Will Higher Energy Prices Aid Vista (VIST) in Q3 Earnings?

Vista Oil & Gas, S.A.B. de C.V. VIST is set to release third-quarter results on Oct 26. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 94 cents per share on revenues of $305.1 million.

Let’s delve into the factors that might have influenced the Mexico-based energy firm’s results in the September quarter. But it’s worth taking a look at Vista’s previous-quarter performance first.

Highlights of Q2 Earnings & Surprise History

In the last reported quarter, the Argentina-focused company beat the consensus mark due to higher production and commodity prices. Vista had reported earnings per share of $1.06, well above the Zacks Consensus Estimate of 43 cents. Revenues of $294 million generated by the firm had also come in 19.8% above the consensus mark.

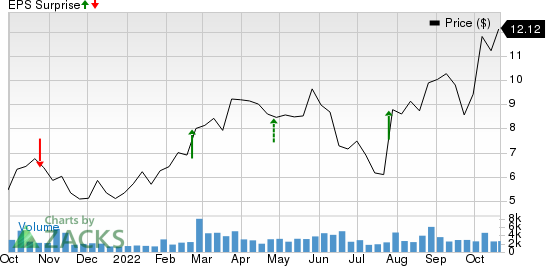

VIST beat the Zacks Consensus Estimate for earnings thrice in the last four quarters and missed once, resulting in an earnings surprise of 47.8%, on average. This is depicted in the graph below:

Vista Oil & Gas, S.A.B. de C.V. Sponsored ADR Price and EPS Surprise

Vista Oil & Gas, S.A.B. de C.V. Sponsored ADR price-eps-surprise | Vista Oil & Gas, S.A.B. de C.V. Sponsored ADR Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the third-quarter bottom line has remained the same in the past seven days. The estimated figure indicates a massive 1,780% jump year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 74.3% increase from the year-ago period.

Factors to Consider

Vista is expected to have benefited from the surge in hydrocarbon realizations. In the second quarter of 2022, the company’s average realized oil and natural gas prices increased by 43% and 11%, respectively, from the year-ago period. The uptick is most likely to have continued in the third quarter, with commodity prices remaining strong on the back of geopolitical tensions, strained supply and robust demand. This price boost is likely to have buoyed the revenues and cash flows of Vista.

The company is also expected to have reaped the reward of higher production during the quarter. VIST continues to churn out an impressive output from its assets in southwest Argentina’s Vaca Muerta basin, where it focuses on growth through a combination of acquisitions and active drilling. In the previous quarter, VIST’s total output was up 12% year over year over year. The uptick is expected to have continued in the to-be-reported quarter on the back of higher productivity from the company’s flagship Bajada del Palo Oeste region.

On a somewhat bearish note, Vista’s total lifting costs in the second quarter increased around 7% year over year to $31.7 million. The upward cost trajectory is likely to have continued in the third quarter due to higher product costs and inflationary pressure. This is expected to have somewhat dented the company’s to-be-reported earnings.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Vista is likely to beat estimates in the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Vista Oil & Gas has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 94 cents per share each.

Zacks Rank: VIST currently carries a Zacks Rank #1, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult this earnings season.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

While an earnings beat looks uncertain for Vista, here are some firms from the energy space that you may want to consider on the basis of our model:

Murphy USA MUSA has an Earnings ESP of +12.68% and a Zacks Rank #1. The firm is scheduled to release earnings on Oct 26.

For 2022, Murphy USA has a projected earnings growth rate of 69.6%. Valued at around $6.6 billion, MUSA has gained 59.9% in a year.

PBF Energy PBF has an Earnings ESP of +10.30% and a Zacks Rank #2. The firm is scheduled to release earnings on Oct 27.

PBF topped the Zacks Consensus Estimate by an average of 78% in the trailing four quarters, including a 43.8% beat in Q2. PBF has gained 180.9% in a year.

Oceaneering International OII has an Earnings ESP of +50% and a Zacks Rank #2. The firm is scheduled to release earnings on Oct 26.

The Zacks Consensus Estimate for OII’s 2022 earnings has been revised 33.3% upward over the past 60 days. Valued at around $966.5 million, Oceaneering International has lost 38.1% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Vista Oil & Gas, S.A.B. de C.V. Sponsored ADR (VIST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance