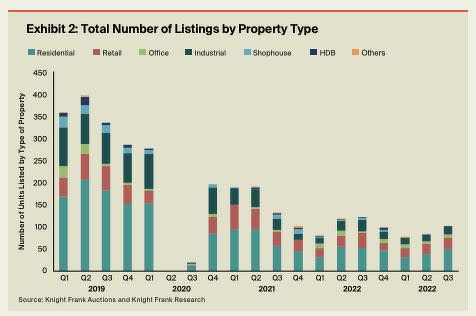

Listings also increased across property types in 3Q2023. There were 50 residential property listings, higher than the 37 registered in 2Q2023. Retail property listings totalled 26, marginally higher than the 25 logged the previous quarter. Industrial and office units made up 20 and six listings respectively, increasing from 15 and 5 listings each in 2Q2023.

Read also: Knight Frank appoints Asia Pacific head of living sectors

Other types of sales, including estate, receiver and bank sales, accounted for three listings in 3Q2023, with all three comprising residential properties.

Out of the 102 total listings, 10 properties were successfully auctioned for a total of $17.8 million in gross sales value. This translates to a success rate of 9.8%, while the gross sales value is more than three times the $4.8 million clocked in 2Q2023. “Of all the properties sold, eight were newly listed, suggesting that despite the slowing economy, fresh inventory on the auction platform appealed to prospective buyers, especially those who had been following the market long enough to be able to identify opportunities,” says Sharon Lee, head of auction and sales at Knight Frank Singapore.

The consultancy also highlights that three out of the four industrial properties transacted were sold between 4% and 9% below opening price. “Some industrial property owners might be under some pressure to either offload or right-size their assets given that their businesses might be underperforming, with interest rates remaining sticky and the manufacturing sector currently at a low point,” Lee adds.

Of the 29 mortgagee listings in 3Q2023, 22 were residential properties, namely two landed homes and 20 non-landed homes. This is almost double the 12 residential mortgagee listings in the previous quarter, signalling that distressed properties are increasing in the market due to elevated interest rates, observes Lee.

The remaining seven mortgagee listings last quarter comprised two retail, one office and four industrial properties.

Eight mortgagee listings were successfully auctioned in 3Q2023, comprising five residential and three industrial properties. For the residences, four were sold at a premium of between 0.4% and 9% from their respective opening prices, while another was sold at a discount of 1.7%.

Read also: Singapore emerges as leading wealth capital in Asia Pacific: Knight Frank

A strata-titled terrace house in The Teneriffe was sold for $3.52 million, recording the highest premium of 9% among all properties auctioned during the quarter.

Of the 70 owner listings in 3Q2023, residential properties made up 25 listings, followed by retail properties (24), industrial (16) and office (5). Industrial listings saw the biggest jump in listings, with only seven such properties listed the previous quarter.

Only one owner listing was auctioned successfully in 3Q2023 — a B2 landed factory in Kaki Bukit Place that was sold for $5 million. The auction price represents a discount of 3.8% below the opening price of $5.2 million.

Nonetheless, Lee points out that owner sale listings continue to exceed mortgagee sale listings, reflecting recognition among owners that the auction platform can garner wider interest for their property. “ Many of the properties found on owner listings were sold outside of the auction process in private treaty deals after buyers had taken note of the opportunity,” she adds.

Looking ahead, Lee believes more mortgagee sale listings will arise in the remaining months of the year in view of the slowing economy, high interest rates and rising inflation. “This presents a window of opportunity for prospective buyers who could ride on the possibility of growth in these assets when the economic situation turns more optimistic and values of real estate assets rebound,” she continues.

She also believes the auction success rate will “improve slightly”, noting that for the first nine months of 2023, the overall success rate stood at 7.7%, exceeding its projection of 5% to 7% for the whole of 2023. To that extent, Knight Frank has revised its auction success rate projection upwards to between 7% and 10% for the year.

Read also: Shophouse transactions cool amid higher financing costs and interest rates

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Singapore emerges as leading wealth capital in Asia Pacific: Knight Frank

Shophouse transactions cool amid higher financing costs and interest rates

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance